With the United Nations Climate Summit COP26 underway in Glasgow amid dire warnings about the future of the planet, with a focus on Asia burning more and more coal, the market Asian coal continues to cool down.

Coal prices are too high in recent times, causing industries that use a lot of electricity such as steel, aluminum, cement, chemicals, etc. to cut output, while the new electricity tariff is expected to push up production costs. increase, putting pressure on the profit margin of the business. That situation forced the Chinese government to announce a series of measures aimed at cooling the coal market.

Coal prices around the world are plunging rapidly after those interventions. Until now, coal prices in China are down more than 53% from the historic record high of 1,982 yuan/ton reached on October 19.

The price of thermal coal for January 2021 on the Zhengzhou Commodity Exchange (China) on November 1 fell by 9.26% compared to the previous session, to 925.2 yuan ($144.48). )/ton, after having just experienced the strongest week of decline in more than 5 years.

Last week, the price of this contract fell 27.6%, a decline not seen since September 2016. In particular, in the last session of the week, June 29, the price dropped dramatically, down 10%, below the threshold of 1,000 yuan / ton.

Spot thermal coal prices at the northern trading hub – Qinhuangdao – last week also fell to 1,500 yuan a tonne, down 41 percent from a record high of 2,545 yuan set on October 19. Mining mines, the price of 5,500 kilocalories energy content thermal coal for spot futures has fallen below 1,200 yuan/ton.

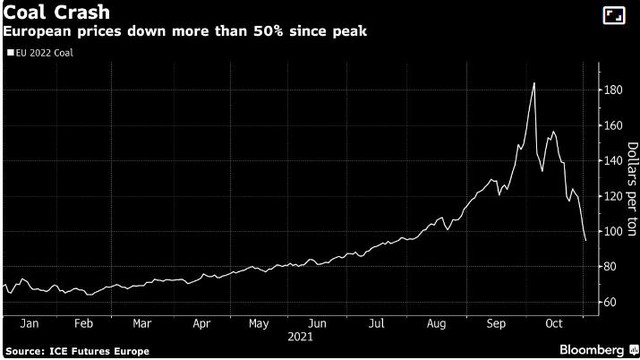

Reference coal futures prices in Europe are also down more than 50% from a record high of 193 USD/ton in early October. With prices in Germany down 6.5% on November 1 to 102 euros/megawatt-hour, lowest since September 23.

Australia’s benchmark thermal coal price – the Newcastle Weekly Index, which is gauged by commodity price reporting agency Argus – also fell to $199.81 a tonne in the week to October 29, down 21% from a year earlier. with a record level hit on October 15, at $252.72.

The price of low-quality Indonesian coal, with an energy content of 4,200 kcal/kg, also fell last week to $135.40/ton, 5.4% lower than the October 15 peak of $143.14. .

The fact that Indonesian coal prices have fallen less than elsewhere may be a reflection of strong demand from Chinese buyers from recent months, after Beijing banned imports of Australian coal.

Coal prices in Europe have fallen more than 50% since hitting historic record highs following price trends in Asia.

Supply improves

The supply of coal in China, both domestic and imported, is increasing.

Since July, the Chinese government has approved capacity expansions at hundreds of coal mines across the country. “Average daily coal production has reached more than 11.5 million tons for several consecutive days since mid-October, now peaking at 11.72 million tons,” the National Development and Reform Commission (NDC) NDRC) said. If that additional level of production continues, actuaries see the country could produce more fuel this year than in any past year.

The daily amount of coal supplied to key thermal power plants in China has also reached 8.32 million tons, the highest level in history, helping the country’s coal reserves at thermal power plants increase. to 106 million tons, 28 million tons higher than the end of September, equivalent to the consumption in 19 days. The NDRC estimates that coal reserves will exceed 110 million tons in just three days. The increase in coal stocks shows that the average daily supply is outstripping consumption.

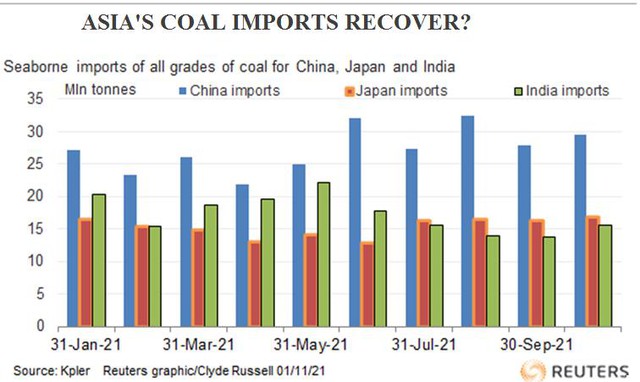

Coal imports into China in October are also estimated to increase compared to September. Preliminary statistics of commodity consultant Kpler show that the amount of coal imported into China in October was 29.6 million. tons, up from 27.9 million in the previous month.

Outside of China, the coal crisis also appears to be easing. Domestic coal production in India is increasing, after a period affected by the Covid-19 pandemic that disrupted mining and transportation operations.

India, the second largest fuel importer in the region, also increased coal imports in October, Kpler estimates to 15.51 million tons, compared with 13.73 million in September. However, imports That import is still far below the prevailing level of about 20 million tonnes a month before the Covid-19 pandemic began to hit Asian economies, in early 2020.

Japan, the third largest importer in Asia, also increased imports in October, with Kpler estimating 16.9 million tons, compared with 16.33 million tons imported in September and the highest level of imports. the most imports since January 2020.

The increase in imports comes despite record-high spot thermal coal prices, although the October cargo was bought before prices hit an all-time high, in mid-October.

Coal imports into Asia show signs of recovery.

Overall, there are signs that the supply shortage – which once pushed coal prices in Asia to historic highs – is easing. But for prices to fall back to where they were a year ago, more intervention from the Chinese authorities may be needed.

Although the coal supply situation in China has recently improved significantly following the efforts of coal producers, logistics industry and downstream users, while coal prices have also been less volatile. However, the price of thermal coal is still over 80% higher than in early 2021, and the price of physical coal as well as in futures contracts is still higher than 530-580 yuan / ton – the price threshold at which The market has long considered the official price mark.

Therefore, China announced that it may take further action after conducting investigations in coal producers.

References: Globaltimes, Reuters

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com