In 2020, the global economic engine almost suddenly “stopped spinning” because of the epidemic. This year, the machine is back to work, but unfortunately is stuck in one of the biggest “traffic jams” in human history.

The whole world is in need

The shelves in the supermarket are empty. At ports, ships wait in long lines to enter the loading dock. Many car factories had to stop working because of a lack of chips. And all in all, there’s one thing no one wants: nearly every item has a massive increase in price.

Gradually abandoning the view that inflation is temporary, it is likely that central banks will be forced to cope with inflation by raising interest rates sooner than expected. This leads to many new risks that threaten the fragile recovery of the world economy, and can cause real estate and stock prices to deflate quickly.

Behind the congestion on the supply chain is a series of factors: an overloaded transportation network, a shortage of workers at key points and a strong recovery in demand after the pandemic.

The problem is not only in the process of transporting goods from one place to another. Even the supply has not been able to keep up with the demand. Last year, when consumers stopped spending, manufacturers drastically reduced the amount of input materials, leaving them unable to react in time when customer demand rebounded.

China, which is known as the “world factory”, is dealing with a new epidemic with draconian lockdown measures. China’s factory gate price index rose 10% year-on-year, the strongest since the 1990s.

Bloomberg Economics has developed a number of new indicators that show how serious the problem is, how the whole world is failing to find a quick fix, and in some places the situation is even unfolding. how it gets worse.

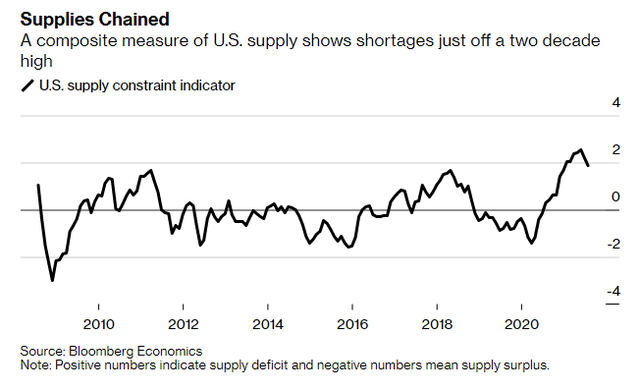

According to the supply stress index compiled by Bloomberg Economics, shortages in the US are at their highest level in 20 years. In the UK and eurozone it is also at the same level. This is a metric that is calculated based on a variety of data, from the factory gate price index to the inventory/revenue ratios of retailers and order numbers of companies operating in the service sector.

Supply stress index developed by Bloomberg Economics, shortages in the US are at the highest level in 20 years.

The market is in normal condition if the index is zero. A negative index means an excess of goods, while a positive index indicates the opposite. From last year to this year, the index shows that the situation has quickly reversed from an oversupply before Covid to a severe shortage like today.

From big manufacturers like Toyota to shipping companies and even consumers who are waiting for their goods to be delivered, the biggest question at the moment is: when New interruptions ended?

Even supply chain gurus like Amazon and Apple can’t improve the situation. Recently, Amazon announced that its entire fourth-quarter profit may be blown away because of rising labor costs and warehousing fees. Apple lost $ 6 billion in revenue because it did not keep up with demand, and the number is expected to increase in the next quarter.

According to Shanella Rajanayagam, economist at HSBC, the strain on the transport network is likely to improve in early February, after the Lunar New Year holiday, although the disruptions will last until the middle of next year. However, it is certain that the need to offset spending and hoard goods will continue to put pressure on the supply chain. Therefore, it will take longer for the supply chain to fully recover.

A new Mercedes-Benz car is located in the port of Barcelona, Spain. Photo: Bloomberg.

We can’t know what will happen next, in part because the number of “bottlenecks” along the long journey from the production line to the consumer’s shopping cart is too great. Because it is a chain with many stages, one person has to wait for the other, the delay time is longer.

