Iron ore prices ended the third quarter at a three-week high. However, in September, the price of this mineral fell for the third consecutive month. The third quarter marked a sad milestone when prices fell the most since 2008.

On September 30, the price of iron ore futures in China rose to the highest level in three weeks. This session, iron ore for January 2022 on the Dalian Commodity Exchange of China at one point reached 758 CNY, the highest since September 8, ending the session still up 5.4% compared to the previous session. before, up 721.50 CNY ($111.58)/ton. At the same time, November iron ore futures on the Singapore Exchange rose 3.4% to $118.45/ton, after also hitting a two-week high of $127.80; Iron ore with a content of 62% imported into North China (spot price at the port) also increased by 4.3% to 119.23 USD/ton, far from the psychological threshold of 100 USD. The price of steel in China ended the third quarter positively when simultaneously increased.

However, the increase in iron ore prices in China – the world’s leading steel producer – in the last sessions of the third quarter largely reflected the need to buy and hoard before the national Golden Week holiday, from May 1. ten.

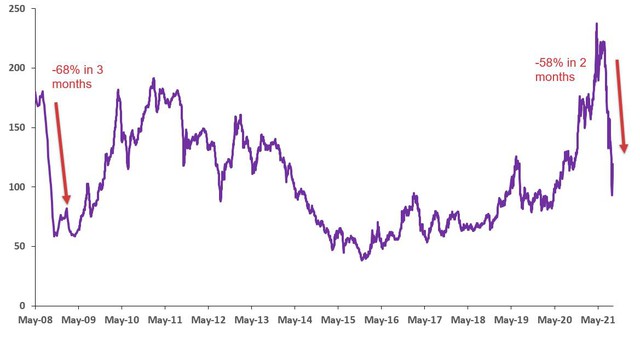

In general, in September, the price of iron ore traded on the Dalian exchange fell about 31%, compared with the record high in May, the price has dropped 42%. In the third quarter of 2021, the price of this mineral fell for the first quarter in two years, with the largest decline since 2008.

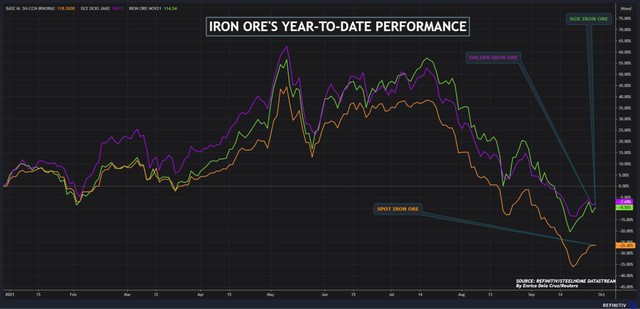

Performance brought by iron ore year to date

The recent reasons for pushing iron ore prices show that the uptrend is difficult to sustain. In fact, a cautious sentiment is pervading the Chinese metal market due to power shortages leading many factories to cut output and concerns about China Evergrande’s default.

“The energy crisis is leading to more steel mills cutting output,” said ANZ senior commodity strategist Daniel Hynes, citing industry data showing Chinese steel production. down 7.2% in the first two weeks of September compared to the same period last month.

On September 20, 2021, the price of iron ore with 62% content – the reference for the Asian iron ore market – fell to only US$92.98/ton, the lowest level in 16 months, 61% lower than that of the iron ore market. with a record high on May 12, 2021 (USD 237.57/ton) and down 58% compared to USD 222.09 on July 15, 2021.

Historically, the last time iron ore prices fell sharply in such a short time was during the 2008 global financial crisis, when it lost 68% within three months.

Why did iron ore plunge?

The main pressure for the rapid decline in iron ore prices is because the Chinese government has imposed restrictions on steel production to limit crude steel production in 2021 not to exceed the record 1.053 billion tons in 2020. This country in the first 6 months of 2021 had about 12% higher steel production than the same period in 2020, the cuts in the second half of the year will be very serious. For many people, it is unthinkable.

Whether that target (the 2021 crude steel output limit does not exceed 2020’s record 1.053 billion tonnes) is achieved, it is clear that most market participants have underestimated the determination of the Chinese government in prioritizing environmental goals, even at the expense of economic growth.

Iron ore price index (ore content 62%), cfr Tan Hoang Dao (Unit: USD tons).

Against this backdrop, the financial difficulties of China’s real estate giant, Evergrande, further contributed to the bearish sentiment towards industrial raw materials supplying the country’s real estate sector. . The real estate sector accounts for about 30-35% of China’s steel consumption.

Meanwhile, global iron ore production continues to bounce back after a multi-year decline for one reason after another, and it seems likely that some steel mills will resell their raw material (iron ore). ) is not contractually necessary in the spot market in recent weeks. For this reason, however, at the end of September Vale announced that licensing issues would hamper its capacity growth target for the coming year, reminding us that things may not go well. when viewed from a supply perspective.

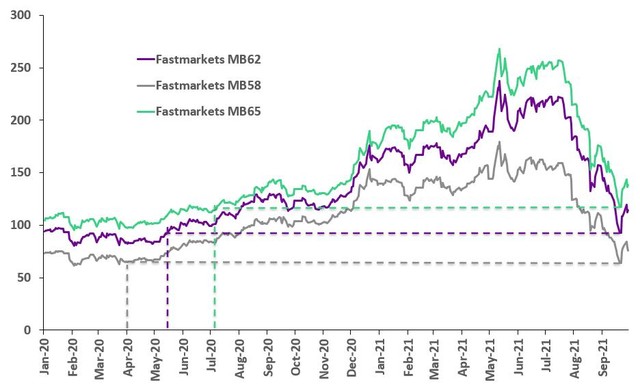

Prices of premium iron ore grades remain resilient to further gains following the sell-off.

What is the outlook?

Since the beginning of the year, Fastmarkets analysts have been predicting iron ore prices to drop significantly this year. In fact, the price fell faster and more than these analysts suggested.

At the end of September 2021, Fastmarkets thinks that the recent iron ore price of about 92 USD/ton may be an overcorrection, so the possibility of price recovery in the coming weeks is very high.

Up to now, Fastmarkets analysts think that the price of 100 USD / ton is reasonable, because this price is significantly higher than the average of the previous decade.

However, the degree of volatility in the price of ores will not be the same, because the world has changed more than in the past, with stricter regulations on the environment, and the price of consumer goods in general. are increasing, even record high inflation in many important markets. Therefore, don’t be too surprised if cost curve pressure starts to manifest in future iron ore prices.

In the near term, an unexpected factor that is likely to support iron ore prices is China’s current power shortage, which is affecting steel output from electric arc furnaces and semi-rolling mills. moon. Although output from these segments accounts for only a small portion of China’s total steel industry, any further cuts could force the country to require mills to raise output a bit. little.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com