China is releasing Australian coal from bonded warehouses, although it is still banning coal imports from the supplier – an unofficial ban that has lasted for nearly a year – in an effort to ease the global electricity crisis. nationwide due to lack of coal.

The electricity crisis in the world’s top coal consumer comes as strong demand for electricity from manufacturers, the industrial sector and households pushes prices to record highs and sparks a recession. widespread restrictions on electricity use.

An estimated one million tonnes of Australian coal has been sitting in bonded warehouses along the Chinese coast for months now, as Chinese customs no longer control Australian coal imports, a trade executive said. since Beijing’s unofficial ban last October.

“Han Australia is stuck in Chinese ports which started to be shipped out late last month … although most of it has been diverted to markets like India,” said a company trader. company based in eastern China said. Last week, Indian companies bought back 2 million tons of Australian coal that is being held in warehouses (in ports) in China.

Another trader said that the release of coal from bonded warehouses will start this week.

China’s top economic planning body – the National Development and Reform Commission – has not yet responded to these reports.

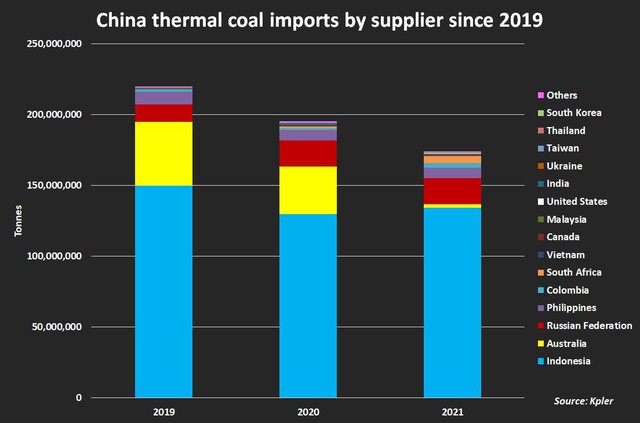

Thermal coal suppliers for the Chinese market in the years 2019-2021.

While China called on top coal miners to increase output and asked power operators to step up coal imports “in an orderly manner” to ease supply constraints, it still refrained from continuing to import directly from Australia – formerly the second largest supplier of coal after Indonesia.

However, at one million tons, or the equivalent of China’s coal imports in just one day, the released coal reserves are not expected to help quench the market’s thirst for coal.

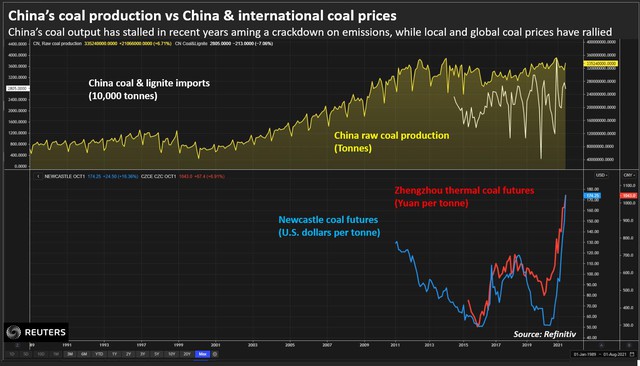

China coal production chart and Chinese and international coal prices.

Another trader said: “Without continuing to import Australian coal, the supply shortage will persist even further, as it will take time to boost domestic production after nearly five years of production restrictions. “.

“I can’t be optimistic. The shortfall will last until at least the fourth quarter and possibly until after February or March, when the heating season ends,” the trader said.

Traders say coal exports from other key suppliers such as Russia and Mongolia have been constrained by rail capacity not keeping up with demand, while exports from Indonesia have been hampered by the weather. rain.

Last year, Indonesia signed a $1.5 billion coal supply deal to China. Indonesia seems to have many advantages in supplying coal to China but cannot meet China’s huge demand in the short term.

That prompted power operators like Zhejiang Energy Company in eastern China to import the first batch of thermal coal from Kazakhstan on Monday, following the first batch of US thermal coal imports. in June and July.

China imported 197.69 million tons in the first eight months of 2021, down 10% year-on-year. But imports in August alone increased by more than a third due to tight domestic supply.

Chinese state media said that to ease supply stress, China State Railway Corporation on Tuesday pledged to allocate more transit capacity to ensure coal reserves at 363. The power plant has direct rail enough for 14 days of use. Currently, China’s coal reserves of coal-fired power plants have fallen to the lowest level in 10 years.

Since the end of last year, China has stopped buying coal from Australia. To replace Australia, China looks to Indonesia, Mongolia, Russia and other countries to offset coal supply.

Australia, for its part, has also stepped up its search for other customers amid trade tensions that have forced China to refuse to import its coal. Coal ships unable to reach China have also been diverted to other destinations to replace the world’s second-largest economy.

The power shortage risks slowing China’s economic growth and exacerbating a downturn caused by problems in China’s real estate sector. Several international organizations have downgraded China’s growth outlook due to the power crisis. Many observers expressed concern about “a significant energy shock” to the Chinese economy. Beijing can raise the price of export goods and it leads to consumer inflation in advanced economies.

Reference: Refinitiv

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com