Due to reduced demand, businesses in the field of building materials have been facing a serious decline in orders.

With this situation, many construction material factories had to suspend production lines, many workshops were closed and workers were laid off; Many businesses have to sell products below cost to have operating cash flow.

According to Mr. Dinh Hong Ky, Vice Chairman of Vietnam Association of Building Materials, in the past 20 years, the domestic construction materials industry has been developing strongly with a scale of the top 15 countries with the largest production scale. leading exporter in the world.

“Especially, the building materials industry has exported to 20 countries with many key products, some of which are at the top of the world such as cement, clinker, iron and steel…”, Mr. Ky emphasized.

However, due to many uncertainties in the world market such as the prolonged Russian-Ukrainian conflict, China’s “Zero COVID” policy continues to tighten; domestic disbursement rate of public investment is still low, and the real estate market continues to “freeze”… making enterprises in the field of building materials face many difficulties.

ORDER REDUCTION SERIOUSLY

Analyzing each industry and field, Mr. Dinh Hong Ky said that Vietnam’s cement industry has 56 factories with a total of 87 lines and a production capacity of 120 million tons.

In 2020, when the COVID-19 epidemic was complicated, the industry still consumed 101 million tons, ranking 3rd in the world. However, this year, consumption volume dropped to 62 million tons.

Similarly, the production and export of clinker (which is an indispensable ingredient for the production of cement – a binder used in construction) is always at the top of the world. But, from the beginning of the year until now, export volume has decreased by 50%, making the export volume of the cement industry decrease by 30%.

The field of ceramic tiles and sanitary ware – always ranks in the top 25 major exporting countries in the world, with a production capacity of up to 800 million m2 of tiles/year, especially when the real estate market is good, the consumption power is over 400 million m2 of bricks/year. However, from the beginning of the year until now, the consumption volume has decreased sharply.

“Besides the mentioned difficulties, China’s old technology products are sold through unofficial channels at low prices, causing great competition in the domestic market,” Ky added.

In addition, with a production capacity of up to 300 million m2, the construction glass industry always has a good consumption volume of 250-260 million m2 annually. However, in the first 9 months of the year, 120 million m2 was consumed (equivalent to 50% of the previous year).

SALE PRICE LOWER CAPITAL PRICE

Vice Chairman of the Vietnam Association of Building Materials said that while orders fell, the input costs of the cement industry, specifically coal (accounting for 55% of the cost) had increased dramatically.

“Compared to the time when the price stabilized, the coal price increased by 262%. Thus, the cost of cement production increased by 30% in the demand decline, the price did not increase. There were factories that had to sell at a loss of 100-300 thousand dong. /ton, the more you sell, the more you lose,” Ky said.

In particular, in the near future, Decree 101 of the Government stipulates that the import and export tax of cement clinker will increase from 5% to 10%, effective from January 1, 2023. towel.

“Enterprises have petitioned to the Government to postpone this Decree for a while so that the cement industry can recover,” said Mr. Ky.

