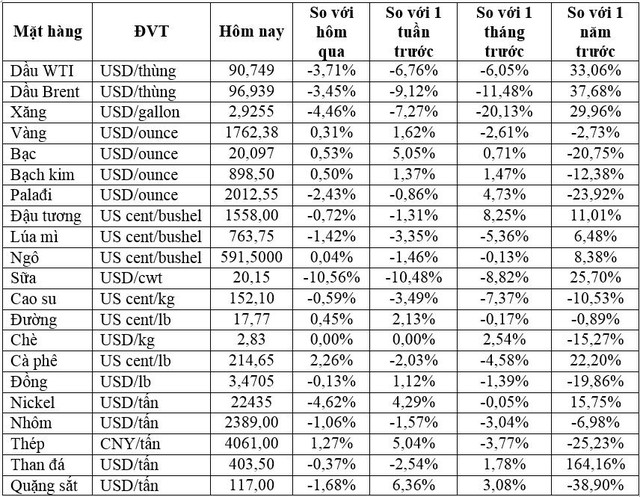

Illustration.

Closing the session on August 3, oil prices fell about 4% on news that US crude and gasoline inventories unexpectedly increased last week, and OPEC + will raise output targets, copper and iron ore will decrease, higher Su Japan ended a 3-day losing streak, US wheat fell to a 6-month low.

Oil down 4%

Oil prices fell about 4%, a sharp drop after US data showed an unexpected increase in crude and gasoline inventories last week and as OPEC+ said it would raise its output target by 100,000 bpd.

Closing session 3/8, Brent crude oil fell 3.76 USD or 3.7% to 96.78 USD/barrel. WTI crude fell $3.76, or 4%, to $90.66 a barrel.

U.S. crude oil inventories unexpectedly rose last week as exports fell and refineries shut down operations, while gasoline inventories rose unexpectedly as demand slowed, according to the U.S. Energy Information Administration.

Crude inventories rose 4.5 million barrels last week, compared with analysts’ expectations for a 600,000-barrel drop. Gasoline stocks rose 200,000 bpd, compared with expectations for a 1.6 million bpd drop.

The ministers of the Organization of the Petroleum Exporting Countries and allies including Russia known as OPEC+ have agreed to slightly increase the group’s output target, equivalent to 0.1% of global oil demand.

Before the meeting, OPEC+ forecast reduced oil market surplus this year by 200,000 bpd to 800,000 bpd.

Also putting pressure on prices, Iranian and US officials said they were traveling to Vienna to resume face-to-face talks on Iran’s nuclear program.

On the demand front, Federal Reserve officials have voiced their determination to rein in high inflation once again, despite what some say is a half a percentage point increase in the US central bank’s key interest rate. next month may be enough to move towards that goal.

A rising USD index makes oil more expensive for buyers in other currencies.

US natural gas up 7%

U.S. natural gas rose 7% after Freeport LNG said its liquefied natural gas export plant in Texas remains on track to resume operations in early October. Prices also rose on forecasts of hotter weather and more air conditioner demand next week than previously forecast.

Natural gas for delivery next month rose 56 US cents or 7.3% to close at $8,266/mmBtu. Since the beginning of the year, gas prices have increased by 118% due to sharp increases in prices in Europe and Asia, making demand for US LNG exports strong, especially since the amount of gas from Russia to Europe decreased after the conflict with Ukraine.

Gas prices are currently trading around 59 USD/mmBtu in Europe and 46 USD in Asia.

Gold fluctuates in a narrow range

Gold prices traded in a narrow range, pressured by the USD and stronger Treasury yields due to tough comments by US Federal Reserve officials.

Spot gold rose 0.1% to $1,761.76 an ounce, fluctuating in a range of about $20. While US gold for December delivery fell 0.7 percent to $1,776.4 an ounce.

The USD index rose 0.2%, making gold more expensive for holders of other currencies. Yields on 10-year US Treasuries also rose to their highest levels in nearly two weeks.

Copper falls on China tensions

Copper prices fell on worries about tensions between the US and China, the world’s top consumer of the metal, and concerns that further interest rate hikes would weigh on global economic activity.

Three-month copper on the London Metal Exchange fell 1.6% to $7,683 a tonne, down for the third day in a row. Copper on the Comex exchange fell 1.7% to 3.46 USD/lb.

China’s stock market continued to decline on worries about escalating tensions over Taiwan following the visit of the US House of Representatives Speaker, while iron ore prices fell amid the crisis in the Chinese property market. .

Hopes of slowing interest rate hikes and China’s economic stimulus helped copper prices recover about 15% after hitting a 20-month low on July 15.

Iron ore decrease

Dalian and Singapore iron ore prices fell as a crisis engulfing property developers in China overshadowed improving mill profits.

The September iron ore contract on the Dalian Commodity Exchange closed down 0.8 percent at 786.5 yuan ($116.44) a tonne.

In Singapore, iron ore for September delivery fell 1.5% to $113/ton, continuing to decline for the fourth consecutive session.

Sentiment has turned unstable after iron ore prices surged last week. A separate survey on August 1 showed that China’s new home prices and sales in July both fell from the previous month. China’s property market, already grappling with a debt crisis and weak demand, was recently rocked by a mortgage boycott.

Analysts say confidence cannot be quickly restored despite government support for the industry.

China’s ailing property sector and decarbonization target leading to a second straight year of steel output cuts in 2022, remain important concerns for iron ore traders despite profitability Steel production is recovering