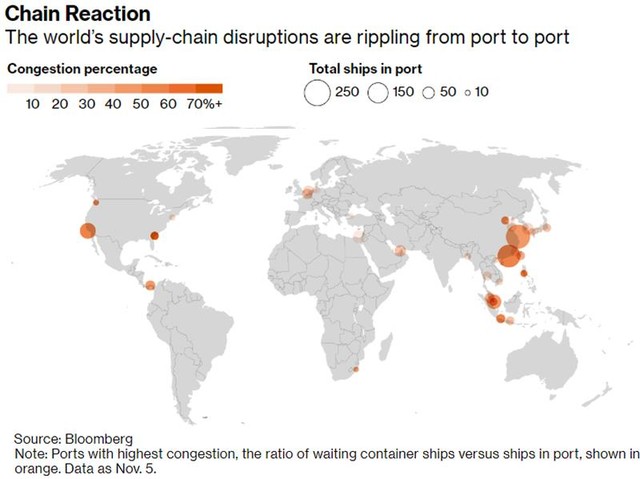

Inadequacies throughout the supply chain since the onset of the Covid-19 pandemic are leading to congestion at ports around the world, driving up prices.

Cargo shipments from the busiest ports in the US show a sharp increase in idle time at these ports. In contrast, the backlog on container ships near Singapore is now 10.5 percentage points higher than usual. Those imbalances are contributing to the increase in global food prices in particular and inflation in general in all parts of the world.

Ironically, inflation is so high, but banks like the Bank of England or the Central Bank of Norway have to ‘stand still’ without being able to do anything else.

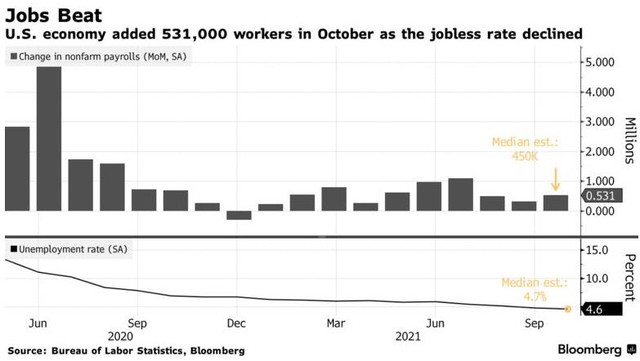

In the US, the number of jobs in the non-farm sector in October was much higher than expected, and this week the US Federal Reserve (Fed) – the country’s central bank – decided to start reducing reduce bond purchases. The Czech and Polish central banks have raised interest rates to combat rising inflation, while the Banks of England and Norway can only watch.

Here are some updated Bloomberg charts this week of the latest developments in the global economy:

AMERICA

The labor market was on track, with new jobs in the non-farm sector in October higher than expected, reaching 531,000. This data adds another piece to the puzzle that paints a brighter picture of the job market than analysts and businesses had predicted, in the context of gradually easing anti-Covid-19 measures and the level of unemployment. Rising wages help employers fill the ‘gaps’ in the labor market, pushing the number of new jobs to nearly a record high. The jobs data also shows the Fed’s decision this week – to begin easing the pace of bond purchases, in place throughout the pandemic, and to keep interest rates (loan costs) low near zero – have reasonable grounds.

The number of new jobs in the US in October increased, the unemployment rate decreased.

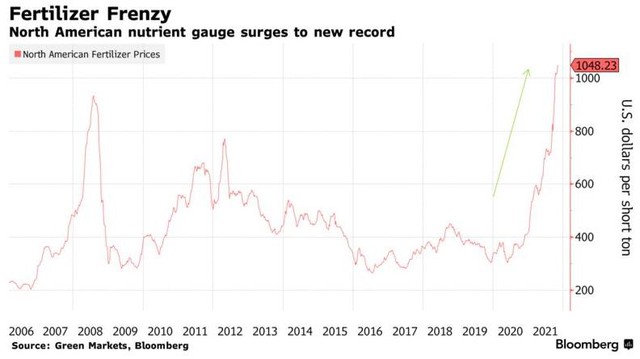

Fertilizer prices increased sharply

Fertilizer prices skyrocketed due to the high price of natural fuel forcing some production plants in Europe to suspend or cut production. Soaring fertilizer prices are raising concerns that farmers may reduce fertilizer purchases, or adjust crop structures to increase planting of crops that require less nutrients. The decrease in the output of some agricultural products can cause the prices of those agricultural products to rise, exacerbating food price inflation.

