The energy transition and the anticipation of peak demand have left oil investors fearful of the possibility that oil production will “peak” sooner than anticipated, accompanied by a price spike.

Key climate talks will begin later this month in Glasgow, Scotland to tackle global climate warming, under the 2015 Paris Agreement, under which fossil fuels are “in the spotlight” ” of policymakers.

But for now, capital-circulation measures that delay both investment in oil projects (upstream) and oil consumption (downstream), could permanently curb both oil supply and demand growth. .

According to research arm Morgan Stanley: “Earth places a limit on how much carbon can be released safely. Therefore, oil consumption needs to peak (to gradually decrease from there). But this foretold prospect has the opposite reaction: Low investment.”

However, with most oil producers and watchdogs predicting a “peak” of world oil thirst a few years from now, demand has returned to pre-existing levels. pandemic occurred.

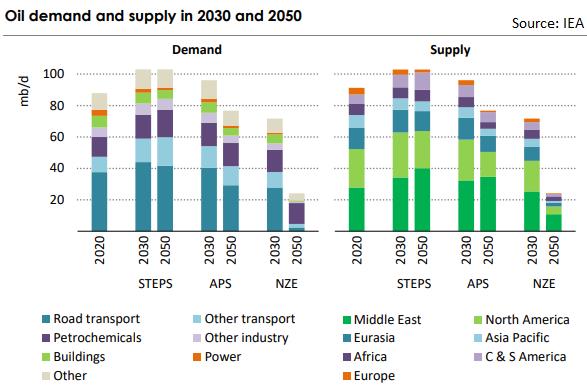

Oil supply and demand forecasts in 2030 and 2050 are based on 3 scenarios (see footnote).

The mismatch between demand for oil and other polluting fossil fuels is returning to normal and production is lagging behind, which has contributed significantly to the energy crisis in Europe and Asia. with crude oil prices rising to multi-year highs.

World oil prices on October 25 continued their upward trend from 9 weeks, to a new record high as global supply remained tight amid fuel demand in the US and other parts of the world. continued to increase after economies gradually reopened after the Covid-19 pandemic.

The price of US light sweet crude (WTI) at noon on October 25 in Vietnam time increased by 87 cents, or 1.0%, to $84.76 per barrel, after gaining 1.5% on Friday. October 22). This is the highest level since October 2014.

Brent crude also rose to $86.43 a barrel at the same time, after gaining 1.1% in the previous session, reaching its highest level since October 2018.

After more than a year of declining fuel demand, gasoline and distillate consumption in the United States – the world’s largest fuel consumer – has returned to the same level as the recent five-year average increase. Meanwhile, US energy companies last week cut the number of oil and natural gas rigs for the first time in seven weeks, even as oil prices rose, energy services firm Baker Hughes said.

Tetsu Emori, CEO of Emori Fund Management Inc., said: “With fuel demand in the US stable at a high level amid tight supply, oil prices still have solid momentum for further gains. Moreover, this led some speculators to short their short positions.

The increase in oil prices was also partly due to worries about coal and gas shortages in China, India and Europe – the factor that spurred the switch from fuel to diesel and fuel oil in production. power output.

“The rate of increase (in %) of WTI oil prices so far this year has reached the same level as 2007 and 2008, when we saw a strong price rally, which shows that oil prices are rising in a way that is going to be a big deal,” said Mr. Emori. a bit “excessive”.

The International Energy Agency (IEA) believes that it is necessary to speed up the process of using renewable energy, such as using electric cars, producing wind energy, etc. to avoid an energy shortage that is difficult to save. and pushed the price up sky-high.

The IEA calculates that investment in renewable energy needs to triple by the end of the decade if the world is to hope to effectively combat climate change and keep volatile energy markets in check.

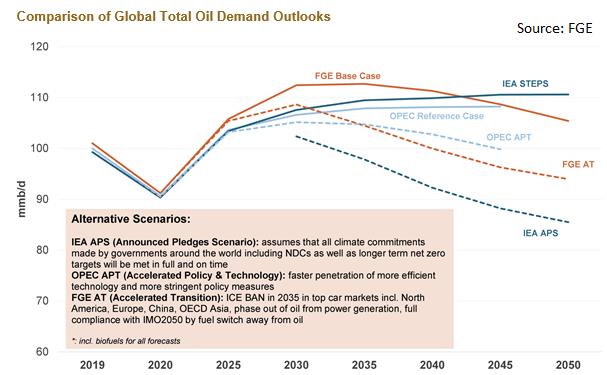

Forecasts for the global oil demand outlook.

In the recently released annual report on the energy market outlook. “The money spent on oil (investment in oil production) appears to be increasingly stagnant or falling in demand,” the IEA said. “Increased spending on clean energy transition is the way forward, but this needs to happen quickly, otherwise global energy markets will face an energy shock.”

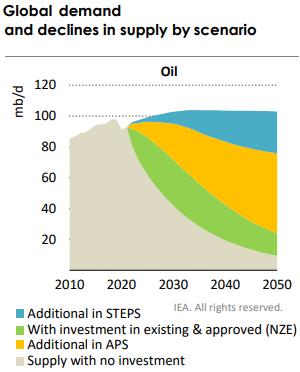

Scenarios for global oil demand and supply decline.

The IEA does not predict an immediate peak in oil supply, citing that the share of oil-producing states in the OPEC group and Russia in total global oil supply will increase over the next decade.

OPEC’s annual outlook last month suggested that global supply would be close to peaking in 2045 but with no clear peak.

Despite the price records and supply problems, the IEA said that the current low level of investment in oil and gas makes the balance of supply and demand unlikely to balance soon. The ambitious anti-pollution target is a scenario of zero emissions by 2050 (Net Zero Emissions by 2050 (NZE), in which no new fossil fuel projects are undertaken.

Oil supply scenarios.

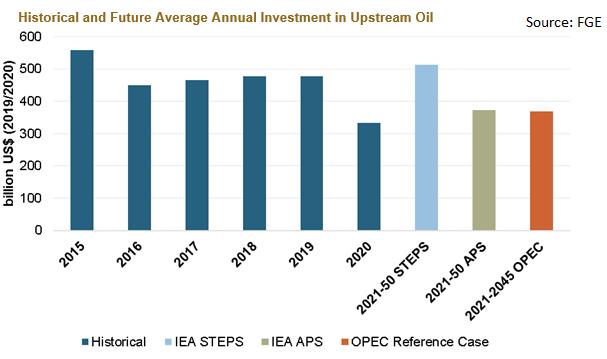

Meanwhile, to meet energy demand, taking into account alternative energies, the average annual investment in oil needs to increase sharply to over $500 billion, higher than at any point in the past five years. past year.

“Despite huge concerns about the state of investment in upstream oil (exploitation and production), assuming it will continue as it is, that level of investment is still insufficient to meet the growing demand for oil. growth in the coming years, this is a matter of 2023 and beyond in the next 12 to 18 months,” said energy consultancy FGE.

Among analysts, there have appeared predictions that the price of oil will increase to 100 USD/barrel, even to 200 USD/barrel.

Invest in historical and forecast oil production based on scenarios.

Note: NZE: Net Zero Emissions by 2050 (zero emissions by 2050), STEPS: stated policies scenario (scenario to implement stated environmental policies), APS: Announced Pledges Scenario (implementation scenario) commitments).

References: Refinitiv, IEA

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com