The Asian steel market, which has been reeling due to the problem of declining demand, is now under pressure again because of the flow of cheap Russian metal.

Cheap steel from Russia

After breaking the flow of oil to Asia cheaply and making a lot of money, Russia continues to push steel to the Asian market at preferential prices. The unusual flow of cheap products from Russia is roiling steel markets in Asia, weighing on prices and prompting key producers in the region to warn of trade remedies. can happen.

According to Asian steel producers, when monitoring trade activities in this region, Russia is trying to send more steel to the Eastern market after the implementation of sanctions turned the West away from the goods. Russian goods and disrupted exports in the Black Sea. An increase in Russian steel volumes in the region could put pressure on markets already hit hard by various supply chain problems as well as a drop in demand.

Despite its much smaller scale compared to other commodities, the shift in trade in the steel industry has brought with it the echoes of many commodities from coal to crude oil, with Russia finding new customers as it grows. is facing sanctions from Europe and a wave of boycotts around the world. Most of Russia’s surplus steel, especially the primary product (steel billet) has flowed to Turkey. Besides, Russian steel mills are also promoting steel exports to Asian destinations at preferential prices.

For Tokyo Steel, which produces alloys from scrap metal, the arrival of Russian products is having a strong impact on scrap prices in the region.

Billet producers across Southeast Asia are cutting output recently. That means they are buying less scrap material even from Japan to supply more to Tokyo Steel.

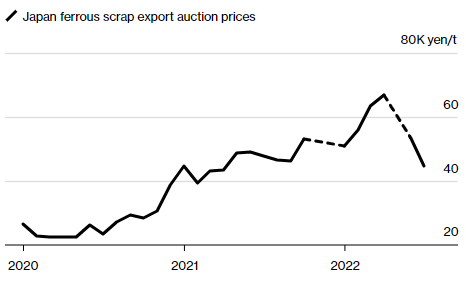

Russian steel products are considered as a completely new and unprecedented factor in the scrap steel market. Soichiro Tsuda, purchasing executive director at Tokyo Steel made the same assessment last week in an interview. The price of Japanese scrap steel has fallen by more than a quarter since its peak in April.

“Prices are likely to fall further, or at best stay where they are,” he added.

Another Asian steel producer of similar size to the U.S. Steel Corp. – said it is closely monitoring cash flows from Russian hot-rolled steel products amid reports of Russian price cuts.

“Russian steel mills are eager to move to the Asian market to sell at a much lower price than the international market in order to eliminate excess steel products,” the company said in a statement. this.

“The news about the sale of cheap Russian steel products on a large scale is boiling over, seriously disturbing the order of the steel market in the region.”

Cheap Russian steel billets threaten to reduce scrap prices. Source: Kanto Tetsugen Cooperative Association. Graphics: Bloomberg

Indian market

After oil and coal, steel from Russia has landed on India’s shores, worrying domestic steelmakers as Russia resorted to selling its growing inventory amid US sanctions. The West. According to traders in this country, two or three shipments of Russian steel have arrived at Indian ports.

Standard Russian hot-rolled coil (HRC) is available at a discount of around Rs 3,000/ton from domestic prices. According to data from SteelMint, since June Indian customers have ordered about 150,000 tons of Russian HRC. This compares to the monthly consumption of 9-10 million tons in the domestic market. This is almost triple India’s total steel imports from Russia in 2021, at around 56,000 tonnes.

Most steel from Russia comes from the leading steel producers Severstal and NLMK. Buyers include local traders and some pipe manufacturers. Transactions were settled mainly in rubles. This comes at a time when Indian steelmakers are struggling in the export market due to a new 15% export tax imposed in May.

India’s steel exports have declined since then and domestic demand has also declined, leaving Indian steelmakers concerned about increasing competition in the domestic market. The CEO of a leading steel company, who declined to be named, said: “Russian steel is a concern. However, the number of pre-orders from Indian customers is still not large enough to ring the bell. warning”.

A top executive of another domestic steel producer is confident that Russian steel imports will soon dry up as the rupee weakens while the ruble holds steady against the dollar. This will negate the price differential that Russian steelmakers can offer to Indian customers compared to domestic prices. Furthermore, Indian steelmakers have adjustments at their disposal to further narrow the price gap, as reported by SteelMint.

T&G Import-Export Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 02473010868

Email: hrm@tginterjsc.com

Website: http://tgimportexport.com