Fertilizer prices in North America are at record highs.

Fertilizer prices in North America are at record highs.

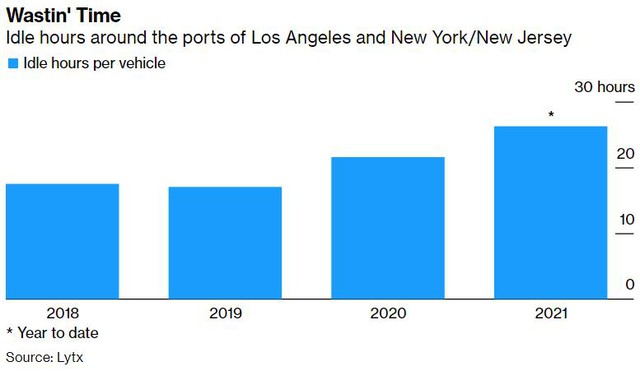

Waste time

Cargo shipping around America’s notoriously ‘busiest’ ports now shows that idle time is on the rise – another sign of supply chain bottlenecks (in some places overcrowded with ships). rafts, in some places too deserted), causing damage to America’s shipping hubs.

Up to now, the average daily idle time of each truck in areas around major US seaports has increased higher than 21.5 hours in 2020 and 17 hours in 2019. .

Idle times of the transportation system around the ports of Los Angeles and New York/New Jersey

Idle times of the transportation system around the ports of Los Angeles and New York/New Jersey

EUROPE

Czech and Polish policymakers this week continued to raise borrowing costs (interest rates), but the Bank of England (BoE) refused to do the same when it decided to leave interest rates unchanged, in contrast. with market expectations.

Interest rate adjustments (basis points) of central banks.

The Czech central bank raised borrowing costs by 125 basis points to 2.75% – the highest level in nearly a quarter of a century, while the governor of Poland’s central bank pledged to do “whatever it takes”. what is needed” after the country’s central bank raised the reference rate by 75 basis points to 1.25%. However, Western European policymakers were more hesitant this week: The Bank of England defied market expectations by leaving interest rates unchanged. Norway followed suit, but said it was on track to raise interest rates later this year.

ASIA

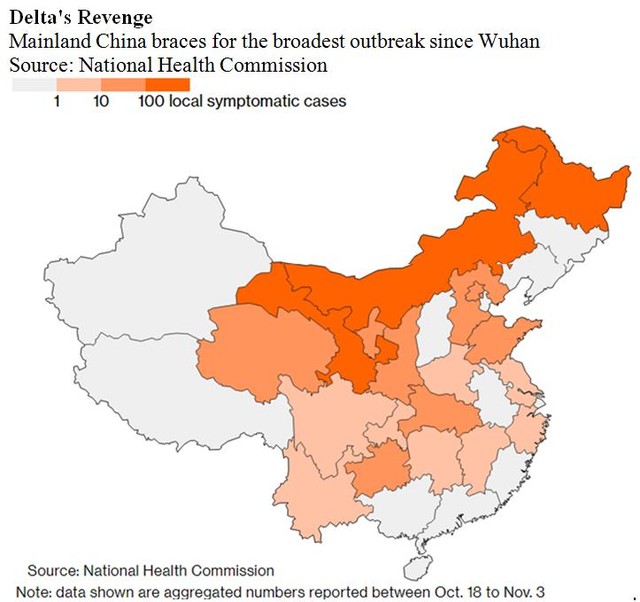

Delta variant virus

As of Wednesday (November 3), the outbreak of the Delta variant virus in China has spread to 19 of 31 provinces and cities, the widest spread the country has seen since the end of the outbreak. first broke out in Wuhan in late 2019. The Delta virus strain is much more contagious than previous strains, forcing Beijing to take drastic measures to combat the virus under measures that increasingly disrupt operations. of the world’s second largest economy.

A major outbreak is also on the rise in Europe as colder temperatures lead to more people taking to the streets than before.

