Three-month aluminum futures on the London Metal Exchange on September 8 fell 0.5% to $2,760/ton. Copper fell 1.1% to $9,344 a tonne, zinc rose 1.2% to $3,043, lead fell 0.1% to $2,272, tin fell 2.9% to $31,950, nickel fell 0 .5% down to 19,550 USD.

Aluminum prices traded on September 8 lower on a stronger dollar, but prices remained near 10-year highs as supply concerns were hit by a coup in Guinea that disrupted production in other parts of the world. other places.

The metal, used in cars and beverage cans, has been hit by supply disruptions around the world, raising concerns about availability.

| Three-month aluminum futures on the London Metal Exchange on September 8 fell 0.5% to $2,760/ton.

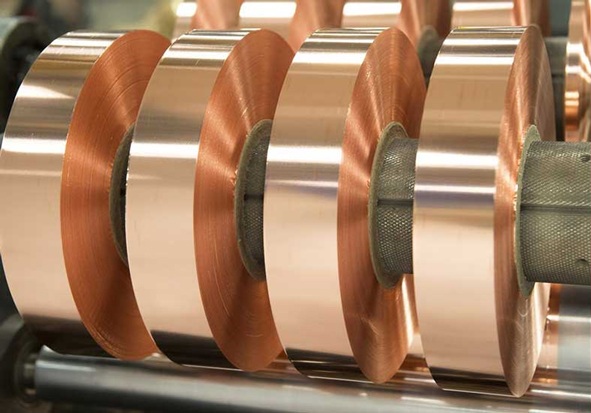

The price of imported copper to the top consumer China in August decreased by 41% over the same period Copper price fell 1.1% to $9,344/ton Zinc prices rose 1.2% to $3,043 Lead price fell 0.1% to $2,272 Tin price fell 2.9% to 31,950 USD Nickel fell 0.5% to $19,550

|

Commerzbank analyst Daniel Briesemann said: “Aluminum has been boosted by repeated reports of supply issues, whether in China, Jamaica, Canada and now in Guinea.

Although no major mines have been disrupted, a coup in Guinea over the weekend has raised supply concerns as the West African nation is the largest source of aluminum bauxite ore for top producer China. Country.

Three-month aluminum futures on the London Metal Exchange on September 8 fell 0.5% to $2,760/ton. In the previous session, aluminum prices hit their highest level since May 2011 at $2,782.

“We believe prices are too high and expect a correction for the rest of the year,” said Briesemann.

The dollar traded on September 7 appreciated against other currencies, making assets such as aluminum and copper denominated in greenback less attractive to global buyers.

Besides, China’s exports of unwrought aluminum and products in August were 490,286 tons, reaching the highest level since March 2020 with an increase of 24% year-on-year and an increase of 4.5. % compared to July.

Analysts expect a correction in copper prices for the rest of the year.

Copper prices imported to top consumer China in August fell 41% year-on-year to the lowest since June 2019 at 394,017 tonnes.

“We believe this drop is a baseline for comparison, as China imported a record high amount of copper during the summer months of last year – presumably in excess of it,” Commerzbank analysts said. needs of this country”.

Copper fell 1.1% to $9,344 a tonne, zinc rose 1.2% to $3,043, lead fell 0.1% to $2,272, tin fell 2.9% to $31,950, while nickel down 0.5% to $19,550.

Source: VITIC/Reuters

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com