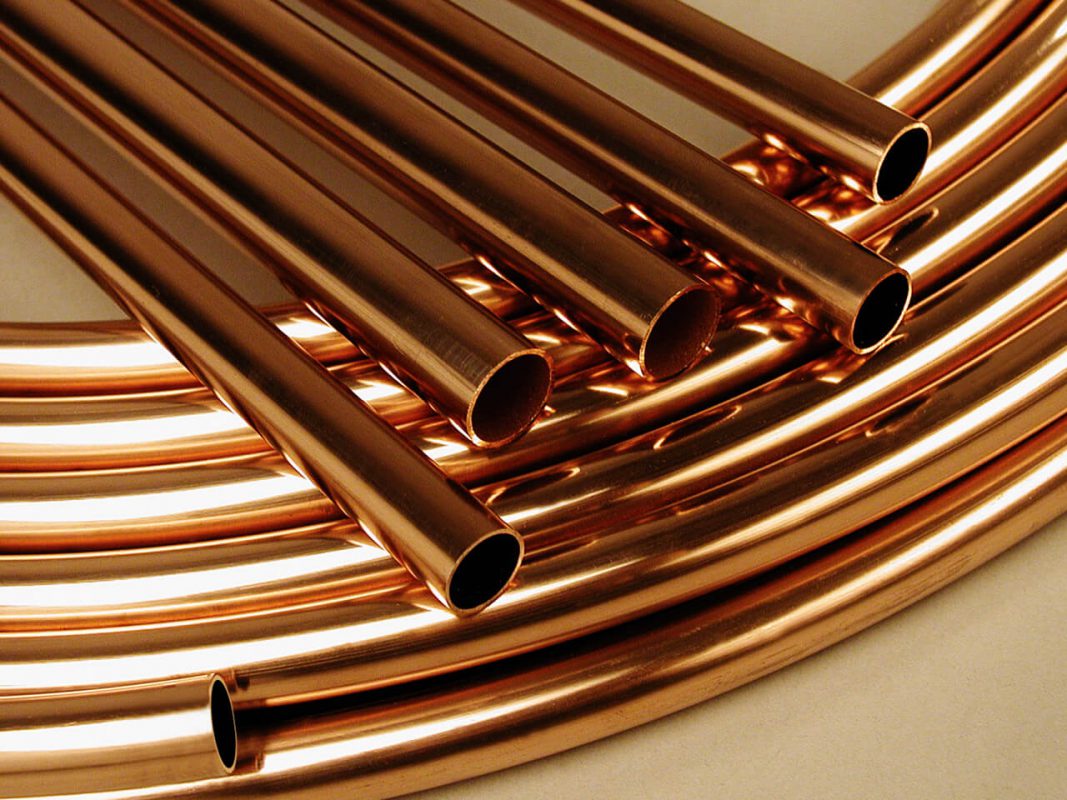

In the steel sector, businesses have to face a “major crisis” when supply outstrips demand, while both export and domestic orders drop sharply.

“Many businesses have to sell products 30-40% lower than cost to have operating cash flow while waiting for the next credit allocation,” Ky said.

CUT MAXIMUM COST TO SURVIVAL

Facing these difficulties, Mr. Dinh Hong Ky said that at cement factories, 1-2 lines had to be closed or factories producing ceramic tiles had reduced output by 50%. This means that the reduction in the number of workers is a reality.

Currently, the leaders of factories can only keep key workers and are forced to lay off easy-to-select workers, no factory can guarantee 100% of full-time jobs.

“There is no general data for the whole industry, but the industry that uses a lot of workers will cut a lot, the industry with high line automation will have a small reduction in labor. In addition to cutting labor contracts, the majority of employers machines for workers to work 3 days a week or to work alternately”, Mr. Ky said.

Mr. Dinh Hong Ky said that businesses in the construction industry are in a state of anxiety because they cannot predict the future.

“The Japanese market has always been a stable consumption market for Vietnam’s building materials for many years. But last October, for the first time, customers suddenly stopped placing orders, they only took orders. Before. We asked the question of when to stop the orders? All distributors in key markets replied that it is impossible to predict in the current situation,” said Mr. Ky. reality with a large market.

Even, there are enterprises producing building materials that have stopped most of the contracts to supply materials for the works; The completed contracts cannot be paid because the investor also has no cash flow and cannot borrow from the bank to pay the material supplier.

Faced with this reality, enterprises in the building materials industry are in the state of cutting maximum costs from labor, or marketing… in order to have cash flow to maintain existence.

“Due to the frozen real estate market and slow disbursement of investment capital, if the Government and ministries and branches promote public investment, promote the construction of elevated highways using concrete, iron and steel. the building materials industry can cling to as the industry’s salvation in the current context”, Mr. Ky hopes.

T&G Import-Export Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 02473010868

Email: hrm@tginterjsc.com

Website: http://tgimportexport.com