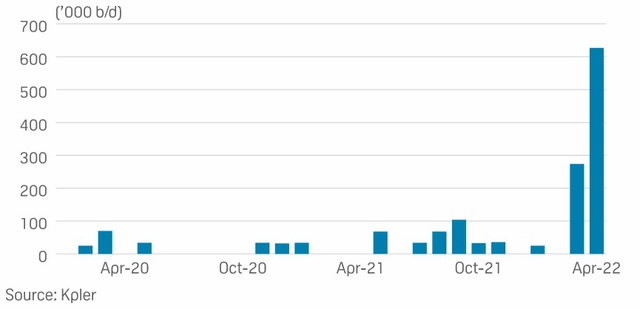

In April, India imported 627,000 bpd of crude oil from Russia compared with just 32,000 bpd in 2021. “Russian crude is too cheap compared to other alternatives. They simply don’t can be ignored at this price,” said the expert.

India is emerging as Russia’s biggest purchaser of Urals crude in April, largely thanks to massive discounts as some European buyers have boycotted the oil.

Urals oil has been trading at record lows in recent weeks, with some trading at a discount of nearly $40 a barrel to the Brent crude benchmark.

According to trading sources and ship-tracking data, about a quarter of Russia’s crude oil exports by sea in April were ready to go to India. Russia exported 627,000 bpd of Urals oil to India in April compared with just 274,000 bpd in February and March, according to data from Kpler.

Kpler data also shows that Russia’s Urals crude oil exports averaged 2.24 million bpd, the highest since May 2019 – despite sanctions and boycotts by several oil refineries in the country. Europe.

Before the Russia-Ukraine conflict broke out, Russia very rarely bought Russian oil. But with Russian crude trading at a record low in recent weeks, refiners in India have been unable to resist buying cheap crude, despite pressure from Western governments.

Medium sour Urals oil sold for its lowest price ever against the Dated Brent benchmark at -39.40 USD/barrel on April 29. Urals delivery at the port of Rotterdam averaged $69.89 in April, compared with an average of $104.40 for Brent in the UK.

According to trade sources, Russia is trying to find new customers after the Western buyer has dropped sharply and India is the partner they are looking for.

“Indian refiners are always hungry for a bargain. Russian crude oil is too cheap compared to other alternatives. They simply can’t ignore Russian oil at this price,” said one analyst. Geneva-based crude oil trader said.

New shipments are heading to several Indian refineries such as Reliance’s two refineries in Jamnagar with a capacity of 1.36 million bpd and Nayara Enegry’s plant in Vadinar with a capacity of 400,000 bpd. Indian Oil’s plant in Panipat has a capacity of 300,000 bpd, Hidustan Petroleum Corp’s plant in Vizag has a capacity of 166,000 bpd and Bharat Petroleum Corp’s plant in Kochi has a capacity of 310,000 bpd.

Russia’s crude oil imports spiked in April 2022 from India.

Previously, India was not an active customer of Russian crude, mainly due to economic and logistical problems. Kpler data shows that Russia’s Urals crude oil exports to India will be 16,000 bpd and 32,000 bpd in 2020 and 2021, respectively.

Urals crude oil, which is mainly exported from the Baltic and Black Sea ports, has to be transported for a long time. Even Russian ESPO crude is not convenient for Indian refiners to import. But at these prices, it is hard for Indian refiners to ignore Russian oil.

With the move to increase oil purchases from Russia, the Indian government has come under great pressure from Western countries. However, they still defend their point of view. “The amount of oil India imports from Russia is only a fraction of what the rest of the world imports from Russia. Ultimately, we look at this from an energy security perspective. Not only India, Other countries are also following,” Indian Foreign Minister Vinay Kwatra said at a press conference on May 2.

India’s oil demand is also growing strongly again as the country’s economy is recovering from Covid. Russian crude makes up less than 3% of the roughly 4.3 million bpd India imports in 2021, according to S&P Global Commodity Insights.

India increased its imports of Russian oil as the EU may propose an embargo in its sanctions package against Moscow this week.

However, this purchase may decrease as the EU and US tighten sanctions from mid-May, which could affect logistics operations. Most Indian refineries buy crude on condition that the seller bears the costs associated with insurance and shipping.

India has recently emerged as the world’s third largest crude oil importer, heavily dependent on crude oil from the Middle East and West Africa. They are trying to diversify their suppliers over the past few years.

Russia is the world’s top major oil supplier, exporting more than 7 million bpd of crude oil and petroleum products – about 13% of total oil trade.

Europe is particularly dependent on Russian oil and imported about 2.7 million bpd of crude oil and 1.5 million bpd of other products, mainly diesel before the time of the Russia-Ukraine conflict. break out

T&G Import-Export Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 02473010868

Email: hrm@tginterjsc.com

Website: http://tgimportexport.com