In 2020, China will put into operation coal-fired power plants with a total capacity of 38.4 GW, three times higher than the 11.9 GW capacity of the whole world.

The Chinese government and national power plants have set aggressive targets for renewable energy. But plans to decommission or control coal-fired power plants, which account for a third of China’s carbon emissions, have not kept pace.

According to a February report by the Global Energy Monitor in San Francisco and the Center for Clean Air and Energy Research (CREA) in Helsinki, in 2020, China will put into operation coal-fired power plants with a total capacity of 38. ,4 GW, three times the worldwide capacity of 11.9 GW.

According to the report, the construction approval rate has also tripled to 36.9 GW in 2020, five times faster than the construction rate outside of China.

China’s coal-fired power generation capacity.

According to the World Environmental Climate Research Organization (E3G), China has added about 29.8 GW of capacity since the beginning of 2021. Elsewhere, old coal power plant outages have been replaced by larger ones, recording a global increase of 12.5 GW.

This comes despite the fact that China has canceled 85% of coal power projects in developed countries and 77% in developing countries outside of China.

The country’s coal-fired power capacity currently stands at around 1,080 GW, about half of the global total, with another 250 GW under development, according to estimates by environmental nonprofit Greenpeace. The power sector accounts for about 40% of China’s carbon dioxide emissions.

The world’s largest carbon emitter pledged in the 2016 Paris Agreement to increase its share of non-fossil fuels to 20% by 2030. President Xi has increased the target contribution of wind power and energy solar power to 25% of total electricity, or 1,200 MW by 2030.

China’s coal mines, coal-fired power plants are still growing, financed by an endless supply of cheap state-owned banks. These banks have supported one of the largest industrial sectors in the country operating amid the economic downturn. Millions of jobs and billions of yuan are at stake in the coal industry.

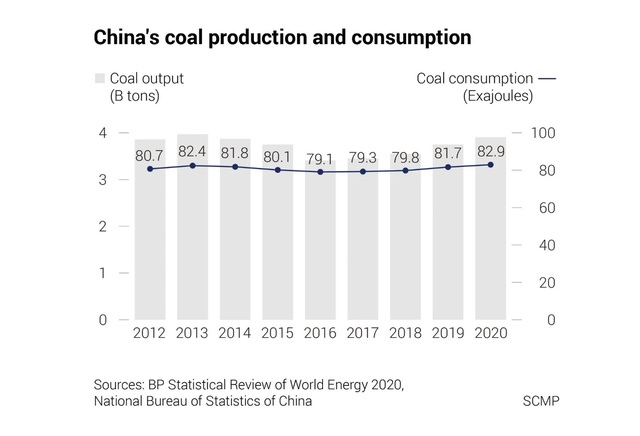

Coal production and consumption in China. Unit: Ton/EJ

Five major state-owned power companies produce more than half of China’s coal power, including State Energy Investment Group, China Huaneng Group, China Datang Group, China Huadian Group and State Power Investment Group. These companies have about 2 million employees and 5.5 trillion yuan ($836 billion).

While American banks are among the largest oil and gas donors, Chinese financial institutions lead the way in financing coal-fired power plants and coal mining.

This is echoed by findings from a separate study of 29 NGOs including Urgewald and Reclaim Finance, which tracked loans provided by 380 banks, as well as equity issues and The bond helped sustain 934 coal mines and power producers.

The Chinese NGO leads in coal financing, which includes projects in many developing countries, which grew to $222 billion in the first 10 months of 2020, accounting for nearly half of the total, NGOs said. global number.

Since 2016, China’s National Energy Administration has implemented a “traffic light system” to classify and impose restrictions on domestic coal power projects. The banking regulator has asked Chinese banks to reduce lending to certain emission-prone and energy-intensive sectors, including coal-fired power, since 2007. But implementation has been delayed. Criticism is ineffective.

Banks have yet to comment on the matter. A senior manager at the Shanghai Pudong Development Bank, said loans are only granted in special cases, such as large-scale coal mines and coal-fired plants that are key to the country’s economic growth. local economic growth.

HSBC last month pledged that it would stop funding coal mines and power plants in the European Union and OECD member states by 2030, extending the ban everywhere else a decade later. there.

To meet President Xi’s 2030 and 2060 carbon targets, China’s coal power capacity must be reduced by 40% by 2030, according to CREA in Helsinki.

That is considered a high target because China’s coal power plants have not shown any signs of shrinking. The number of operating hours of China’s coal power plants in 2020 has decreased by 16% compared to 2013. Even so, coal power plants will still play a necessary role for many years, due to the periodic demand for electricity as well. such as capacity limitations and intermittency of renewable energy.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com