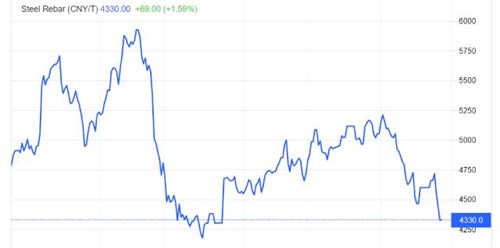

Dalian iron ore is on track for its biggest weekly drop since mid-February, while iron ore prices in Singapore fell more than 2%, dragging on a bleak demand outlook from top steelmaker China.

The most-traded iron ore price on the China Dalian Commodity Exchange ended the volatile morning session 0.7% higher at 734 yuan ($109.67) a tonne. The iron ore contract has fallen more than 12% this week after a record 10-session drop.

On the Singapore Exchange, the July delivery contract of the steelmaking material fell 2.5% to $113.30 a tonne.

SGX iron ore prices rose 7.4% in the previous session, recovering from their weakest close this year on Wednesday at $108.14 a tonne, after Chinese President Xi Jinping pledged to do so. more effective measures to achieve the country’s social and economic development goals.

Mr. Xi’s comments also boosted the spot market, with 62% of standard iron ore delivered to China at $117.50 a tonne. Iron ore fell to $112.50 in trading the previous day, its lowest level since Dec. 10, according to SteelHome consultancy data.

While “market confidence has been restored to a certain extent”, Sinosteel Futures analysts said, the absence of any specific and additional economic stimulus measures from Beijing will limit any price increase at the moment.

According to Sinosteel, in China’s steelmaking hub, Tangshan city, 56 out of 126 blast furnaces have had to close for maintenance, as mills struggle.

to cope with shrinking profit margins amid weak steel demand and high inventories.

COVID-19 restrictions, which have put downward pressure on the real estate sector, and construction disruptions due to unfavorable weather are indirect difficulties for China’s giant steel sector. .

On the Shanghai exchange, the price of bar steel futures increased by 0.5%, while hot rolled coil increased by 0.4%. Stainless steel fell 2.5%.

On the Dalian bourse, the price of Dalian coking coal fell 0.6%, but the price of coke rose 0.5%.

Before June 22, steel demand was gloomy, causing steel prices to go down. Atilla Widnell, managing director of Navigate Commodities in Singapore, said that steel consumption in China fell due to Covid-19, affecting manufacturing activities at the country’s complexes.

According to analysts, the gap between large supply and weak demand has caused steel prices to fall. When factories cut output and the real estate market recovers, steel prices will recover. Experts expect economic stimulus policies and infrastructure investment will push up steel demand and pull steel prices up.

Regarding the domestic market, steel prices went sideways after major steel brands simultaneously adjusted down construction steel prices from June 19. Accordingly, each ton of steel reduced by 300,000 – 510,000 VND. The last adjustment is the 6th consecutive decrease from May 11 with a total reduction of more than 2.5 million VND/ton.

After adjustment, the price of Hoa Phat’s CB240 coil and D10 CB300 rebar in the North are VND 16.65 million/ton and VND 17 million/ton, respectively. In the South, the above two types of steel are 16.95 million VND/ton and 17.41 million VND/ton, respectively.

T&G Import-Export Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 02473010868

Email: hrm@tginterjsc.com

Website: http://tgimportexport.com