Iron ore futures in Asia rose more than 3%, on concerns that tight supply of the steelmaking raw material would reduce Chinese steel demand.

The most-traded iron ore in September on China’s Dalian Commodity Exchange rose 3.5% to CNY 1,227.50 (US$189.87) a tonne.

The most active August trading price of iron ore on the Singapore Exchange increased 1.5% to $210.95/ton.

Industry leaders and market analysts agree that China’s steel demand will decline in the second half of 2021, which could slow down mill purchases of iron ore.

“China’s steel demand growth in the second half of the year will be slower than in the first half,” said Wang Yingsheng, chief economist of the China Iron and Steel Association (CISA) while speaking at the opening ceremony. Singapore International lasts three days.

Unfavorable weather in China’s top steelmaker has slowed construction activity, while demand for steel used in manufacturing will also decline as export orders fall.

“As we enter the second half of the year, all eyes will be on the extent to which Chinese demand slows and Brazilian supply increases,” said Rohan Kendall, head of iron ore research at Wood Mackenzie. “.

China’s iron ore imports fell to a 13-month low in June as shipments tumbled, and analysts expect demand could continue to decline in the second half of the year.

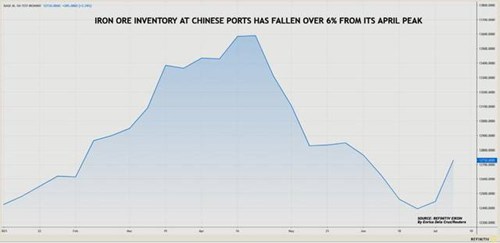

Iron ore inventories in China’s seaports are down more than 6% from April’s record high.

China – The world’s top iron ore consumer imported 89.42 million tons of the material last month, down 0.4% from May. Iron ore imports in June fell 12.1% compared to May. with a year earlier.

In the first half of 2021, China imported 560.7 million tons of raw materials, 2.6% higher than the same period a year earlier.

Strong steel output and strong margins at mills boosted iron ore demand in China in the first half of the year, while also pushing raw material prices higher.

The value of iron ore imports increased by 71.7% year-on-year in the January-June period.

However, as China has announced it will control its annual crude steel output to help meet its emission curbs, analysts expect iron ore consumption to decline.

China’s steel output surged in the first months of this year as high mill profits boosted demand for iron ore in the market, while a good dollar pushed iron ore prices to all-time highs. age. The value of iron ore imports into China in the first six months of this year increased by 71.7% over the same period last year.

Meanwhile, key iron ore suppliers have struggled to keep up with demand. “Vale has set a target to produce 400 million tonnes of iron ore this year, but supply progress has been slow,” said Rohan Kendall, head of iron ore research at Wood Mackenzie. It is known that its production has not yet fully recovered from the 2019 waste dam failure.

Inadequate supply of iron ore and strict environmental regulations boosted imports of recycled steel into China in May to 114.741 million tonnes, 28 times more than in January. – when the country lifted restrictions on imports of scrap iron and steel.

Currently, steel demand in China is slowing down due to seasonal factors. Chinese leaders and some market analysts believe that the country’s steel demand will continue to decline in the second half of this year, which could lead to steel mills reducing their purchases of iron ore. However, the problems of iron ore suppliers still exist.

Source: VITIC/Reuters

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com