Efforts to tighten steel production and cool down China’s coal furnaces have caused great volatility in the metal market recently.

Real estate, energy crises and pressure on economic growth have brought confusion to China in the final months of 2021. However, with drastic policies in tightening production steel and “cooling down” the coal furnaces, Beijing is still trying to bring a better sky for the upcoming Winter Olympics.

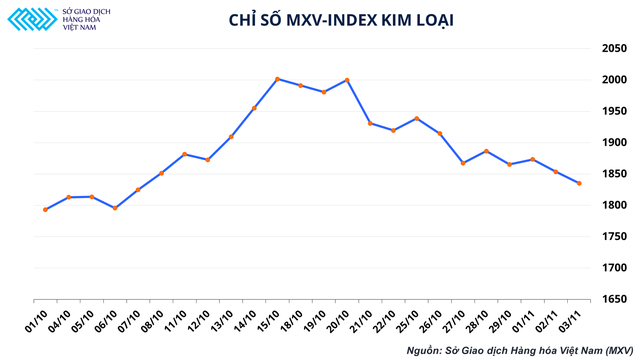

The world metal market accordingly also witnessed large and erratic fluctuations in recent times. The MXV-Index Metals, an index showing the volatility of metal commodities that are linked to the world at the Commodity Exchange of Vietnam (MXV), fell 1% to 1,835 points yesterday. (3/11). However, investment cash flow into metal group is increasing markedly, reaching an average of more than 500 billion dong/session in the past 3 days.

Production slows down, coal price “cools” gradually

China’s economic recovery is still a hot topic in the last months of the year. According to Caixin Global, China’s purchasing managers’ index (PMI) has fallen for two consecutive months, reaching 49.2 points in October. This shows that the manufacturing industry is in a stagnant state.

In October, the amount of newly added special bonds was 537.2 billion yuan (NDT), bringing the total value of bonds issued in the past 10 months to 2,750 billion yuan, reaching three-quarters of the year plan. The government may further increase fiscal support to combat the economic slowdown during the Covid-19 pandemic.

Concerns continue to surround China. Not only indebted to real estate, the global energy crisis also put this country in a difficult position. Under the impact of the scarcity of supply, China’s metallurgical coke price has increased by nearly 60% compared to the end of July. However, there are reports that mills are in north and northeast China. reduced the purchase price of coke by 200 yuan/ton this week.

Coal prices also fell 20% less than a month ago as demand weakened. Yesterday, the ex-factory prices of dry coke in Shandong province and Linfen city (Shanxi province) were 4,520 – 4,620 yuan/ton and 4,550 yuan/ton, respectively. The price of imported coal from Mongolia fell by 50-70 yuan per tonne this week, down to 4,000-4,050 yuan per tonne.

As of October 29, coking coal inventories of 100 private coking plants reached about 6.2 million tons, down 0.7 million tons (equivalent to 10.2%) compared to the 2020 average and down 19.5% over the same period last year.

In autumn and winter, China’s environmental protection efforts are more stringent. According to the Commodity Exchange of Vietnam (MXV), some steel mills continue to reduce crude steel output on demand, leading to a decrease in coking coal demand and an increase in inventories. If the steel market does not have a clear improvement, the profit from steel will also shrink. As such, the metallurgical coke market is expected to be under a lot of pressure in November and prices in the traditional market may fall for several more waves.

Energy crisis drags metal prices down

However, the lack of energy has pushed China into a serious electricity shortage for the metallurgical industry. Production activities were cut, causing the prices of raw materials such as copper, aluminum, and nickel to drop.

On the Shanghai spot market yesterday, copper prices increased by 30 yuan / ton to 70,780 yuan / ton while the futures contract price decreased by 580 yuan. Meanwhile, spot aluminum prices fell 130 yuan to 20,100 yuan / ton, aluminum futures price increased 45 yuan to 20,095 yuan / ton.

