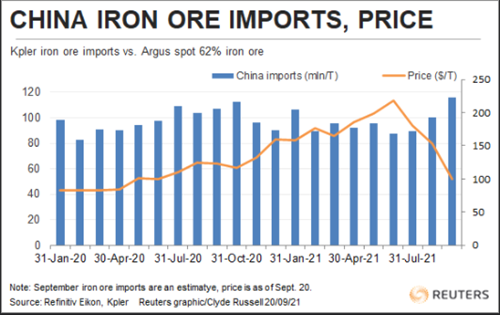

Prices of steelmaking materials are now down 57.4% from a record high of $235.55 a tonne reached on May 12. The world supply of iron ore has gradually improved in recent months, after an earlier period of decline due to bad weather reducing output in Australia – the world’s top exporter of iron ore, and the Covid-19 epidemic. outbreak in Brazil – the world’s second largest exporter.

The spot price of imported iron ore at a northern Chinese seaport announced by Argus last week fell 22.2% to $100.5 per tonne. Thus, the price of the main raw material in this steel production has lost 57.4% from the record high of 235.6 USD/ton reached on 12/5.

While the price rally to record highs in May is supported by fundamentals, and the recent drop has good reasons, the extreme drop in prices is perhaps a sign of a decline in prices. speculators’ interest in a market that was formerly backed by miners and steel mills.

The main reason for the price drop is that China – which imports about two-thirds of the total volume of iron ore transported by sea globally, cut steel output in the second half of this year to ensure that the supply steel this year does not exceed the record 1.065 billion tons of 2020.

Prices of steelmaking materials are now down 57.4% from a record high of $235.55 a tonne reached on May 12.

|

The world supply of iron ore in recent months has gradually improved after a period of decline.

The main factor behind the decline is China’s cutting of steel production in the second half of 2021, to ensure that full-year output does not exceed a record 1.065 billion tonnes year-on-year.

Meanwhile, the world supply of iron ore has gradually improved in recent months, after an earlier period of decline as bad weather reduced output in Australia – the world’s top exporter of iron ore, and The Covid-19 epidemic broke out in Brazil – the world’s second largest exporter.

However, the movement of iron ore flows around the world is impervious to fluctuations in the price of this mineral.

In the first eight months of this year, China’s iron ore imports were 746.5 million tons, down 1.7 percent year-on-year, according to customs data.

In August 2021 alone, iron ore imports were 97.49 million tons, the highest since April, which is a sign that supply is recovering.

September is likely to see even higher imports, with Refinitiv vessel tracking data estimating up to 111 million tonnes of iron ore will arrive at Chinese ports this month, while private company data Kpler commodities advisor is even more optimistic with an estimate of 116.6 million.

So far, the recent increase in import volumes has not been stored in warehouses. Accordingly, the amount of iron ore stored at port warehouses in the week ending September 17 decreased for the second week in a row, to 130.1 million tons, data from consulting firm SteelHome showed. A year earlier, the amount of storage was only 118.3 million tons. However, that is normal as ore stocks are usually high before winter arrives, then decrease as the cold weather passes, as construction activity will resume as the weather warms up. .

Supply slows down

On the supply side, iron ore exports from the world’s top suppliers in September are estimated to slow down. Kpler estimates show Australia will export 75.2 million tonnes, down from 76 million tonnes in August and 73.1 million tonnes in July. Meanwhile, Brazil’s exports for August are forecast. was 29.5 million tons, also down from 34.4 million tons in August – the highest export month this year.

The world’s third largest exporter – South Africa – will also reduce exports. According to Kpler, the country will export 4.9 million tonnes of iron ore in September, down from 5.6 million in August – the highest level since December 2020.

|

China’s iron ore import price Source Reuters

Overall, the market seems to be more balanced than it was at the start of the year – when supply was disrupted and China’s steel production set new highs every month.

Does that show that the iron ore price of about 100 USD/ton is unreasonable?

History shows that iron ore prices generally stay below $100/ton longer than above $100/ton. Spot iron ore prices have been below $100/ton for more than 6 years to June 2020, and only exceeded $100/ton during the brief period from May to August 2019, when demand China’s steel surge in the summer pushed prices up to $125/ton.

Assuming the disruption in iron ore supply from now until the end of the year is not significant, and China will continue to maintain its goal of limiting steel production in 2021, not exceeding 2020’s, the possibility of prices recovering to above USD 100/ton will be less likely to happen.

However, given the fact that the iron ore market recently is not only affected by supply and demand, it is also not excluded that the price of this mineral may suddenly reverse unexpectedly.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com