Pandemic turns everything upside down

Normally, the logistics system will easily adjust to the ups and downs of the global economy. The increased demand will boost trade, drive up freight rates and bring about a golden age for carriers – until capacity is overwhelming and the industry enters a period of decline.

However, the pandemic has turned everything upside down. Despite signs of slowing global economic growth, the international trade network has never been so congested.

More than 70 ships are lined up in the waters off the Port of Los Angeles, with 20-foot containers loaded with enough cargo to stretch from Southern California to Chicago. And even if these giant ships can dock, the cargo will continue to be stuck at the port, waiting for a very long time to be transported inland.

The longer-term solution requires the world to control Covid-19, build a new and more efficient infrastructure system, and improve technology to conduct digital transactions and exchanges. information more quickly.

Bottlenecks often appear after new outbreaks and extreme weather events have just taken place. For example, recently because of the outbreak again in Singapore, congestion has occurred. That’s a problem for the US, where the supply of clothing and home electronics is heavily dependent on foreign countries. And with vaccination rates low in many Asian countries, the problem isn’t going away anytime soon.

Simon Heaney, an expert at research firm Drewry, says that getting a supply chain back up sometimes takes luck (avoiding bad weather or disease), plus time and capital investment to increase capacity.

Empty shelves at a supermarket in Colorado, USA. Photo: AP.

For the global economy that has just come out of the worst recession in history, it’s not too worrisome, even good, that the supply shortage is partly due to overwhelming demand. However, there are still a lot of problems that come with it.

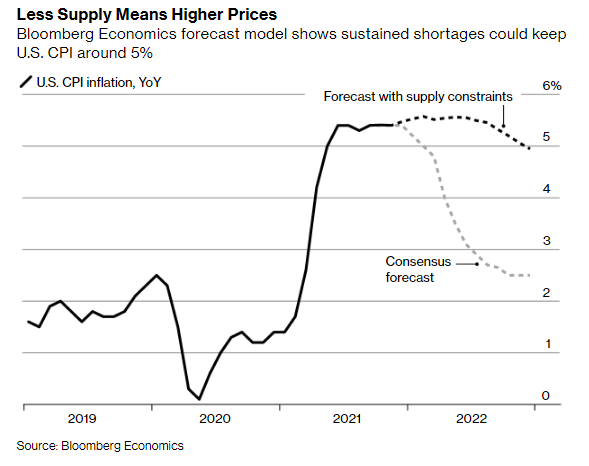

The inflation rate has been pushed to a high enough level that monetary policymakers feel uneasy. In the US, the figure is 5.4% and is forecast at 4-5% next year if supply tensions do not improve.

That does not mean that the world will return to the state of “stagnation” (stagnation accompanied by inflation) like the United States in the 1970s. At that time the US made the wrong policies and the economy developed. overheated over the course of a decade to result in inflation rising to more than 10%. It is now likely that the Federal Reserve and other central banks will not repeat that mistake again. Moreover, the unemployment rate is very low compared to the 1970s and is still on a downward trend.

However, the current situation still presents a super-challenging problem for central banks. If interest rates are kept at the current low level, the global economy will continue to recover, but there is a risk of soaring inflation. Raising interest rates may help curb inflation, but it’s wrong not by increasing supply but by reducing demand – it’s like a surgeon declaring “the operation was successful but the patient died”.

The market is predicting the Fed will raise rates twice in 2022, but Bloomberg Economics’ prediction model shows that if inflation continues to be high, twice is still not enough.

Of course, this prediction can be completely wrong. Demand will immediately decrease after the Covid-19 stimulus packages fade or the fear of the Fed tightening monetary policy causes consumer confidence to erode. The trend of shifting from spending on buying goods to spending on services (which is happening in the US) will help close the gap between supply and demand. China’s economic slowdown will cause commodity prices to cool down.

However, the current crisis is unprecedented, so we cannot predict exactly what will happen next.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com