Commodity prices from energy, metals to agricultural products rebounded strongly in 2021, with electric fuels leading the gain, fueled by tight supplies and a strong economic recovery as Vaccination against COVID-19 helps prevent widespread blockade.

Analysts and traders believe that the world economy will continue to recover in 2022, from which global demand for commodities will continue to grow strongly and drive prices higher, although it will be less likely. likely to repeat the strong price growth rate as in 2021.

“The year 2021 sees a strong bullish wave across the board,” said Jeffrey Halley, senior analyst at brokerage OANDA.

“Although I believe commodity prices will remain high, I do not expect prices to recover in 2020 and particularly strongly in 2021 because those are exceptional years. Therefore, I do not predict a level. The growth of 2022 will be similar,” said Mr. Halley.

Food and energy prices have skyrocketed in 2021, hitting utilities and consumers around the world, from Beijing to Brussels, adding to inflationary pressures.

High prices are encouraging producers to increase output, but some analysts say supplies for products such as oil and liquefied natural gas (LNG) will continue to be scarce as these projects require more money. ask many years to go into production.

The strongest bull markets in 2021.

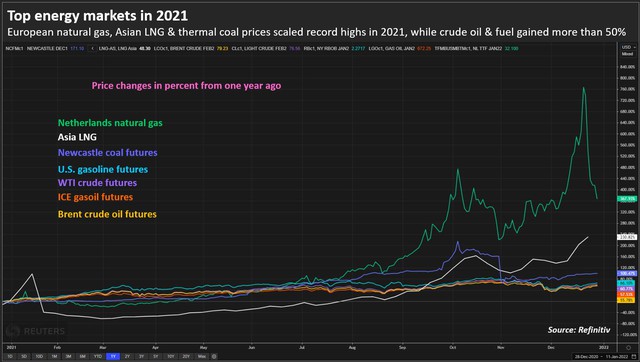

ENERGY INCREASES HUGE PRICES

Historically high coal and natural gas prices lead to a severe electricity crisis from Europe to India and China in 2021.

The price of liquefied natural gas (LNG) on the Asian market has increased by more than 200%, while the reference contract price of coal in the Asian market has doubled.

Valery Chow, head of gas and LNG research for Asia at Wood Mackenzie, said: “Global LNG demand will increase by 20 million tonnes in 2021 year-on-year, with Asia accounting for more. almost all of this increase”, adding that “more than 20%b of the total demand came from China, making this market the top importer in the world, surpassing Japan.

“However, persistently high spot LNG prices are likely to begin to dampen overall demand growth, particularly in highly price sensitive markets such as South Asia and Southeast Asia,” he said.

Global oil prices also recovered between 50% and 60% in 2021 and are expected to continue to rise in 2022 as jet fuel demand rebounds strongly.

In China, coal prices have more than halved from their record highs reached in October 2021 after China – the world’s top producer and consumer – made an effort to increase output and alkalize. price regime.

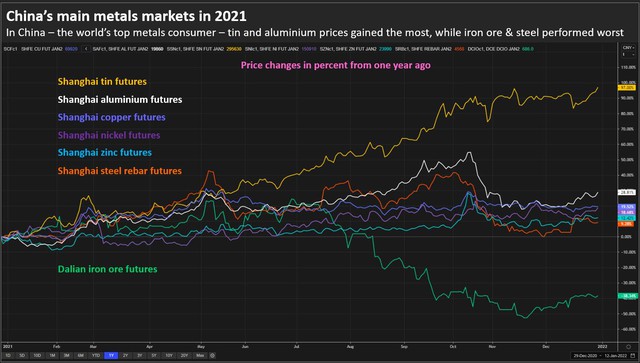

METAL UP PRICE

The energy crisis in China and Europe affected aluminum production, sending three-month aluminum futures on the London Stock Exchange (LME) up more than 40% in 2021 for the second consecutive year. However, that crisis also affected iron ore demand as the world’s top steel producer – China – cut output.

Iron ore prices, which hit a record high in May 2021, fell in the second half of 2021 amid China’s strict output curbs. The price of iron ore futures on the Dalian Stock Exchange (China) fell more than 10% after a strong increase in the past two years.

The base metals market will outperform the ferrous group in the near term, analysts say, as the energy transition will drive demand, while bottlenecks in the supply chain can still going on.

The price of copper for 3-month delivery on the LME has increased for 3 consecutive years, in which, in 2021, it will increase by 25%.

“Copper demand is expected to expand in 2022, the second consecutive year of growth, especially after the recent COP26 climate change conference ended for the foreseeable future,” said OCBC economist Howie Lee. see governments increasingly willing to prioritize clean energy.”

Prices of major metals on the Chinese market in 2021.

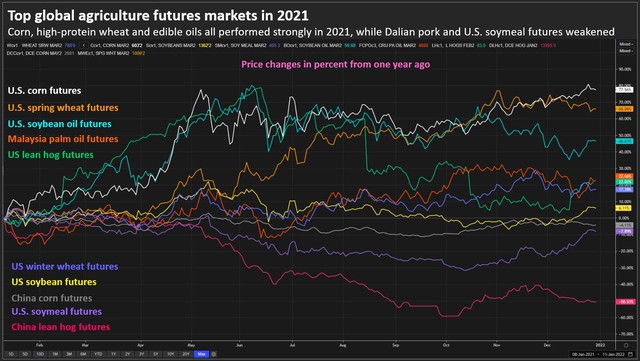

AGRICULTURE PRODUCTS ALSO GROW

Chicago soybean futures rose for the third year in a row, while corn was up nearly 25 percent and wheat more than 20 percent.

Limited supply due to adverse weather and strong demand usually drives the agricultural market.

Both Malaysian palm oil and US soybean oil have increased in price by more than 30% in the past year, the third year in a row.

Prices of some major agricultural products on the world market.

For beverages, arabica prices rose nearly 80 percent, posting profits for the second year in a row, and robustas rose 70 percent due to supply chain problems and increased demand, taking back all of what was already lost. died in the previous 3 years.

Raw sugar prices rose more than 20%, recovering for the third year in a row, while white sugar rose similarly as output fell in the world’s top producer – Brazil – because of drought and frost.

Precious metal prices are likely to cool off due to increased demand for high-risk assets such as industrial metals, equities and other markets, analysts said.

Gold prices in 2021 are mostly flat, after falling in 2020, while silver also fell after two years of strong gains.

Reference: Refinitiv

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com