In theory, when output goes up prices should fall, but investor reaction is going in the opposite direction.

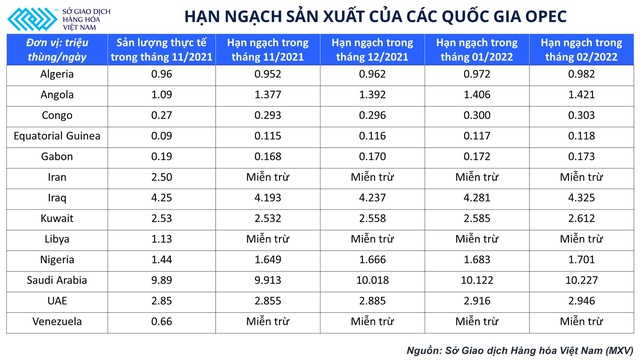

During the monthly meeting on January 4, 2022, the Organization of the Petroleum Exporting Countries and its allies (OPEC+) agreed to maintain the output policy in February 2022. Accordingly, the production quota next month will be increased to 400,000 bpd.

Theoretically, when output increases, the price will decrease, but the actual reaction of investors is in the opposite direction, the buying force continuously increases and pushes Brent price to 80 USD/barrel. So what is the reason for the market to move like this?

The reason why OPEC+ maintains its output policy

In recent months, OPEC+ has continuously maintained its policy of increasing output despite many downside risks such as the new Omicron variant and the expectation of a surplus in early 2022.

Some of the main reasons for this decision are that OPEC+ wants to give a consistent guide to the market, the surplus forecast for next year has been revised down, the Omicron variant is not expected to have much of an impact on the market. the actual demand and total output of the group may not be as much as the figures suggest.

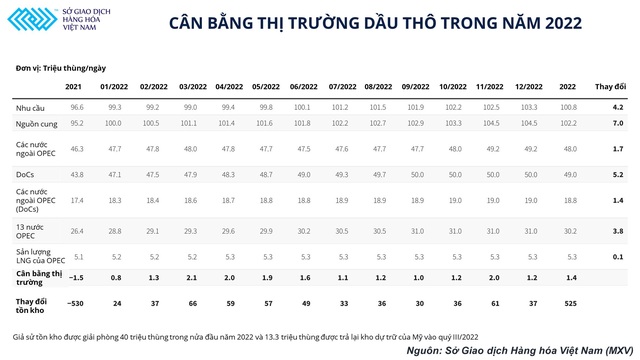

According to an internal OPEC+ document, the supply surplus in January and February 2022 will reach 0.8 million b/d and 1.3 million b/d. The supply surplus, adjusted down by nearly half compared to the figure released in December 2021, is a big positive factor for investors, especially in the context that a series of reputable organizations have announced predicts that supply will be in surplus early next year. It can be said that the overall market picture has improved quite a bit since December, boosting oil prices right after the results of this week’s meeting.

Part of the reason for this cut may be because OPEC+ does not expect the new variant of Omicron to affect global crude oil demand too much. Not only that, the World Health Organization (WHO) also said that Omicron has not shown a more severe effect than other variants.

Crude oil prices have had a sharp downward correction since October 26, 2021 when the initial information about Omicron was released. Concern about demand in major consuming countries as lockdown measures were reintroduced contributed to this correction but as of today prices have recovered. Therefore, new variations will still be an important factor holding back crude oil’s momentum in the near term, but without evidence of an effect on demand, oil prices are unlikely to fall further. .

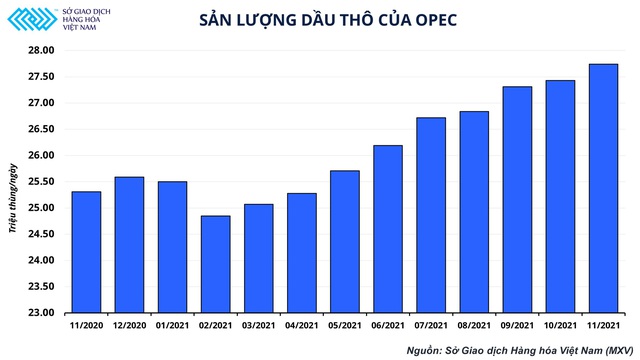

Actual output of OPEC+

Although OPEC+ production quota is increased by 400,000 bpd next month, based on recent months’ data, it is understandable that the group’s actual total output will not be as high as expected. Some countries in the group are not able to increase production as planned due to difficulties in production.

Even if the top producing countries have enough spare production capacity to make up for their decline, this is not the solution as OPEC+ regulations do not allow this to happen. The main reason is that when countries that produce less than their quotas can increase output again, countries that increase production to make up for the shortfall will not be able to reduce output quickly without suffering losses. financial harm.

The next direction of OPEC+ in the coming months

Despite calls from the US as well as major consuming countries to increase production further, OPEC + maintained the current increase because they believe that the oil market does not need more supply yet. In response to this action, the US and Asian countries coordinated to release crude oil from storage to cool down prices but did not achieve much.

According to the Vietnam Commodity Exchange (MXV), OPEC+ is highly likely to maintain the policy whereby output will be increased by 400,000 bpd per month because their plan shows high efficiency. Besides, with the current high prices, big manufacturers have an incentive to produce more and earn more profits.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com