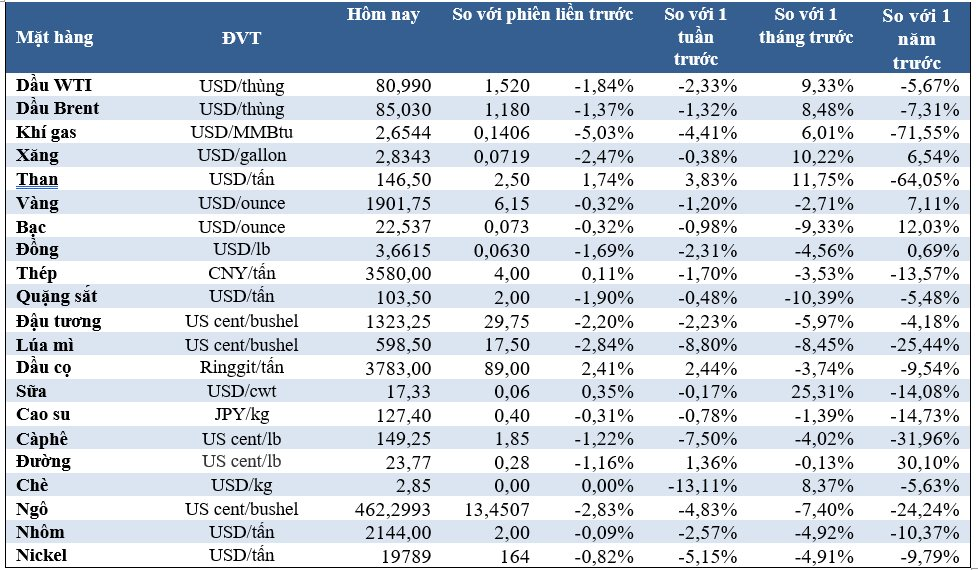

Prices of some commodities dropped on Tuesday (August 15), in which oil fell more than 1% and copper hit a 6-week low. Cereal prices also fell this session. Meanwhile, rubber rebounded, iron ore prices also went up.

Illustration Oil drops more than 1% on worries about China economy Oil prices fell more than 1% on Tuesday on sluggish Chinese economic data coupled with concerns that Beijing’s surprise policy rate cut was not strong enough to revive the country’s recovery after epidemic. Brent crude ended the session down $1.32, or 1.5%, at $84.89 a barrel, while U.S. West Texas Intermediate (WTI) crude fell $1.52, or 1.8%, down to $80.99. China’s industrial output and retail sales data both showed a slowdown in the Chinese economy in July, adding to pressure on already slowing growth and prompting authorities to cut interest rates. policy rates to promote economic activity. China’s central bank eased interest rates slightly after data showed growing pressure on the economy, mainly from the property sector, although analysts said the cuts were too small to warrant a major cut. make a meaningful difference. Gold steady as US dollar depreciates Gold prices steadied on Tuesday on the back of a weaker dollar despite predictions that the Federal Reserve will likely keep interest rates higher for longer after strong US data kept bullion prices near lows. in 6 weeks. Spot gold ended the session little changed at $1,905.19 an ounce, having hit its lowest since June 29, at $1,895.50. US gold futures futures fell 0.5% to $1,935.2. The dollar index fell 0.1% against key partner currencies, making gold cheaper for holders of other currencies. Copper hits 6-week low London copper prices fell on Tuesday, as the demand outlook from the world’s top consumer – China – deteriorated after data showed slowing industrial output growth and falling property investment. . Three-month copper futures on the London Metal Exchange (LME) fell 1.2% to $8,191.5 a tonne at the close, after touching its lowest since June 29 at 8,163 ,90 USD. Beijing on Tuesday cut key policy rates to boost economic activity, but analysts say more support is needed to revive growth. Corn, soybean and wheat decrease US corn prices fell on Tuesday to their lowest levels since 2020 after a weekly report from the US government showed better-than-expected crop conditions. Soybean futures also fell on improved US crop ratings, while wheat touched its lowest level in more than two months. On the Chicago Mercantile Exchange, the most traded corn contract ended down 12-1/4 cents to $4.75-1/2 per bushel and hit its lowest price since December 31, 2020. Soybean prices fell 20-3/4 cents to close at 13.05-1/4 USD/bushel. Wheat fell 17-1/2 cents to $5.98-1/2/bushel and hit its lowest price since June 1. Arabica coffee hits 7-month low ICE arabica coffee futures hit a seven-month low on Tuesday as the harvest at the top Brazilian producer draws to a close and the Brazilian real weakens. December Arabica coffee futures fell 1.25 cents, or 0.8%, to $1.5135/lb, after previously hitting its lowest since mid-January at $1.4940/lb. Robusta coffee for November delivery fell 2 USD, or 0.1%, to 2,433 USD/ton. Rubber rose Japanese rubber futures recovered on Tuesday, as the yen weakened, although rubber on the Shanghai exchange extended losses on a series of disappointing economic data. Rubber contract for January delivery of the Osaka Exchange ended the session up 0.4 yen, or 0.2%, to 195.2 yen ($1.34)/kg. The rubber contract for January delivery on the Shanghai futures exchange fell 70 yuan to 12,805 yuan ($1,759.05) per tonne. Earlier, the yen hit a fresh nine-month low of 145.60 yen against the dollar, making yen-dominated assets more affordable for overseas buyers.