The copper metal market was calm amid the turmoil of the London Metal Exchange (LME) this month. This is unexpected because Russia accounts for about 4% of global copper production.

The copper market was only shaken for a short time by a margin crisis that led to the LME suspending Nickel trading on March 8, causing copper to spike in a short period of time, skyrocketing. all-time high, at $10,845/ton.

But since then, the price of 3-month copper on the LME – the reference for the global market – has not fluctuated much. Currently, copper is at 10,340 USD/ton.

The reason copper seems to stay out of the Russia-Ukraine crisis is partly because the price of copper has dropped significantly since the turmoil in October last year – when the LME also had to intervene to limit the stock of the exchange. copper is not available to fulfill delivery requests, by opening an inquiry, asking banks and brokers to provide information about their activities and their clients in the copper market in 2 most recent month.

On the other hand, Russia’s copper supply has been largely unbroken by the conflict in Ukraine, unlike other industrial metals, such as nickel, which have been shaken to the breaking point by the Russo-Ukrainian conflict. .

But why is that?

Russia is a major copper producer with refined copper production of about 1 million tons per year, accounting for about 4% of global production. Russia is also a major exporter of both unwrought copper and copper wire, but does not hold the position of control of the supply chain in the West as palladium – for which Norilsk Nickel alone accounts for 45% of global production. bridge.

Furthermore, most of the Russian-produced copper is exported to China, which absorbs about 400,000 tons of Russian copper annually. The assumption is that other world markets (except China) can survive without the Russian currency, and that China will simply absorb what is ostracized from Western markets.

That is probably one of the reasons why the LME Copper Committee, which represents many consumers, manufacturers and traders, feels able to vote in favor of a ban on accepting Russian coins on the exchange. transaction.

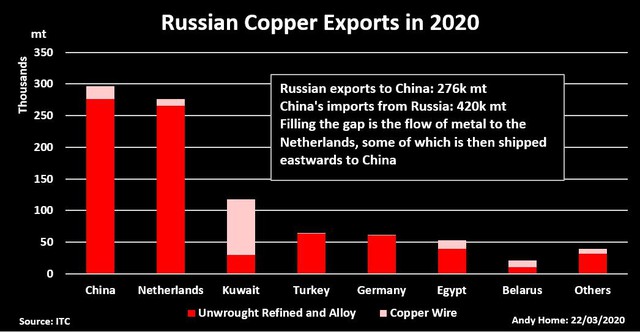

Russia’s copper export markets in 2020.

However, the LME executive has made it clear that it has no plans to unilaterally ban any Russian metals. “We do not plan to take independent action outside the scope of government sanctions such as placing restrictions on the circulation of metals produced in Russia in the LME system”; Our priority is to maintain an orderly market for the benefit of all market participants and therefore, we will maintain dialogue with governments as the situation becomes more tense.” , information from the LME exchange said.

The LME exchange has their own reasons because not everyone is too optimistic about the consequences of Russia’s “special operation” in Ukraine.

Goldman Sachs argues that copper is “mispricing Russia’s supply risk,” and that the metal has yet to come out of a super-bullish cycle, with prices likely to hit $12,000 a tonne within the next 12 months.

Russia’s copper exports are not stable

The flow of Russian copper exports is nuanced and difficult to analyze. The country’s unrefined copper exports total 463,000 tonnes in 2021, the lowest level since 2014, according to the International Trade Commission (ITC). The reason is that the production of Norilsk Nickel has been significantly reduced due to the flood of the mine and the disruption of global trade due to Covid-19 and the transport crisis, leading to the Government having to impose a temporary export tax. 15% from August to December 2021 to stabilize domestic supply.

It is worth noting that the country’s copper exports in January 2022 hit a colossal high, 117,000 tonnes, compared with 35,500 tonnes in January 2021, as export flows boomed after the tariff period ended. .

Russia’s copper exports averaged around 700,000 tonnes during 2018-2020, supplemented by 150,000 tonnes of copper wire, much higher than the figure for 2021.

However, last year’s trade figures show a significant tightening of Russian copper flows to China. Russian data shows that Russia exported 155,000 tons of copper to China, while Chinese data shows that it imported 403,000 tons of Russian copper.

There is a similar disparity in the 2020 trade figures, Russia exports 276,000 tonnes to China and China imports 420,000 tonnes of Russian dong.

It is clear that a significant amount of Russian copper is being shipped to the Netherlands – the second largest destination after China – and then transferred through the physical exchange system or LME before boarding the ship to Shanghai.

According to Goldman Sachs, although there is a direct rail link between Russia and China, currently used to transport copper ore, the route has little redundancy for refined copper. Much of the country’s refined copper exports to China pass through the Black Sea or through European ports such as Rotterdam. Both shipping routes are becoming increasingly difficult as logistics companies automatically stop trading with Russia, disrupting Russian sea trade.

“Until sanctions are eased, Russian copper is likely to be taken off the market,” Goldman added.

Copper reserves are very small

The question is to what extent can the current global refined copper supply chain handle Russian copper supply disruptions of that scale?

Global copper reserves are currently at a low level. The warehouses of the LME, Shanghai and CME floors currently only have a total of 276,000 tons.

Total stocks have increased by 85,800 tons year-to-date, but that is because seasonal stocks in China usually increase around the Lunar New Year. Compared to the same time last year, the amount of copper in storage of exchanges has decreased by 121,000 tons.

The amount of copper in the LME’s stockpiles has decreased by nearly 9,000 tons since the beginning of the year, to only 79,975 tons, equivalent to a global usage of just over a day.

The LME has extended the copper delivery deadline since October last year, but that also involves a rollback limit for all major contracts traded on the LME.

Overall, with the LME’s copper inventory almost exhausted, the market is very vulnerable to any panic buying if it happens, like around October last year, before the LME exchange. intervene in the copper market.

Russian copper is not yet sanctioned and the LME is not banning Russia from trading the metal, at least for the time being. And even if there is a ban, it is certain that the Russian dong will easily find a consumer, which is China.

However, for Russia to bring copper to China, it also has to go to Europe, and that is becoming extremely difficult now. As a result, the adjustment of trade flows for Russian copper can be extremely difficult.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com