Saudi Arabia has just announced an increase in oil prices for Asian and US customers, a sign that the oil giant thinks oil demand remains strong despite the spread of the Omicron variant virus.

Saudi Arabia’s move to increase oil prices comes days after OPEC and its allies – a 23-nation group led by Saudi Arabia and Russia – surprised traders with their decision to increase crude output.

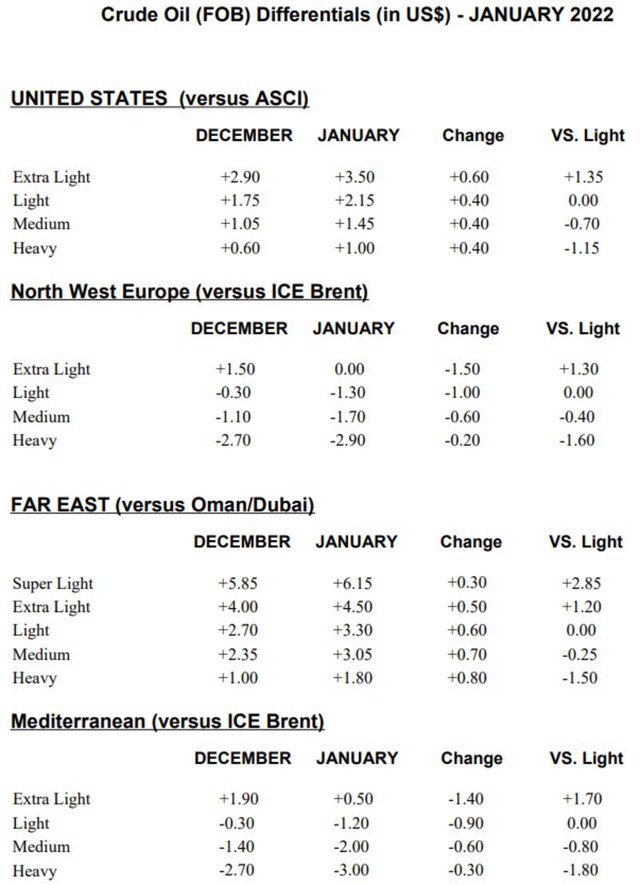

Accordingly, Saudi Aramco raised the price of all crude oil for January 2022 to be sold to Asia and the US. The price of Arab Light light oil sold to Asia was adjusted to increase by 60 US cents compared to December 2021, up to 3.03 USD compared to the reference price.

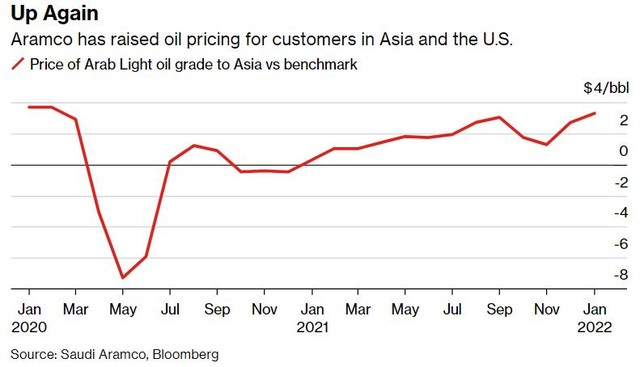

Aramco raised oil prices for customers in Asia and the US.

On Thursday (December 2), OPEC + decided to add more oil supply next month, although the increase in the number of new Covid-19 infections threatens to depress demand, amid the alliance’s own prediction. The oil market will move from a lack of supply to a surplus of 3 million barrels in the first quarter of 2022.

The price of Brent crude has fallen 15% since the end of November to just under $70 a barrel, dragging down the year-to-date Brent price gain to 35%.

The recent drop in oil prices is mainly due to the emergence of Omicron – the latest variant of the SARS-CoV-2 virus that is believed to spread more quickly – which can cause a decrease in travel activity and the number of cases in the country. European countries continuously set new records. In addition to the prediction that OPEC + will increase production, major oil importers such as the US and a number of countries with high energy demand such as China, Japan, and India open strategic oil reserves to cool down. oil prices and the possibility of Iran’s return to the oil market.

While Aramco’s price increase was in line with the results of a Bloomberg survey of traders and refineries in Asia, it showed optimism on the part of the company’s management. Aramco CEO Amin Nasser said last week he was “very optimistic about demand” and that the market was overreacting to the Omicron virus.

Saudi Aramco’s January oil futures price to Asia and the US (compared to the world reference price)

iTVC from Admicro

Asia accounts for more than 60% of Saudi Arabia’s crude oil exports, with China, South Korea, Japan and India being the biggest customers. Aramco’s official selling price, or OSP, acts as a support to the oil market and often leads the way in pricing in the region. Most Middle Eastern countries set the monthly price by adding or subtracting from the world reference oil contract price.

Due to the recent plunge in oil prices due to the appearance of the Omicron virus, once the scientific community understands this virus and if Omicron is not as scary as the market is worried, the world oil price will quickly reverse its upward trend. In contrast, in the context that most countries are implementing reopening and economic recovery, along with vaccination rates are constantly increasing.

Analysts say the impact of the Omicron variant appears to be related only to jet fuel, particularly in Africa and Europe, as many countries do not allow entry of visitors from the South. Africa and some European countries have imposed new restrictions to prevent the spread of COVID-19. According to the report, fuel demand in the transport industry in Europe could also be affected.

In addition, OPEC+ commented that even if the US continues to export strategic oil reserves, this unprecedented move is only temporary, with no significant impact on current oil supply and prices. now on. The evidence is that oil prices are still high after the news that the US has released its reserves.

In a report published in mid-November, the International Energy Agency (IEA) maintained its forecast for oil demand growth, according to which in 2021 and 2022, oil demand will increase, respectively. 5.5 million bpd and 3.4 million bpd. The IEA believes that global oil demand is growing strongly due to the rate of gas consumption increasing and international movement to resume as more and more countries open their borders after a period of restriction to contain the epidemic. However, a new wave of disease in Europe, slowing industrial production and higher oil prices are likely to hold back the upward momentum.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com