China went through “golden September, silver October” with less expectations than the same period last year. The pressure of green economic growth and the epidemic have made this country “struggling” on many fronts and is expected to last through the next year. Difficulties swept into many industries, including metallurgy.

Plan to supply 3.3 million tons of coal/day in the period near Tet and after Tet

On December 3, the Shanxi provincial government planned a plan to supply coal during the Lunar New Year and Spring Festival. Accordingly, the average daily coal production is expected at 3.3 million tons. Shanxi province’s monthly coal production has remained above 100 million tons since July and is expected to exceed 1.2 billion tons in 2021.

Since September, China’s coal prices have been steadily rising, reaching record highs many times. As a major coal-producing region, Shanxi Province has actively implemented relevant national policies to promote the coal market and bring coal prices down to a reasonable level. Recently, the price of 5,500 kcal thermal coal in Shanxi province has dropped below 900 yuan/ton.

Shanxi province considers coal production capacity as an important measure to boost output and secure supply. Since the beginning of this year, 104 coal mines of the province have increased their capacity. Of which, 35 coal mines have been approved with an actual increase in capacity of 47 million tons per year; Another 33 coal mines have been inspected and are in the process of adjustment. It is expected that the capacity will increase by 27.8 million tons/year after being approved. The remaining coal mines are under inspection.

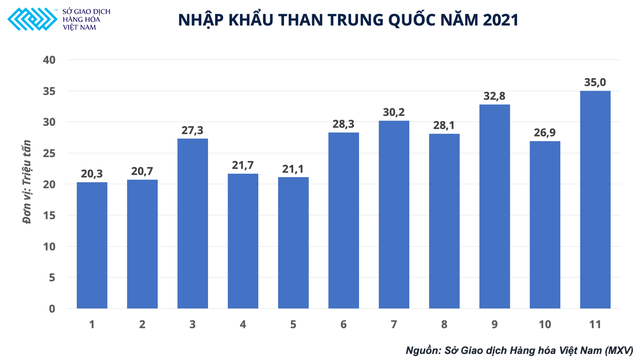

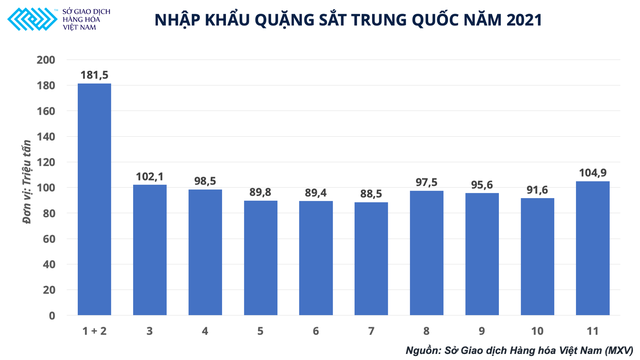

In November, the country imported more than 35 million tons of coal, up 23.3 million tons (200%) over the same period last year. The average import price is about 109 USD/ton, up 35 USD over the same period. Accumulated in the first 11 months of the year, China imported more than 292 million tons of coal, up 10% over the same period last year. According to the General Statistics Office of China, in the first 10 months of the year, the revenue of 4334 coal enterprises in the designated area reached 2,525 billion yuan, up 53% year-on-year. Profit increased by more than 210% year-on-year to 543 billion yuan.

This week, China’s metallurgical coke prices remained stable. The ex-factory coke price in Shandong was stable at 2,920 – 3,020 yuan/ton. Profits of steel mills also recovered better when steel prices recovered. According to the Vietnam Commodity Exchange (MXV), China’s metallurgical coal prices will continue to be stable in the first half of December and this will help the relevant markets to stabilize after a period of great volatility in the last quarter of the year. midyear.

Iron and steel market recovers in many worries

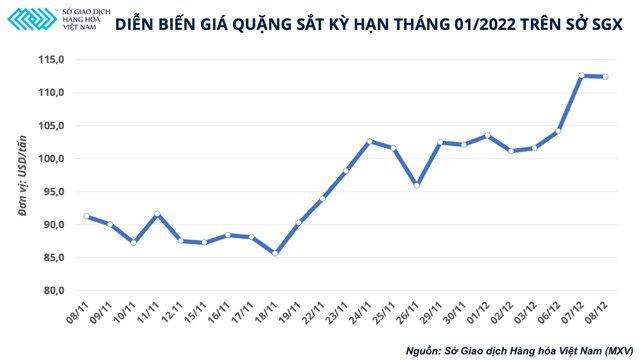

Along with coal prices, iron ore also maintained positive developments from last week and especially increased strongly this week, after the Central Bank of China decided to cut the reserve requirement ratio by 0.5 points. percent down to 8.4% on December 6. At the same time, the government also proposes to promote the recovery of the real estate market.

The Metals MXV-Index (one of the four commodity indexes of the Vietnam Commodity Exchange) also increased nearly 1% to 1,843 points. Notably, the trading value of metal products doubled in the fourth quarter to VND 1,300 billion/day, according to data from MXV’s Clearing Center.

As of December 2, iron ore inventories reached 155.4 million tons, an increase of 4.5 million tons compared to November 25 and 36% higher than the lowest level in the middle of the year. According to MXV, China’s iron ore reserves will continue to increase in the near future and the short-term outlook for imported iron ore 62% Fe is at $95-110/ton.

On December 7, the China Steel Association said that the country will continue to limit steel production next year, and this could reduce China’s iron ore demand by about 100 million tons. Therefore, MXV believes that it will be difficult for the market to see strong increases in iron ore prices like before next year.

In the finished steel market, prices temporarily stopped falling and recovered slightly from the last week of November. In particular, the construction steel segment has better price growth prospects when demand from downstream industries is gradually recovering. The government promoted the issuance of special bonds and facilitated real estate development.

According to the General Administration of Customs of China, the country exported 4.3 million tons of steel in November, down slightly from the same period last year. In contrast, steel imports were about 1.4 million tons, 23% lower than the same period last year. Accumulated in the first 11 months of the year, steel exports reached nearly 62 million tons, up 26.7% over the same period. However, steel imports were 29.6% lower, reaching more than 13.2 million tons.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com