Metals have become the “victims” most affected by the energy crisis when half of the base metals, including copper, aluminum and zinc surged in price while the other half also escaped. price range

The wave of metal supply cuts is spreading from China to Europe, stemming from the energy crisis that has spread across the globe as shortages ranging from natural gas to coal and oil have caused power shortages and shortages. increasing electricity, pushing up metal production costs.

Countries’ natural gas stockpils have been depleted while fears of a cold Northern Hemisphere winter are fueling stiff competition among buyers in Europe, Asia and North America in the coming months. race to get gas to replenish the stockpile in time for next winter. For metals, the decline in gas supplies means that metal production will drop just as demand is exploding. Demand for zinc, used in steel production, is strong as economies around the world reopen after the lockdown/social distancing period against Covid-19. Aluminum demand for food packaging, auto manufacturing and construction also rebounded…

Meanwhile, metal supply was forced to cut due to lack of electricity and high fuel prices. In China, the world’s top metal producer and consumer, the government must allocate quotas for electricity use, forcing energy-intensive industries such as metallurgy to limit electricity consumption. Meanwhile, many metal mines and smelters were forced to cut or even halt production.

The situation of metal supply is more and more stressful because the logistics sector has not been able to get rid of the difficult situation, causing the supply, causing the risk that the metal supply in the near future will be further restricted.

The latest big “catalyst” of the metal’s price boom came on Wednesday (October 13) when Nyrstar – one of the world’s largest zinc producers – announced it would cut production in China by up to 50%. three smelters in Europe as rising electricity prices push up costs associated with carbon emissions.

“Investors look to metals in anticipation that the output cut, due to higher electricity prices, will outweigh the drop in demand,” said John Browning, an analyst at BanDS Financial in Shanghai. if any”.

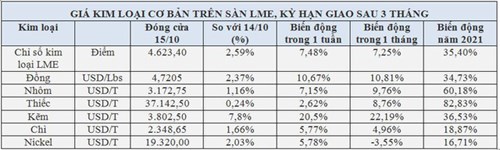

Against this backdrop, copper prices this week posted their biggest gain since 2016. Three-month copper futures on the London Metal Exchange (LME) – the global copper reference contract – ended. this week at 10,4623 USD/ton, up 3% compared to the previous session, and for the whole week increased by more than 10%, the highest increase since 2006. On Thursday (October 14), the price of copper had a point in time. reached a record high of 10,747.5 USD/ton.

Copper production was hit by the power shortages, which coincided with a sharp drop in copper stocks at the LME’s bonded warehouses, to just 14,150 tonnes, their lowest level in decades. Shanghai futures (ShFE) were also at their lowest since 2009, at 41,668 tonnes. The low amount of copper reserves pushed the spread between the spot price of copper compared to the 3-month term to $245 per tonne, the highest since 2005.

Zinc and aluminum prices also rose this week to their highest levels in more than a decade as soaring energy costs and power shortages in China forced zinc and aluminum smelters to cut output.

The price of zinc for 3-month delivery on the LME ended the last session of the week up 7.8% from the previous session, to $3,802.50 per tonne, at times reaching $3,944, the highest level since 2007. , bringing the price increase in just the past week to 20%. The announcement of Nyrstar about a plan to drastically cut zinc production has “ignited the fire” of the price fever in the zinc market.

Aluminum prices this week also hit their highest since 2008, at $3,215 per tonne due to aluminum production cuts across Europe and China. Ending the last session of the week, aluminum price increased by 1.7% compared to the previous session, to 3,170 USD/ton. For the whole week, prices increased by 7%.

Other base metals such as nickel, tin and lead also all increased in the last session of the week as well as this week.

|

With metal prices rising, analysts are also concerned about the risk that demand will be hit as producers – key metal consumers – will face an increase in prices. prices of raw materials simultaneously on a large scale. Additionally, some analysts are wary that raw material demand at factories in China, one of the world’s biggest consumers of the metal, could disappoint.

However, with the approaching winter conditions expected to exacerbate the energy crisis, ANZ bank forecasts high electricity prices and the possibility of prolonged power shortages will affect supply more than demand. metals in the coming months.

Saxo Bank analyst Ole Hansen said the high cost of electricity is also causing inflation and this is boosting demand from investors for copper and other physical commodities as a hedge.

Only recently, international zinc and copper research and research organizations forecast copper and zinc supply in 2022 will be in excess. But now they are revising these projections on the basis that the power crisis could reverse those predictions.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com