The huge increase in steel prices has had a ripple effect on all aspects of the economy, from construction companies to home appliance manufacturers.

Demand for steel has been so crazy that US mills have stopped taking orders in recent weeks, according to Dan DeMare, sales manager for Heidtman Steel Products Inc. Factories may not take new orders until the end of the summer, he said, so they can clear backlogs of work.

In the context of the global economy being shaken by supply shortages and the risk of inflation, the move of steel mills could signal that deliveries will be more difficult and steel prices, face key commodities of many industries, will go higher. Worldwide, each person uses nearly 227 kg of steel every year, from paper clips and cars to skyscrapers to toasters.

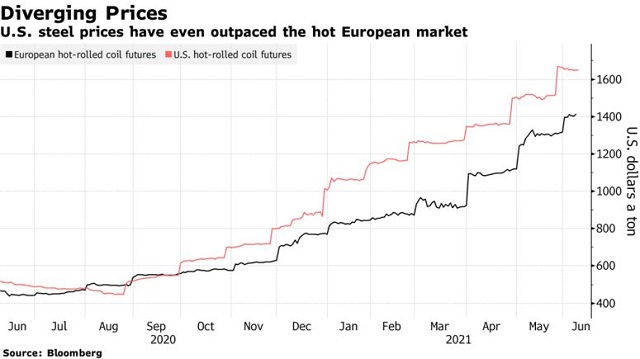

Steel prices in the US tripled in the past 12 months as the world’s largest economy recovered faster than expected, surprising manufacturers as well. Steel futures in China also hit a record after authorities pledged to reduce output to control emissions. Prices are also strong in the European market, so steel imports will probably only increase by a certain amount even if the US lifts tariffs under President Donald Trump.

Phil Gibbs, an analyst at Keybanc Capital Markets, said in nearly 15 years of researching the steel sector, he had never seen such a “crazy” rise in this commodity.

Although prices have increased across the commodity market, the 220% increase in steel prices in the US over the past year has knocked out other high-value commodities such as copper and crude oil. Standard&Poor’s index tracks steel companies, including Nucor Corp., Cleveland-Cliffs Inc. and the U.S. Steel Corp., up 69% in 2021 and is the strongest index increase in the first 5 months of this year.

This upward momentum seemed unthinkable to steel companies 10 months ago when they assumed that it would take at least 2022 for steel demand to return to pre-pandemic levels. The rapid recovery of steel mills but slow production has reduced inventories, which were always at a low level during the peak of the Covid-19 pandemic.

Lumber, a market where manufacturers are also struggling to meet a spike in demand, is one of the few materials that has seen such a rise as steel.

Carl Harris, who has been in the construction industry for 36 years and is the director of Harris Homes, said he is looking at the impact of delayed deliveries of refrigerators, ovens and dishwashers. The normal delivery time was 2-3 weeks, now it has taken up to half a year in many areas, he said.

The delay meant that Harris was unable to install home appliance packages to market newly built homes even though other parts were completed. According to him, other home builders in the area are also having problems installing water systems that are required before a residence permit is issued.

“Household appliances use a lot of steel to make, so we’re facing a huge backlog,” Harris said.

Things are even more expensive when it comes to oil drilling, as the prices of steel, cement, etc. have all increased sharply, pushing up the cost of oil exploration, according to Citigroup. Steel used to produce drill pipes used in new oil fields could increase by about 50% in 2021.

The automotive sector also faces a similar situation. According to Ford Motor management, commodity prices increased mainly in the aluminum, steel and precious metals markets. The company predicts the goods market will receive an additional $2.5 billion between the second and fourth quarters of this year and this will directly affect the auto sector, said John T. Lawler, CFO of the company. Ford, said.

A sharp increase in commodity prices risks causing buyers to falter or look for substitutes if possible.

“To some extent, this could destroy demand,” said Keybanc’s Gibbs.

However, there are some signs that the supply shortage could be ameliorated.

US steel producers are expected to increase capacity by 4% from current levels, or about 4.6 million tons/year, by the end of 2022, according to Bloomberg Intelligence analyst Andrew Cosgrove. In China, the government has frequently reiterated its commitment to limit production since late last year, but steel mills are still recording unprecedented output levels.

However, those who want to buy steel right away still have to pay more and have to wait longer. “There are not many available goods. Steel mills are restricting receiving orders, limiting the number of orders so they can keep up with production,” said Mr. DeMare of Heidtman Steel.

T&G . International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com