Illustration.

The expectation that China will ease measures to combat the COVID-19 epidemic and the dollar and US Treasury bond yields fell, pushing the prices of oil, gold, base metals and agricultural products all up in session 16/5.

Oil rises on stronger demand outlook

Oil prices rose in the past session on optimism that demand in China will recover significantly after positive signs that the Covid-19 pandemic in the hardest-hit areas of the country is recovering. remission.

Ending the session on May 16, the price of Brent oil for July futures increased by 2.69 USD to 114.24 USD/barrel (up 2.4%), while West Texas Intermediate (US) crude oil increased by 3.71 USD, equivalent equivalent to 3.4%, to 114.20 USD/barrel.

On Monday (May 16), a Shanghai official said the city aims to reopen widely and allow all activities of 25 city residents to return to normal from June 1, after declaring that 15 of the city’s 16 counties were free of COVID-19 cases outside of quarantine.

However, an estimated 46 cities in China are being closed, affecting procurement, factory production and energy use.

Gold rises as USD and US Treasury yields fall

Gold prices rose slightly in the past session as US Treasury yields fell amid a weaker dollar.

Closing the session, spot gold rose 0.3 percent to $1,817.12 an ounce, after hitting its lowest level since January 31, at $1,786.60, as investors focused. on the US central bank about to raise interest rates. Gold futures in June this session also increased 0.3% to 1,814 USD.

RJO Futures senior market strategist Bob Haberkorn said the slight uptrend in gold prices is due to lower Treasury yields and a little weaker dollar.

The dollar fell on May 16 but remained near a two-decade high, making gold expensive for overseas buyers.

Copper, aluminum rise on expectations of demand recovery in China

Industrial metals prices rose on May 16 as China – the world’s top metal consumer – plans to ease anti-COVID-19 restrictions, raising expectations of demand recovery, but the The negative impact of the recent blockade policy on economic growth has limited the increase.

At the end of the session 16/5, the price of copper for delivery in 3 months on the London floor increased 1% to 9,254 USD/ton; while aluminum rose 1.4% to $2,828/mt, after hitting a one-week high of $2,865/mt.

LME approved inventories are currently at a near 17-year low of 532,500 tonnes, and warrantied aluminum inventories are at a record low – at 260,075 tonnes reflecting market tightness. aluminum outside China.

Wheat hit the ceiling, corn and soybeans also increased

U.S. wheat prices on the Chicago Mercantile Exchange hit a ceiling on the last session, adding 70 cents, due to India’s ban on exports of the grain – an abrupt policy shift that has raised concerns about supply across the world. demand while supply is already strained by the conflict between Russia and Ukraine.

Prices of soft red winter wheat contracts on the Chicago Mercantile Exchange all maturities hit the ceiling.

Accordingly, the price of soft red winter wheat ended the session up 70 US cents to 12.47-1/2 USD/bushel, compared with the record high of 13.63-1/2 USD this spring.

India’s export ban, fueled by a heatwave that has reduced harvest prospects and sent domestic prices higher, has raised concerns about the country’s ability to export wheat next year.

Corn prices on the Chicago Mercantile Exchange this session also increased 28-1/4 cents to 8.09-1/2 USD/bushel, while soybeans increased 10 cents to 16.56-1/2 USD/bushel.

Arabica coffee up 5% on forecast of cold spell in Brazil

The price of arabica coffee futures on the ICE floor ended up 5% on the forecast that Brazil is about to receive a cold front with the risk of freezing.

Accordingly, arabica coffee for July term ended up 10.9 cents, or 5.1%, to $2,248/lb, after hitting a three-week high of $2,620.

Robusta coffee delivered at the same time this session also increased by 47 USD, or 2.3%, to 2,087 USD/ton.

Recovery rubber

Rubber futures prices traded on the Japanese market recovered from an 8-1/2-week low, while Shanghai rubber futures prices also increased due to increased buying activity in amid expectations of increased demand from top buyer, China, despite sluggish economic indicators.

At the end of the session, the reference rubber contract (October term) on the Osaka floor increased 3.1 yen, or 1.3%, to 244 yen (1.9 USD)/kg. Last Friday (May 13), the contract fell to its lowest level since March 15 at 240.4 yen.

The September rubber contract on the Shanghai Futures Exchange also increased 275 yuan to 13,070 yuan ($1,922) a ton.

Iron ore and steel recover

Iron ore prices on the Chinese market rebounded on supply concerns, reduced inventories at Chinese ports, and some easing of restrictions against COVID-19.

The September iron ore contract, the most traded on China’s Dalian Commodity Exchange, ended the session up 3.9% to 834.50 yuan ($122.80) a tonne, after Last week, the biggest price drop in nearly 3 months.

On the Singapore Exchange, the June contract increased 1.3% to 128.60 USD/ton.

Iron ore inventories at ports in China as of May 13 stood at 141.75 million tonnes, the lowest level since October, according to data from consulting firm SteelHome.

Steel prices also rose this session, with rebar on the Shanghai floor up 1.4%, while hot rolled coil increased 1% and stainless steel increased 1.9%.

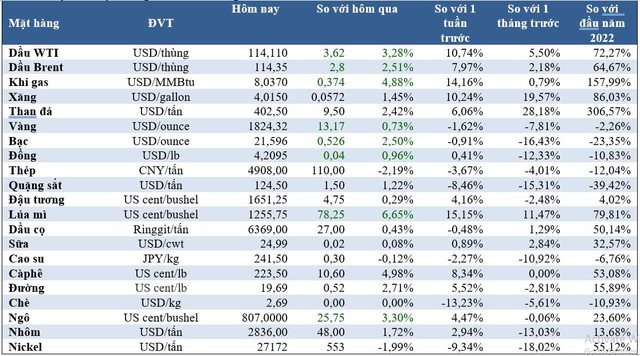

Prices of some key items in the morning of May 17: