Most of the main oil-consuming countries are currently either in the third or fourth wave of Covid-19 infections since the start of the pandemic, or are battling to contain community outbreaks.

The number of Covid-19 virus infections per day in the world last week doubled, to 84 cases per 1 million people, compared with only 46 cases per million people at the end of June, according to official statistical data. by Refinitif.

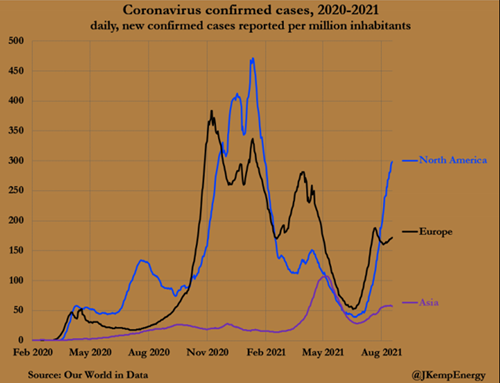

North America has seen the number of new infections increase to nearly 300 cases per million population per day, from 40 cases two months ago, while in Europe this number has increased from 50 to 170 cases, and Asia from 30 cases to 60 cases.

The high number of Covid-19 infections in all key oil-consuming regions, delaying plans to ease social distancing and restoring international air transport, sending oil prices consecutively. decreased in recent sessions.

|

| Số ca nhiễm virus tăng mạnh |

Oil prices have fallen for seven consecutive sessions (August 12-20), and last week fell the most in more than nine months as investors sold off futures contracts in anticipation of weakening fuel demand worldwide. the world due to the increase in the number of Covid-19 infections.

The last session of the week, August 20, Brent oil price fell 1.27%, or 1.9%, to 65.18 USD/barrel, the lowest since April 2021; US light sweet oil (WTI) dropped 1.37 USD, or 2.2%, to 62.32 USD/barrel. For the whole week, Brent oil price fell about 8%, while WTI oil lost more than 9%, the biggest drop lost about 8%. Overall, the whole week lost more than 9%.

Many countries around the world are responding to the increased rate of Covid-19 infection caused by the Delta variant virus by adding travel restrictions.

Bank of America commodity strategist Francisco Blanch said: “The oil market has been quick to recognize that the Delta variant virus is an increasingly serious problem and a potential obstacle to a recovery. fuel/travel needs”.

“Aviation remains the weakest link in the global oil demand chain at the moment, and the risk of further travel restrictions increases, including domestic and inter-country travel, due to the Delta variant virus.” will be the key factor that changes the oil industry picture from now to the end of the year, especially as the driving season in the US is coming to an end,” said Stephen Innes, manager of SPI Asset Management.

The nearing end of the peak gasoline demand season in the US and the end of the summer holidays in the US and Europe will further weaken gasoline demand.

John Kilduff, an associate at Again Capital LLP in New York, said: “It is difficult to find momentum to support the market in the context of many uncertain factors like today.” “They (countries) are acting very harshly on these outbreaks and this is a direct threat to oil demand,” Kilduff said.

The fact that nervous investors avoid high-risk assets while the US Federal Reserve (Fed) moves to consider reducing fiscal stimulus this year pushes the USD to a high of more than 9 months is even more disturbing. pressure on the oil market. Oil prices often move inversely to the USD, as a rising USD makes oil more expensive for overseas buyers.

“The spread of the Delta variant amid weak economic growth and the prospect of tighter monetary policy is creating short-term ripples in commodity markets,” commodity analysts said. ANZ said, adding: “Increasing restrictions on travel are raising concerns about oil demand.”

“The latest lockdowns in major economies around the world could hurt economic activities and growth prospects in the future,” said Margaret Yang, a strategist at DailyFX – based in Singapore. the coming months”.

China, the world’s largest crude oil importer, has imposed new restrictions with a “zero tolerance” policy on Covid-19 that is affecting the global supply chain. More stringent measures at its ports have caused congestion.New Zealand and Australia have stepped up social distancing measures as the number of community-acquired Covid-19 infections has increased. blockade, while the number of Covid-19 infections increases in many countries such as Korea, Malaysia, the Philippines, Vietnam and Thailand, whose industries need oil, will also be affected by the Delta variant.” , said DailyFX strategist Margaret Yang.

Meanwhile, many countries, including the US, China and Australia, have imposed travel restrictions, causing global jet fuel demand to reverse downward after a period of significant improvement in recent years. throughout the summer.

Some US companies have delayed plans for employees to return to the office. Apple Inc, the largest US company by market value, is delaying the return of workers until early 2022, Bloomberg reports.

Meanwhile, oil supply is still steadily increasing. Services firm Baker Hughes said U.S. production rose to 11.4 million bpd for the week ended Aug. 14, and drillers added rigs for three straight weeks.

The Organization of the Petroleum Exporting Countries and its allies are also ramping up supply to the market – the amount of oil the group has withheld during previous pandemic outbreaks.

Oil prices in futures contracts indicate that the market expects more abundant supply in the coming months. The price of Brent oil for 1-month futures versus 3-month futures has nearly halved since the end of July, showing that short-term supply will not be as tight as the market expected.

If Covid-19 behaves like other respiratory diseases, it will spread faster in the autumn and winter in the Northern Hemisphere, when students return to school, other activities will also be affected. increased, people will move more on the street than at home.

Due to incomplete vaccination campaigns and limited control of the spread of the disease, most governments are unlikely to lift the remaining travel restrictions in the next few months. Even long-haul passenger air operations may be pushed back to 2022. Until governments are confident enough to reopen international routes widely, the oil market will continue to move. under pressure.

Source: VITIC / Reuters

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com