.

Mainland China is at risk of the heaviest Covid-19 outbreak since the first outbreak in Wuhan (aggregated data from October 18 to November 3).

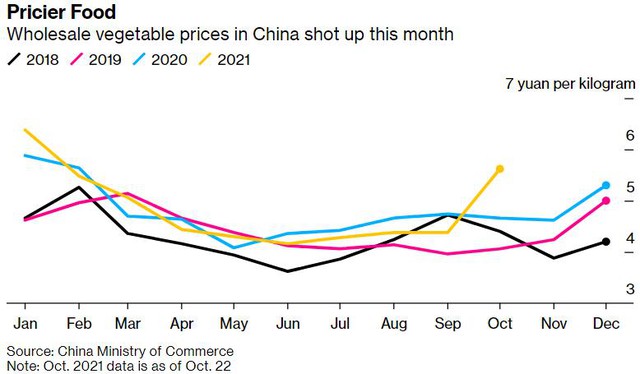

Food becomes more expensive

The mainland Chinese government has called on local governments to find ways to ensure there is enough food for people during the winter and encourage people to stock up on some essentials due to the resurgence of the Covid-19 epidemic. development, increasingly widespread, in the context of cold weather, heavy rain affects agricultural production, and may even increase tensions with Taiwan (China).

Wholesale vegetable prices in China skyrocketed this month (Source: Ministry of Commerce of China)

Emerging Markets

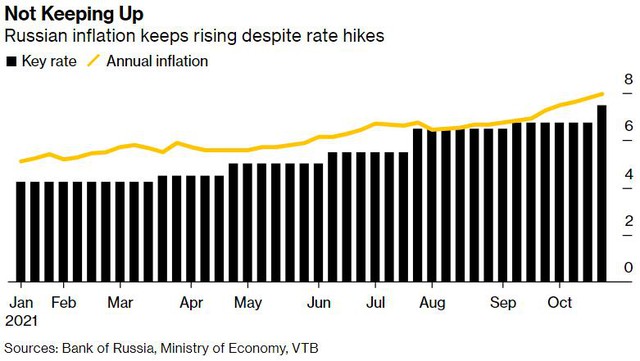

Inflation in Russia has persisted for many months, continuing to increase in October, putting pressure on the Central Bank of Russia to increase interest rates in December. Consumer prices in this country increased by 8.1% in October. , the highest level since early 2016 and above the 8% median forecast of analysts surveyed by Bloomberg. Food prices rose 10.1%, and core inflation also increased.

Inflation in Russia continues to rise despite interest rate hikes (Source: Bank of Russia, Ministry of Economy, VTB)

WORLD

The biggest of many crises in 2021 is still getting worse. Disruptions to the world’s supply chains are happening across ports around the world.

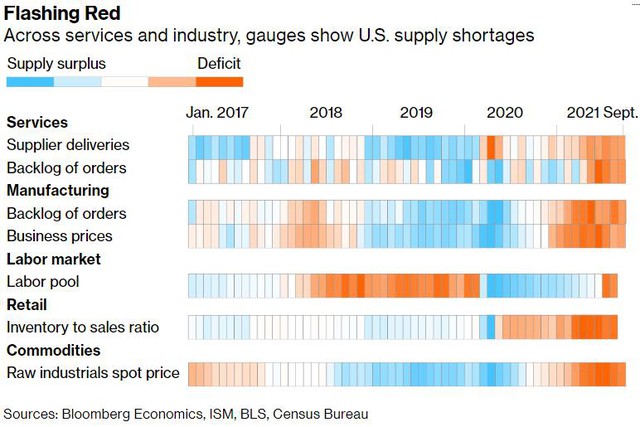

In the service and industrial sectors, the ‘meters’ show a shortage of supply in the US (Source: Bloomberg Economics, ISM, BLS, Census Bureau).

Last year, the global economy slowed down. This year, the economy has rebounded, leading to the most severe bottleneck in the history of global logistics. New indicators from Bloomberg Economics show increasingly severe congestion, showing the world’s failure to find a quick fix, and in some areas.

Chain reaction

The world’s supply chain disruptions are happening from port to port (Ports with the highest congestion, ratio of container ships waiting to ships in port, shown in orange. November).

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com