Last session, the price of oil, grains, coal, aluminum… increased, while the price of gold and coffee turned down.

In the energy market, oil prices rose slightly as investors were optimistic about global economic growth despite the COVID-19 pandemic, amid a more-than-expected drop in US weekly crude inventories.

At the end of this session, Brent oil price increased by 1.44 USD (2%) to 73.03 USD/barrel, while US light sweet oil (WTI) increased 1.40 USD (2%) to 69.99 USD/barrel. .

The short-term rally pushed WTI crude above its 50-day moving average for the first time in a month, an upbeat signal for investors. Additionally, crude oil futures contracts are up more than in recent months, another sign that investors expect demand to increase as supply shrinks.

The US Energy Information Administration (EIA) has reported that crude oil inventories in the US fell by 7.2 million barrels last week. New US jobless claims fell last week, while the number of people who lost their jobs in August fell to the lowest level in more than 24 years, suggesting the labor market is growing despite the number of corona virus infections. new.

India’s gasoline demand this fiscal is estimated to be at a record high as more people move after the relaxation of Covid-19 restrictions.

Optimistic about the global economic recovery, the Organization of the Petroleum Exporting Countries (OPEC) and its allies, also known as OPEC+, have just agreed on a policy to gradually increase crude oil production in accordance with the current policy. applied, even when raising the forecast for oil demand in 2022 and facing pressure from the US to rapidly increase production.

China’s coking coal prices continued to rise 8%, hitting a daily limit and hitting a record high, boosting coking coal prices, as slow imports and production controls at mines raised concerns over supply. .

Mongolia reported the highest number of Covid-19 cases on September 1, suggesting that imports of coking coal from the country may continue to decline in September. Meanwhile, China’s National Mine Safety Administration The country recently reiterated the importance of safe production at the mines for the rest of the year.

Some factories in Shanxi province have raised the price of coking coal as reported by Huatai Futures.

The price of coking coal on the Dalian Commodity Exchange for January term futures increased 8% to 2,669 CNY (US$412.99)/ton. Coke in Dalian closed up 6.5% to CNY 3,359/ton.

In the precious metal market, gold prices turned lower as investors waited for the US to release the August jobs report late on September 3.

At the end of the session, spot gold price fell 0.2% to 1,809.6 USD/ounce; December gold futures fell 0.3 percent to $1,811.5 an ounce.

The US Department of Labor said on September 2, the number of US initial jobless claims fell 14,000 to 340,000 seasonally adjusted applications for the week ended August 28, and was the lowest level since. when the COVID-19 pandemic took hold in the US and brought down the price of gold.

The labor market is the determining factor for changes in US monetary policy. At a conference in Jackson Hole last week, Federal Reserve Chairman Jerome Powell said he was in favor of slowing the pace of bond purchases this year, but did not specify when the Fed might start. head is reduced. Market analysts said Mr. Powell’s comments made the monthly US jobs report extremely important as it was the basis for the Fed’s meeting at the end of September 2021.

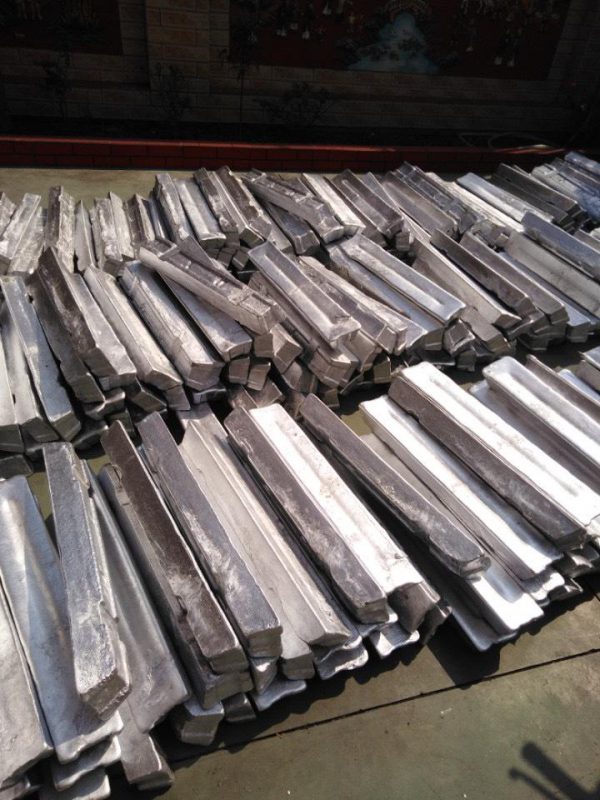

In the industrial metals market, aluminum prices rose to a 10-year high on growing concerns that restrictions on metal production in China are squeezing supply.

Aluminum on the London Metal Exchange (LME) rose 0.1% to $2,692.5 a tonne, before reaching $2,734.5 a tonne, the highest since May 2011.

Falling Chinese output is transforming a market that has been abundantly supplied for years. It is predicted that aluminum prices will increase above 3,000 USD/ton.

China produces more than half of the world’s aluminum supply. Some local governments have restricted consumption for aluminum or metal producers because of limited power sources and pressure to reduce environmental pollution.

Aluminum inventories on the LME exchange fell from nearly 2 million tons in March to 1.3 million tons last month, before rising slightly.

The price of iron ore traded in China fell 0.6% to 774 CNY/ton, falling again after rising in the early session; Spot iron ore with 62% Fe content exported to China decreased by 11 USD on September 1. Steel prices in Shanghai mixed. Bar steel rose 0.2% to 5,273 CNY/ton. Hot rolled coil price fell 0.9% to 5,571 CNY/ton. October stainless steel futures fell 0.7% to 17,805 CNY/ton.

In the agricultural market, prices of corn, wheat and soybeans all rose as investors took advantage of bargains to take advantage of previous declines.

Soybean futures in November this session increased 7-1/2 cents to 12.85-1/4 USD/bushel; Corn for December delivery rose 3-1/4 cents to $5.26/bushel, and wheat for December delivery was up 2-3/4 cents to $7.17/bushel.

The market for all three grains has stabilized after a few previous declines due to concerns that

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com