Expensive raw materials combined with falling steel demand in China weigh on steelmakers’ profits. Some steelmakers in Tangshan have reduced output. While ports near Beijing such as Tangshan, Jingtang, Caofeidian also suspended operations until the afternoon of July 1.

Iron ore prices traded on July 1 fell due to falling steel demand in China. This is due to unfavorable weather conditions and influences on the country’s policies.

Iron ore for September delivery traded on the Dalian Commodity Exchange fell 0.7 percent to 1,165 yuan per tonne (equivalent to $180.50 per ton), down 14.2% from a 12-day record high /5.

However, Dalian iron ore ended the quarter with a gain of about 20% from the previous quarter, driven by a record price increase in May.

Strong demand for raw materials in China, the world’s largest steel producer, has pushed iron ore prices to record highs.

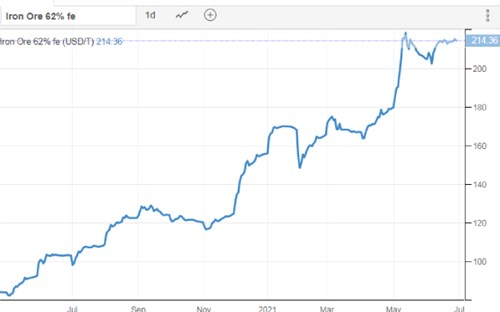

Iron ore price movements. Source: Trading Economics

Expensive raw materials combined with falling steel demand in China weigh on the profits of steelmakers, analysts say.

“Steel prices have fallen sharply from their record highs in May,” said Robert Rennie, head of financial strategy research at Australia’s Westpac bank.

According to Fast Markets, the price of 62% Fe ore imported into North China was at $214.1/ton on June 30, up 1% from June 29.

The price of 62% Fe ore at Tianjin port, China on June 30 was at $214.55/ton, up 0.09% compared to June 29.

Bar prices on the Upper Futures Exchange increased by 0.9%, hot rolled coil prices increased by 1.1% and stainless steel prices increased by 1.7%.

In the opposite direction, the price of DJMcv1 coking coal on DCE fell 1% and the price of DCJcv1 coke decreased by 1.5%.

In 2020, China is the world’s third largest iron ore producer with 340 million tons, behind Australia (900 million tons) and Brazil (400 million tons). China takes environmental protection measures. school before the 100th anniversary of the founding of the Communist Party of China. Some steelmakers in Tangshan have reduced output. While ports near Beijing such as Tangshan, Jingtang, Caofeidian also suspended operations until the afternoon of July 1.

China’s iron ore imports are likely to fall by 79 million tonnes a year over the next five years, in line with the target of the country’s five-year plan for the steel industry, analyst Jinshan Xie said.

Imports will fall as China develops its own iron ore mines. Besides, the domestic production of scrap and iron and steel will likely help meet 45% of their total iron ore demand in 2025, up from 37% in 2020. However, import iron ore. will remain above 1 billion tons/year, Xie added.

According to data from the General Administration of Customs, China imported a record volume of 1.17 billion tons of iron ore in 2020, up 9.5% from 2019 as construction and infrastructure demand boomed, spurring production. steel increased. According to the World Steel Association, the country’s steel production in 2020 will increase to 1,064 billion tons from 995.40 million tons in 2019.

The spike in iron ore prices this year is believed to have made China’s inventories more valuable to mines. Horizon Insights believes that prices will continue to remain at a high level with a few slight downward adjustments in the fourth quarter of 2021 when supply from Australia and Brazil increases strongly again. This could lead to inventories at Chinese ports reaching 135 million tons by the end of the year.

T&G. International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com