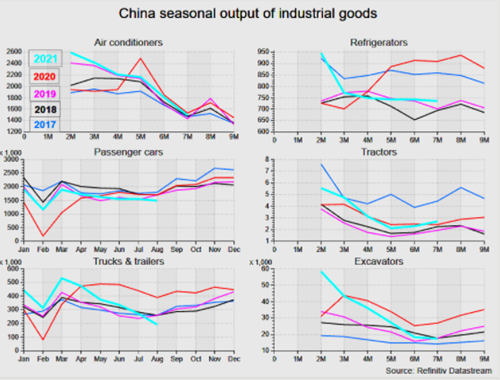

Output restrictions tied to winter emissions caps are nothing new for China’s steel and aluminum producers. However, many metal producers have been ordered to cut operations to reduce production costs. saving energy throughout the summer of this year, resulting in the loss of production of important industrial raw materials.

Metals consumers in China, from manufacturers to companies, to construction… are poised to face potential supply shocks after power cuts and power shortages forced some Metallurgical plants have had to cut output in recent weeks.

Output restrictions tied to winter emissions limits are nothing new for China’s steel and aluminum producers. This year, however, power constraints persisted throughout the summer due to low coal supplies and strong demand, leading to forced closures of energy-intensive operations and worries about insufficient heating. when cold weather approaches.

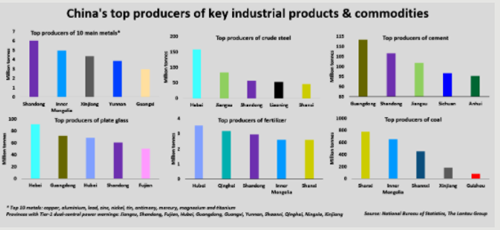

Power consumption sectors such as aluminum and cement also consistently ranked first as regions of China were required to double efforts earlier this year to meet energy consumption and strengthening targets. lower degree.

Fertilizer producers, too, have been affected by power cuts and rising costs, but because of their importance to food security, they have been allowed to maintain a high and secure operating speed. about the power supply.

IMPORTANT INDUSTRIAL MATERIALS LOST

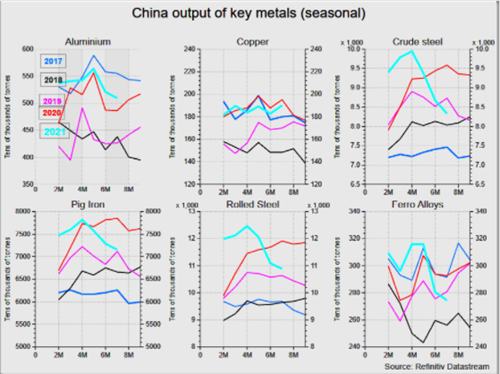

However, many metal producers have been ordered to cut operations to save energy, resulting in lost output of important industrial raw materials.

Much of China’s metal production is concentrated in severely power-constrained regions, including Jiangsu, Hebei, Xinjiang and Yunnan, as soaring electricity demand outstrips supply and forces the government to must take drastic action to try to prevent the loss.

|

Investment bank Morgan Stanley estimates 7% of aluminum capacity in China has so far been affected by the power cuts, while around 67% of China’s total steel capacity across 11 provinces have announced some measure. output control measures for the second half of 2021.

For cement, 35% of total production and about 30%-40% of China’s main petrochemical production capacity have been affected.

China will produce 1.5 million tonnes less aluminum than planned this year, meaning a loss of metal revenue of $4.5 billion, said BMO Capital Markets analyst Colin Hamilton.

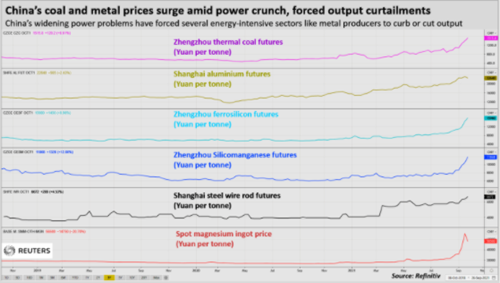

Some of the biggest commodity price gains this year have been in steelmaking raw materials such as ferrosilicon and silicomanganese, which rose 87% and 58% respectively this quarter, as limited energy forced output cuts.

|

Clare Hanna, senior steel analyst at CRU estimates China’s silicomanganese output fell 40% in July month-on-month as restrictions that began in Inner Mongolia spread to Guangxi and elsewhere.

“We anticipate that electricity will be quite scarce during the winter,” Hanna said.

Production restrictions on aluminum also began in Inner Mongolia before spreading to Yunnan in the southwest of China. Over the past three years, aluminum smelters have moved capacity to the province, also a major tin and zinc hub, to tap China’s abundant hydroelectricity, but severe droughts hit May and June. This year has also had serious effects.

|

According to Paul Adkins, managing director of consulting firm AZ China, Chinese aluminum companies have sought to catch up with the low-carbon aluminum trend.

But “there is simply not enough renewable energy to support more than 20% of total demand”

BOOKED COSTS

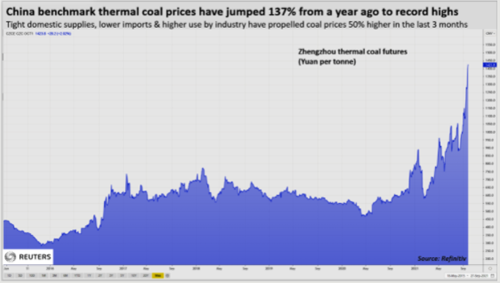

Smelters also face a hefty cost to secure enough coal for power plants forced to shut down, with China thermal coal futures near a record high above 1,300 yuan (equivalent to CNY 1,300). equivalent to 200 USD)/ton.

|

Dozens of manufacturers ranging from dye makers to soybean crushing plants have also had to cut back or shut down operations at least through the end of the upcoming National Day holiday from October 1. although some market observers think the restrictions will last longer.

China’s power shortages reflect the strain on energy markets globally and will not be resolved overnight, Capital Economics said.

“The capacity allocation will limit industrial activity until demand weakens enough to bring the domestic electricity market back to equilibrium.”

A prolonged shutdown of the metal risks putting a person forced to use the commodity by the end of the year, they will have to face rising prices.

“The main concern for the auto supply chain is the cost of inflation and upstream supply tightening that could impact downstream production/profits,” said Morgan Stanley.