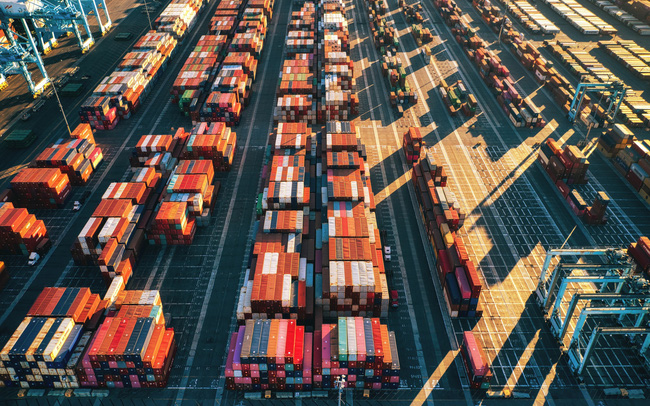

Chinese companies that want to go global are facing an unusual problem: transportation.

The ability to access low-cost manufacturing centers at home has long been a major competitive advantage for Chinese enterprises to compete abroad. But now that has become a disadvantage, as the pandemic and trade tensions have disrupted the global supply chain.

According to Fang Xueyu, vice president of global marketing and Asia Pacific market at home electronics manufacturer Hisense, many goods cannot be exported right now.

Container shipping charges have increased fivefold, from $3,000 to $15,000 per container. Shipping time to Europe also increased by 1 week.

From the Ever Given ship getting stuck in the Suez Canal in March to new Covid-19 outbreaks in the export hub Guangzhou in June, the global supply chain has been continuously disrupted since the beginning of the year. .

“Given what’s going on in Europe (floods) and around the world, it’s not quite chaotic yet, but the logistics network is disrupting on so many points,” said Alexander Klose, vice president of electric tram company Aiways. . “So we have to rebook the ship, the goods are often late because there are no ships, no containers. The impact is huge,” Klose told CNBC.

Aiways makes cars in China and then sells them in the European market. Many shipments are delayed by up to 2-3 months just because the cars have been delivered to the port but waited forever without being shipped.

Demand in overseas markets for “Made in China” products is huge, according to company calculations as well as official government figures. According to the General Administration of Customs of China, in the first 6 months of the year, exports to the EU increased by 35.9% compared to a year ago, to 233 billion USD. Exports to the US also increased by 42.6%, to $252.86 billion.

Hisense continues to expand overseas, reaching $7.93 billion in revenue from international markets last year. The company plans to triple its revenue from overseas markets by 2025, to $23.5 billion.

But shipping difficulties are the latest challenge facing Chinese companies. Of the approximately 3,400 Chinese companies operating overseas, only about 200 have earned more than $1 billion in revenue from overseas markets, according to James Root, an expert at consulting firm Bain. .

“When you dig deeper, you’ll see pioneering companies – like Lenovo, Haier or Huawei – being the exception rather than the role models that most Chinese multinationals can emulate. Chinese companies need to rethink when faced with the best growth opportunities that are presented to them.

China is currently the world’s second largest economy and many economists predict China will overtake the US as the world’s largest economy within the next few years.

Amazon ban, taxes and other risks

Recently, the US e-commerce giant Amazon is aggressively implementing a campaign to remove fake comments on its sales platform, the main target of which is Chinese businesses. Country.

“Some companies have violated Amazon’s seller standards and have restricted their operations,” said Li Xianggan, director of the foreign trade department under the Ministry of Commerce of China. “We always require businesses to comply with regulations and laws of other countries, respect local customers and develop business activities within the framework of the law,” he added.

In addition, Chinese businesses face higher tax rates than in the EU. “The political, economic, legal, logistical and personnel challenges that Chinese enterprises face abroad are increasing,” the People’s Daily said in late June.

Alibaba Airmail Advantage

For Alibaba, which dominates China’s domestic commerce market, the strategy to enter foreign markets includes investing in a logistics business called Cainiao. Through the cooperation relationship between Cainiao and air freight companies, Alibaba has developed a fairly stable transport network connecting to European countries, said William Wang, general manager of the service. responsible for the Spanish, French and Italian markets of AliExpress.

Thanks to that, the AliExpress sellers can ship the goods to the customers without delay. However, the cost of shipping by air is much higher, so it will be difficult to apply to items such as cars or large household appliances.

Increase the number of warehouses abroad

Faced with the current challenges, many Chinese companies are “localizing” deeper in international markets. For example, e-commerce companies have built or leased warehouses in close proximity to European customers. This way the goods will be shipped first and sent to the customer from a warehouse near the customer instead of from another continent as usual.

Figures from China’s Ministry of Commerce show that Chinese companies built about 100 new warehouses abroad in the first six months of the year. Last year there were 800 new warehouses.

Next year AliExpress plans to double its staff in France, Spain and Italy from its current 200 employees. As for Hisense, the company plans to acquire or build more factories in the US because the tariffs are causing the selling price to increase significantly.

Check out CNBC

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com