Steel prices in China fell for a second session in a row as concerns about slowing demand for construction materials and manufacturing outweighed worries about output cuts. The country’s intention to increase steel export tax increases the downward pressure on prices.

Construction steel prices on the Shanghai floor ended July 28, down 0.3% to 5,658 yuan ($869.82)/ton after falling 1.3% in the previous session; hot rolled coil this session fell more sharply, losing 1.6% to 5,879 yuan/ton, after falling 1.4% in the previous session; Stainless steel also fell 1.8% to 19,120 yuan/ton, after falling 2% in the previous session.

Iron ore prices recovered slightly this session after falling sharply in the previous session. Accordingly, iron ore on the Dalian bourse inched up 0.2% to 1,137.50 yuan/ton, after falling 2.8% in the previous session.

Wood Mackenzie senior economist Yanting Zhou said China’s slowing industrial production growth and falling investment in manufacturing and infrastructure are expected to have a negative impact on demand. domestic metal demand. It is known that the profit growth of these country’s steel companies has decelerated for the fourth consecutive month to June as high raw material prices reduce the profits of mills.

“Steel demand is likely to suffer more than other metals,” especially due to a “significant” slowdown in investment in transport infrastructure, Zhou said.

Despite falling demand, concerns about limited supply as China strives to reduce carbon emissions has prevented steel prices from plummeting.

This country sets a target that steel production for the whole year 2021 will not exceed the volume of 2020, which means that it will have to sharply cut output in the second half of the year, because output in the first half of this year has increased by 12% compared to the previous year. same period last year due to concerns that the Government may strengthen control measures and cause a shortage of steel supply, pushing up steel prices and profit margins from steel production activities, thereby prompting mills to improve the production.

China’s monthly crude steel production

With the domestic demand for steel despite being in the low season, but still high and expected to increase when it comes to the construction season, and similarly, steel prices, although falling from the record high of last May, are still at a high level. In order to ensure sufficient supply for the domestic market and achieve the target of reducing carbon emissions, China is considering imposing steel export tax.

Bloomberg on July 28 reported that China is considering imposing more taxes on steel exports with the goal of both limiting domestic steel production and curbing the price of this item – which has risen to a record high, causing a flare-up. inflation concerns. After this news, steel prices in China continued to fall.

Outside of China, steel prices in all markets have increased by the most in recent decades, with prices in Europe and North America continuously breaking records due to economic stimulus programs and government spending. infrastructure on a large scale. Not only China, Russia is also planning to impose tariffs on steel and other base metals exports to curb domestic inflation.

Steel prices this year increased around the world

Accordingly, the Chinese authorities are discussing tariffs of 10 to 20 percent on exported steel products, including hot rolled coil. Officials in the country want to start applying this tax as soon as the third quarter of 2021, although the policy has not yet been approved.

“If the export tax increase is implemented, steel producers will be less interested in exporting,” said Ban Peng, an analyst at Maike Futures.

Previously, this world’s largest steel producer canceled the tax refund policy for steel exports and raised taxes on some products from the beginning of May 2021. This time, the export tax will target a number of steel products not mentioned in the tax increase in May. This tax increase will affect small-scale and low-margin producers.

Even so, China’s steel exports still increased in June 2021. After a decline of more than 30% in May 2021, China’s steel exports increased by more than 20% in June 2021.

“With this move, China wants to target steel producers that may have ignored the government’s directive because the profit margins are too large,” said Atilla Widnell, CEO of Navigate Commodities. He forecast that China’s hot rolled coil exports will be subject to tariffs of up to 20%.

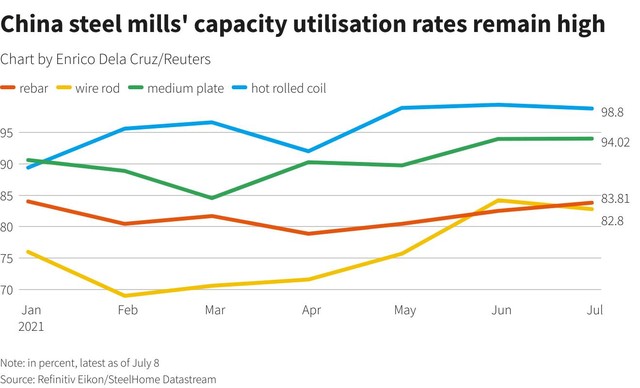

SteelHome consulting data shows that capacity utilization rates at blast furnaces in China still increased in the first week of July, but could decline as production cuts increase, analysts say. know.

China’s manufacturing capacity utilization rate remains high

Some experts said that China’s increase in steel export tax is also unlikely to be enough to make up for the lack of supply due to the policy of cutting steel output in the last months of this year. Therefore, it is likely that steel prices in China will continue to increase in the last 5 months of 2021.

References: Bloomberg, Reuters

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com