China iron ore prices continued to fall for the fourth consecutive session as investors worried about the government’s intervention in this market. Whether the price will continue to fall or recover soon is what analysts and investors are trying to explain.

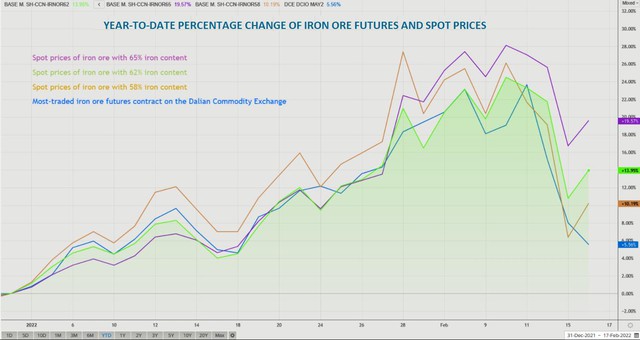

Iron ore futures for May 2022 on the Dalian Commodity Exchange ended February 17, down 3.8% to 685 yuan/ton, down 5.2% in one session to 675 yuan. ($106.62)/ton.

Falling iron ore prices drag down the prices of steel products. Rebar prices fell 2% to 4,686 yuan/t, hot rolled coil fell 1.5% to 4,823 yuan/mt, while stainless steel fell 2.1% to 18,720 yuan/mt.

The price of iron ore, with 62% iron content, imported into China’s seaports for immediate delivery was at $140/ton, down 7.3% this week.

China’s policymaking body – the National Development and Reform Commission (NDRC) – has asked some iron ore traders to release their hoards, which are too large to return to reasonable levels, after a short period of time. The inspection was conducted in collaboration with the market regulator in Qingdao, one of the country’s largest iron ore import ports, and retrieved a list of companies with rapidly growing inventories.

The Chinese authorities held a symposium, asking some iron ore trading companies to provide information on their recent inventories, when they buy and sell products and other details, including quantity and price.

They also urge traders to coordinate to verify if there are any anomalies in the iron ore market, such as hoarding or bullish tactics.

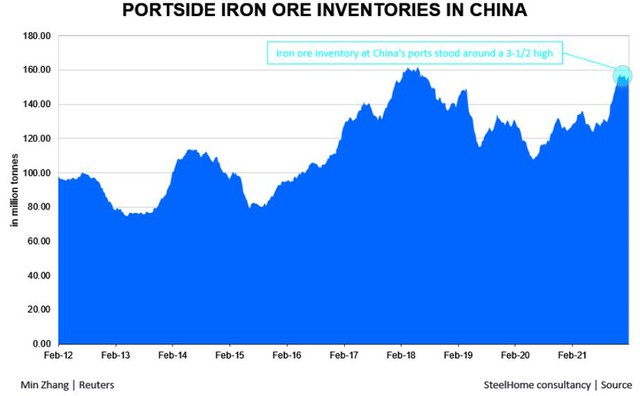

Inventories of imported iron ore at Chinese ports have increased since the second half of 2021, reaching a 3.5-year high of more than 157 million tonnes at the end of December.

Data from consulting firm SteelHome showed imported iron ore inventories at the port as of February 11 amounted to 156.35 million tonnes, the highest in three years.

Iron ore storage in Chinese seaports.

Will the price drop again?

China is once again trying to lower iron ore prices because the price of imported 62% iron ore (for spot goods at northern China’s seaports) has recently rebounded to nearly $150/ton, equivalent to an increase in iron ore prices. 68% from the 2021 low, of $87, reached in mid-November, the country’s policymaking body has warned market participants that “should not fabricate or publish anything any misinformation about prices.”

While China’s move is putting downward pressure on iron ore prices, analysts say the commodity is largely driven by real supply and demand fundamentals.

China, which is heavily dependent on imported iron ore, buys nearly 70% of the world’s seaborne iron ore.

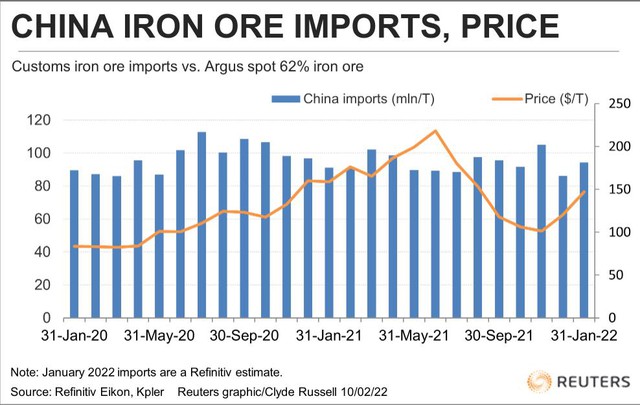

Iron ore imports into the country in January 2022 increased sharply, according to Refinitiv data at 94.28 million tons, while according to data of commodities consultant Kpler even higher, at 108.41 million ton. These figures are all well above the 86.07 million tonnes (official data) imports in December 2021, although below the 2021 peak of 104.95 million tonnes in November.

Refinitiv and Kpler data, collected by vessel tracking, may not match official Customs data due to differences in when goods are cleared, but are also strongly correlated with about working time.

Thus, the import of iron ore into the world’s No. 1 steel-producing country has been on track to increase sharply in the latest 5 months, showing that China’s steel mills and traders are looking to hoard raw materials.

Situation of China’s iron ore imports.

Meanwhile, China’s iron ore inventories, assessed by consulting firm SteelHome, were 154.05 million tons in the week to January 28, continuing a downward trend from their 2021 peak of 2021. 157.5 million, reached mid-December.

On the other hand, China’s steel production is likely to increase in the coming weeks, when the anti-pollution restrictions imposed during the winter will come to an end.

At the same time, Beijing is expected to step up economic stimulus measures to achieve its economic growth targets, and that is likely to boost demand for iron ore imports even more strongly.

Another factor that is likely to positively support iron ore prices is on the supply side, with hurricane season underway in Western Australia state, which produces most of Australia’s iron ore production – iron ore producer. the world’s largest.

The Australian Bureau of Meteorology has predicted the number of cyclones this year will be moderate or above average, increasing the risk of disruption to mining and transport operations in Western Australia.

Overall, data on China’s imports and inventories as well as steel production is expected to grow strongly and the risk of weather-related supply disruptions will be enough to prevent iron ore prices from falling sharply, even if it is not. may increase in the near future.

References: Refinitiv, Cnbc

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com