China’s iron ore futures fell, topping a second straight weekly decline, hovering near a seven-month low on worries about steel production curbs.

January 2022 iron ore traded on October 10 on the Dalian Commodity Exchange was 0.3% lower at 732.50 CNY (equivalent to 113.66 USD)/ton. Iron ore has touched CNY 717.50/ton, the lowest level since February 4, 2021.

The price of raw materials for steel production in October traded on the Singapore Exchange fell 0.4 percent to $129.15 per ton.

Spot iron ore prices fell to a nine-month low of $131.50 per tonne.

Iron ore prices have had a few months of volatility, but by the end of August, there was a change in volume in the market, leading forecasters to have revised down their year-end forecast from $175/ton to $125/ton. ton.

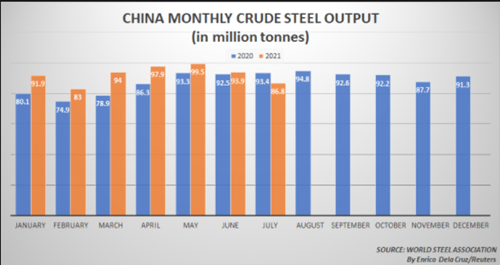

China has announced it will limit crude steel output this year to no higher than 2020 output to limit industrial pollution. But news that restrictions could continue to be tightened further confused the market.

In Jiangsu, China’s second-largest steel-producing province, a campaign to monitor energy consumption among industrial enterprises including steelmakers has raised fears of continued disruption. operation of large capacity furnaces.

Dalian coking coal prices have fallen from record highs. Coking coal prices are down 4.9% but up nearly 13% this week. Coke prices fell 6% after gaining 20% in the previous session.

|

China’s monthly crude steel production

Rebar prices on the Shanghai futures exchange rose 1.3%, while hot rolled coil increased 0.4%. Stainless steel prices rose 0.2%.

China’s ore imports in August 2021 increased again after 5 consecutive months of decline. However, experts worry that China’s policies to limit carbon emissions, coupled with a slowing property market and Beijing’s search for new iron ore import partners, will make Australia lose a major customer. .

According to the Australian Financial Review, there are other signs that the Chinese government wants to rein in the steel industry to meet climate goals and cool down the already very sunny property market. This caused iron ore prices earlier this week to drop to a 7-month low.

However, import and export data for August showed that China’s demand for iron ore imports from Australia has not peaked despite the strained trade relationship between the two countries.

Accordingly, in August, Australia exported more than 97 million tons of iron ore to China, up 10% compared to July 2021. However, this figure is still 3% lower than the same period last year.

However, in terms of turnover, the import value of iron ore in the first 8 months of this year was 80% higher than the same period last year thanks to the record price increase of this item.

However, experts are concerned that China’s policies to limit carbon emissions are starting to affect the country’s steel industry.

In addition, another concern for Australian ore miners is that China’s real estate industry has begun to falter.

Evergrande, one of China’s largest residential real estate companies, has also had to suspend some projects and face the risk of not being able to repay some loans. Many people expressed concern about Evergrande’s situation partly reflecting the consequences of China’s real estate fever in recent times.

Some experts warn that China’s carbon reduction policy coupled with a slowing property market and Beijing’s search for new iron ore importers will make Australia lose a major customer.

“China is looking for iron ore suppliers in Africa to reduce dependence on Australia and Brazil,” said William Curtayne of research firm Milford Asset Management.

Source: VITIC/Reuters

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com