Precious metal mines in Vietnam are estimated to bring huge profits due to increasing demand in the world.

High value nickel mine in Vietnam

Nickel is a silvery-white metal with a lustrous surface whose main characteristics are hard, malleable, malleable, and easy to spin. Because of its special properties, nickel is rarely used in its pure form, but is mainly used as an alloying element, especially in anti-corrosion alloys, magnetic alloys, heat-resistant alloys, and alloys. Metal has special properties.

According to sources, the whole country is currently only Ban Phuc Nickel Mine Co., Ltd (Ban Phuc Company) licensed to exploit and process nickel concentrates, other nickel mine areas only stop at the stage of searching and visiting investment exploration and preparation.

At the end of May 2019, BlackStone Company (Australia) announced to buy 90% of Ta Khoa nickel mining project, Ban Phuc commune, Bac Yen district, Son La province from AMR Nickel Limited for an undisclosed purchase price. , the remaining 10% belongs to Son La Mechanical Joint Stock Company. Mineral company from Australia at that time was confident that the project would be a new source of mineral supply in the future.

Nickel is an essential metal for the manufacture of batteries.

On December 23, mineral company Blackstone said that its prediction of nickel, copper and platinum mineral reserves in the Ta Khoa mine – located about 160 km west of Hanoi – was higher than previous estimates. seventy three%. Accordingly, 4 mines are being exploited with reserves of about 130 million tons with 0.37% nickel content – equivalent to 485,000 tons of ore containing nickel.

It is known that Blackstone’s exploratory drills to a depth of 374.7m have obtained many positive results. At a depth of 2m below the surface, the nickel content of the ore is 0.30%, a depth of 10.3m has 1.13% nickel ore, and a depth of 169m has 0.43% nickel.

In total, it is estimated that there are 58.6 million tons of solid ore with a nickel content of about 0.48%. The company said that the mines in this area contain more than 280,000 tons of nickel (not including cobalt, copper and PGE – platinum group minerals) which will create a great profit for investment and development activities in Ta Khoa nickel mine.

“In the relatively short period of time since the acquisition of the Ta Khoa Nickel-Copper-PGE Project, Blackstone has been able to locate a large deposit, which further confirms the mineral supply and profitability of the company. , ” said the company.

Nickel mining project suffers heavy losses

It is known that before being acquired, Ban Phuc Nickel Company started mining in 2013. However, the company decided to suspend mining and processing activities of concentrated sulfur ore (including nickel, copper, cobalt) at the Ban Phuc Nickel mine, during the period from September 2016 to the end of September 2018 because the revenue from the Project was not enough to cover operating costs.

Explaining this story, in 2017, Mr. Stephen John Ennor, General Director of Ban Phuc Nickel Mining Co., Ltd. said that nickel and copper prices in the world market were low, causing sulfur ore mining and processing activities. The density in this mine area cannot be maintained at the present time. In addition, many taxes and fees apply to the Project at a high level, causing the project’s operating costs to increase. As of August 2017, Ban Phuc Nickel Mine Project has accumulated a loss of USD 129 million.

Illustration.

Blackstone’s nickel-copper-PGE project is deployed at Ta Khoa – located 160km from Hanoi. The project occupies a strategic location on one of the most nickel-rich terrain in Asia and spans over 15 km at Ta Khoa. Exploration reveals the terrain to have more than 25 distinct nickel mining sites that are promising.

The company’s 2020 scoping study envisages a large-scale mining operation at Ta Khoa, with an initial mining life of 8.5 years, producing approximately 12,700 tonnes of nickel per year. The study also concludes a large economic benefit, with an estimated net present value of more than $1 billion for the project, with an estimated cash flow over the project’s life of $1.7 billion.

Situation of world nickel mining

According to research by Master Dao Cong Vu at the Institute of Mining Science and Technology – Metallurgy, the world is increasingly preferring batteries made from nickel because of their efficiency, long life and reduced costs. This leads to the demand for nickel in battery production is forecasted to increase in the near future as the amount of nickel used in battery technology increases and the scale of battery production expands.

Currently, the proportion of nickel used in production accounts for about 4% of total world nickel production. Indonesia, which has nickel reserves and is also the world’s largest nickel ore mining country, has started a project to produce nickel in 2019 for use in batteries. To date, many projects that were on hold have resumed operations with the forecast of increasing nickel demand from the electric vehicle battery industry.

However, the supply and demand chain of the world nickel ore concentrate market will constantly change and become unpredictable due to many related events, including Indonesia’s ban on nickel ore exports to retain ore sources for the industry. domestic nickel processing or the COVID-19 pandemic affects the demand for production and development of electric vehicles.

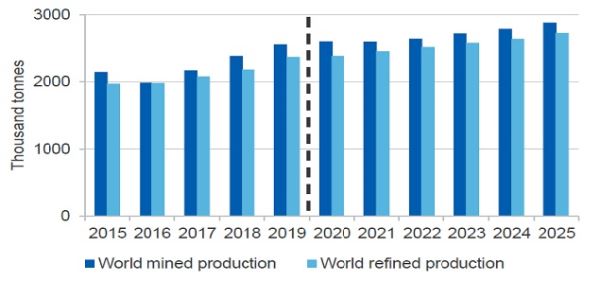

In China, refined nickel production fell in early 2020, partly constrained by the impacts of COVID-19. Nickel-alloy steel mills in Hubei province are not producing as input supply chain disruptions disrupted production. Nickel production is predicted to increase by an average of 2.4% in the coming period and reach 2.7 million tons by 2025.

Product orientation of Vietnam

The demand for nickel metal in the world is increasing, at the same time, the price of nickel metal traded on the market is forecasted to be higher. Therefore, the work of improving the recovery efficiency of nickel metal and useful metals in low-concentration nickel mines will be increasingly invested in research and application.

According to research, Vietnam’s nickel is not much. Specifically, total reserves and resources are estimated at 3.6 million tons of metallic nickel, mainly concentrated in the provinces of Thanh Hoa (3 million tons), Son La (420 thousand tons), Cao Bang (133 thousand tons). ). In which, the majority of nickel resources exist in the form of minerals.

The metal industry expert said that the market for using nickel as a raw material for battery production in the world is growing strongly, with high added value.

Therefore, the most appropriate development orientation of nickel deep processing technology today is: production of nickel salt preparations and cooperation with enterprises with source technology to produce batteries from domestic nickel ore sources. . That goal will both meet the needs for the development of the electric vehicle industry, renewable energy, and effectively promote Vietnam’s precious natural resources.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com