Industrial metals are increasing their presence all over the world. Widespread applications in the transition to renewable energy are driving the demand for metals such as copper, aluminum, zinc, nickel and also the iron and steel market.

The Paris Agreement and the Dance of Industrial Metals

Currently, the European Union, the US and China have all committed to energy transition, towards the goal of reducing net emissions to zero. The Paris Agreement on climate change took effect on November 4, 2016. with the participation of more than 190 countries demonstrated the sheer scale of this journey. According to the US Department of Energy, the country’s electricity demand could increase by nearly 40% if all sectors of the economy were electrified in the next 30 years.

The clean energy transition taking place across the globe could be one of the biggest projects in human history. Because most renewable energy systems – including electric vehicles, wind turbines, solar panels – use large amounts of industrial metals.

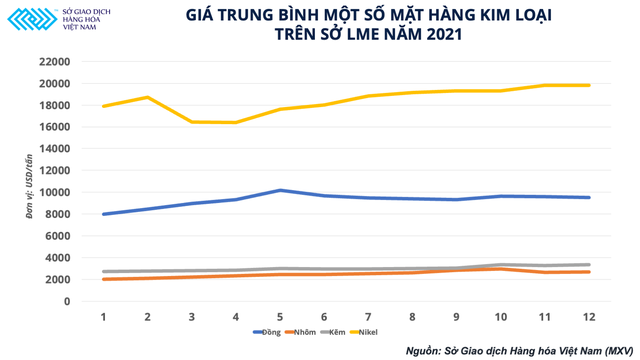

In a volatile 2021, copper prices once hit a record high of more than 10,400 USD/ton when the top consuming country, China, recovered its economy. At the end of the trading session on December 30, the futures price of copper on the LME Department reached 9,680 USD/ton, up 23% compared to the beginning of the year. On the Shanghai Department, copper prices also increased nearly 20% in the past year, currently trading around the threshold of 70,000 yuan / ton, equivalent to 10,991 USD / ton.

China now consumes nearly 14 million tons of copper per year, more than the rest of the world combined. Copper imports in the first 11 months of this year reached nearly 5 million tons, although down 20% compared to the record level of the same period last year. In addition, the disruption of leading copper miners such as Chile and Peru and the infrastructure investment plan of US President J.Biden also created the driving force for copper prices.

Not only copper metal, other commodities such as zinc and nickel on the London Metals Service (LME) have also increased by an average of more than 20% in the past year, especially aluminum has increased strongly by more than 40%. The LME Index also increased by 30%, showing a clear upward momentum of industrial metals. According to the Clearing Center of the Commodity Exchange of Vietnam (MXV), the movements of these commodities have attracted the attention of investors this year, as evidenced by the group’s cash flow data. industrial metals increased 40% in the fourth quarter alone, reaching about 2,000 billion VND/day.

Commodities such as copper, aluminum, zinc or nickel all play an important role in the impending energy transition, and as such, could represent a potential investment opportunity, according to MXV. Metals demand will be higher and more important for many economies, focusing on the supply chain of raw materials for renewable energy. China has also purchased raw material deposits in Africa and elsewhere to rebuild its domestic energy industry, before reaching its carbon-neutral goal. As more and more countries take their emissions reduction commitments seriously, the demand for these metals is expected to continue to grow.

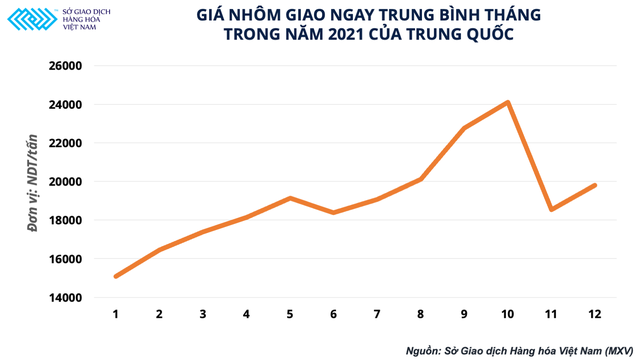

Pressure from the power crisis and a Chinese mission – stability

Electricity prices in Europe skyrocketed in the last months of the year. Yesterday, electricity prices hit an all-time high of more than 400 EUR/MWh in France, Germany, the Netherlands, Belgium, Switzerland, Austria, Slovenia, Croatia, Hungary, Italy and Slovakia. While gas prices have increased by nearly 500%, electricity prices are directly affecting production capacity of non-ferrous metals, such as aluminum and zinc. Along with the development, China’s manufacturing also fell into a period of slow recovery after many crises hit at the same time, including real estate, electricity prices and epidemics.

According to MXV, the copper, zinc and nickel markets are expected to return to balance in 2022 with prices able to cool down and gradually stabilize after China’s impact on production controls. On the contrary, aluminum price can continue to keep at breakeven level. The commodity rallied to a 13-year high of nearly $3,300 a tonne in October on the LME, mainly due to a supply shortage and strong demand.

Aluminum stands out in that, China’s manufacturing activity is unlikely to recover quickly after the Winter Olympics in February 2022. And Citi Group analysts expect the aluminum market to short 1.28 million tonnes next year with an average price of $2,950 per tonne in the fourth quarter of 2022, up 7% year-on-year.

In China, most aluminum factories, especially those using their own electricity, suffered losses from the end of October to November due to electricity costs (accounting for nearly 40%) and raw material prices. auxiliary materials increased. The shortage of thermal coal caused the cost of thermal power to be higher, and aluminum prices remained low in November. However, aluminum mills were profitable again in December when prices of thermal coal, alumina and other raw materials were raised. Other crude continued to decline and aluminum prices stayed below 18,000 yuan, or $2,820 per ton.

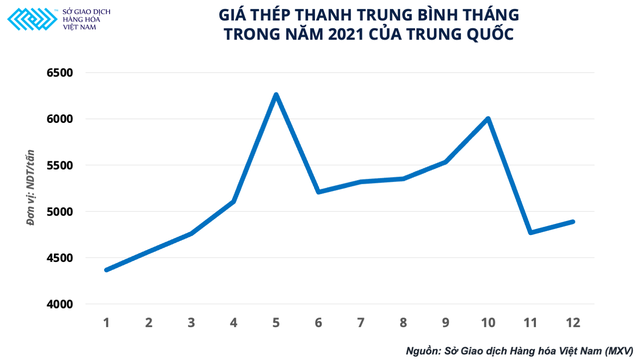

Lack of electricity is indeed a huge pressure on the manufacturing industry, especially when solar and wind power is not yet capable of meeting it. This difficulty quickly spread to industries, including ferrous metallurgy.

In China today, most steel is produced by blast furnaces. However, according to MXV, the share of steel produced between electric arc furnaces and blast furnaces will gradually shift in the next few years, because steel scrap reservoirs in this country are increasing. And if more steel is produced from arc power plants, then electricity is a pressure, even a limitation, at a time when gas and oil are increasing at a dizzying rate.

China is trying to find a balance between supply and price stability of raw materials. If steel prices continue to rise again, the administration of President Xi Jinping will take measures to calm steel prices. This is likely to be more evident in the economic work mission in 2022, with the goal of ensuring stable growth with market-supportive policies and reducing carbon emissions.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com