According to international analysts, Russia’s hot rolled coil (HRC) may appear on the Asian spot market after a period of 4-5 months due to the widening economic sanctions against Russia. , while Russia’s billet exports may be diverted to China if the country does not deal with traditional customers.

As Russia accounts for about 10% of global steel trade, and Ukraine accounts for about 4%, supply disruptions from this region are raising concerns of disturbing the world steel market.

On February 26, a joint statement on the exclusion of Russia from SWIFT (Association of Worldwide Interbank Financial Telecommunication) was agreed by the US, European Commission, France, Germany, Italy, UK and Canada. , seriously affecting the Russian economy and also having a significant impact on the world economy, including the economies that made this decision.

The list of banks is not yet complete, but the US and EU have introduced sanctions against Russia’s major banks, which account for 80% of the country’s financial transactions.

Russia is not the first country to be excluded from SWIFT. The West kicked Iranian and North Korean banks out of the system after being sanctioned by the EU for their nuclear programmes. Reportedly, Iran lost almost half of its oil export revenue and 30% of the value of international trade after this move. Only in 2017, Iran could use SWIFT again when the West lifted sanctions.

According to Sputnik, about 300 leading Russian banks and institutions are using SWIFT, more than half of Russian credit institutions are represented in SWIFT, and Russia is ranked second in terms of the number of users of this platform, after the US. Observers said that this sanctions would probably wreak havoc on the Russian economy and market, heavily affecting the ruble.

Chinese steel exporters recently said they are concerned about steel prices going up, predicting exports from Russia will fall when their banks are removed from Swift. The decline in Russian exports is expected to lead to global steel supply tension and increase the price and volume of China’s steel exports. Argusmedia website quoted a Chinese exporter as saying that at the moment, Russia does not provide spot goods and no one will consider buying from Russia. Another trader in eastern China said sanctions on Russia’s Swift access would increase commodity price inflation, including in the steel sector.

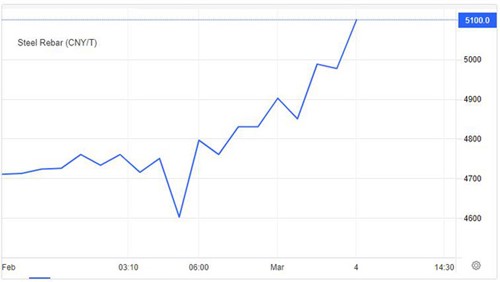

The price of HCR steel for May term on the Shanghai Futures Exchange on March 4 at 5,210 CNY/ton, up nearly 6% compared to February 27 and reached the highest level since October 2021; Construction steel also increased to CNY 5,100/ton, while stainless steel reached CNY 18,775/ton.

The disruption of steel exports from Russia and Ukraine has pushed customers to look for alternative sources, especially China, the world’s largest steel producer.

Price of Chinese rebar in the past week.

“Some Russian banks have been sanctioned, but that’s not the problem, because we can switch to other banks to do business. If Russia is sanctioned for financial payments using dollars. America, the way of Iran, then exports will drop significantly,” said the trader based in eastern China.

Russia is not a country that sells a lot of steel to Asia in recent months because export prices to this region are not attractive compared to domestic and regional levels. The country’s rebar exports to Hong Kong fell to 55,000 tons last year after rising to 220,000 tons in 2020. There was no sales of rebar from Russia to Singapore last year.

International analysts say that increased steel output at Vietnam’s Hoa Phat factory, which started supplying rebar to Hong Kong and Singapore last year, is a factor that can support the Asian market ahead of time. any immediate Russian supply disruption. But changes to trade flows are possible.

Hoa Phat produced 707,000 tons of crude steel in January 2022, up 5% over the same period last year. The company said in January that its consumption volume reached 631,000 tons, of which construction steel accounted for 382,000 tons, double that of the same period in 2020.

Russian steel supplies account for a small share of HRC trade in Asia. Russia sells about 30,000 tons of HRC steel to Vietnam every month. Russian steel exports to Vietnam have limited volume since October 2021 as Vietnam has enough domestic and regional supply to meet its needs.

Vietnam’s iron and steel imports from Russia in January 2022 were 117,549 tons, worth $96 million, the volume increased by nearly 70% compared to December 2021 but decreased by 8% compared to the same month last year, putting Russia in the top position. ranked 5th among iron and steel suppliers to Vietnam, accounting for 11.5% in volume.

But the decline in Russian HRC exports to Europe and the US could lead to many Indian steel exporters leaving the Asian region to redirect sales to customers in those regions.

Russia exported 13 million tons of semi-finished steel in 2020, with China accounting for 6.7% of total Russian steel exports. In 2021, China accounts for 5% of Russia’s total 14.9 million tons of semi-finished steel exports. China’s share of steel billet exports, largely semi-finished steel that it imports from Russia, could increase due to increased sanctions on Russia.

It remains unclear whether Asian steel market participants, including those in China, are willing to deal with Russian banks or trade Russian commodities. Buyers of coking coal in China last week raised concerns about Russian coal purchases amid uncertain trade finances. They show such reluctance despite China’s growing reliance on Russian coal, after the country refused to import Australian coking coal in 2020 due to political tensions with the country.

Activity in the Black Sea iron and steel market has almost stopped since the end of February because Ukraine’s billet producers limited production, when the main ports stopped working. Customers are also hesitant to deal with Russian factories because of uncertainty about what upcoming sanctions will look like, with some turning to Turkish suppliers.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com