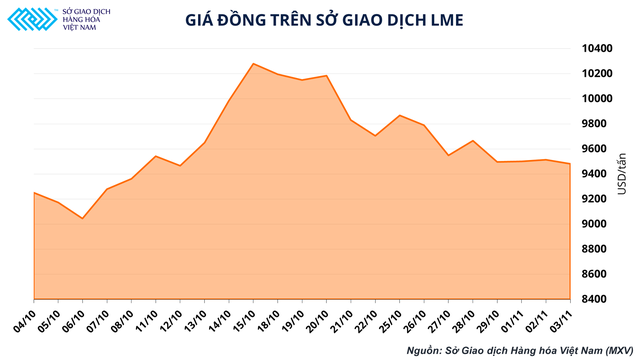

On the London Metal Exchange (LME), copper prices also fell about 10% from their peak in October, amid rising debt risks in the Chinese property sector. According to MXV, the deteriorating demand outlook and supply shortage are causing spot and futures prices to diverge.

Late last week, US President Joe Biden said that Washington would exempt import duties on steel and aluminum from the EU, in equal volumes before the administration of former President Donald Trump imposed tariffs in 2018.

The US Commerce Department said Washington is consulting with Japan and the UK on issues related to steel and aluminum, focusing on the impact of overcapacity in these two markets. At the same time, want to limit access to dumping countries in their markets. And this may continue to put pressure on the Chinese steel market.

With the input situation of Chinese steel mills, the positive factor is the decrease in coke prices, the increase in seaborne iron ore shipments, which will help lower import prices. This week, daily iron ore to five largest ports in northern China is estimated at 1.7 million tons, up 290,000 tons from last week. However, the billet market was mixed, speculative transactions increased. Many factories using electric arc furnaces have reduced scrap prices because the finished steel market is cooling down.

Yesterday, construction steel price decreased by 120-300 yuan/ton, HRC hot-rolled steel price decreased 120-360 yuan/ton. On the same day, Shagang Group also announced that the new steel price decreased by about 600 yuan/ton, including the price of steel rod about 5,500-5,800 yuan/ton (tax included). With the current situation, MXV predicts that iron ore demand will hardly increase again when steel production is tightened, the price of imported 62% iron ore may range from $100 to $115/ton. Similarly, steel prices will continue to decrease by 50-100 yuan/ton until the middle of the month. The current steel market will focus more on coke price movements.

The “cake” of futures trading

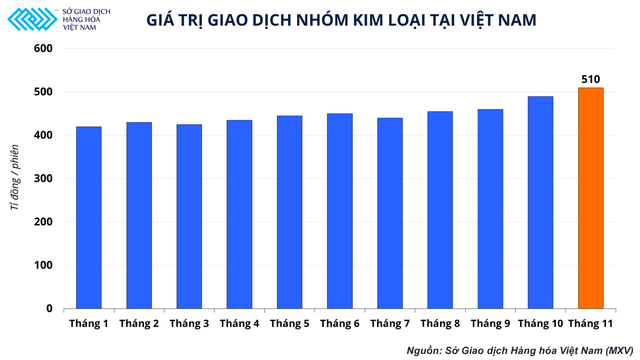

The mixed spot and forward markets have left attractive signals for investment cash flow. According to statistics from the MXV Clearing Centre, the value of metals traded on the London Stock Exchange has increased by 30% since the second quarter. Investors are inclined to think that the price will decrease, so they have opened more short positions, combined with continuously increasing cash flow. In the face of large fluctuations in metal prices, the London Exchange (LME) has repeatedly changed the margin levels of these commodities in an effort to stabilize order in this year’s stormy market. However, this has not stopped the wave of metal investment worldwide in general and Vietnam in particular.

Not only attractive to investors, the large fluctuations in metal prices are posing an urgent hedging problem for businesses in trading, metallurgy, construction, real estate, …domestic. Metals are the input to most industrial production. Enterprises will not be able to float input prices, to fluctuate according to world prices, because this will bring unpredictable risks.

In the context that Vietnam’s economy is trying to recover from the Covid-19 pandemic, industrial production needs to ensure stability and continuity to support this process. Therefore, hedging by futures and options contracts will become a mandatory business for domestic enterprises, if they want to survive and develop in the long term.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com