Commodity prices all dropped in the last session, in which oil lost 2.5%, coffee lost 4%; wheat, iron and steel… also fell due to the prospect of increased supply and a stronger dollar.

Oil down 2.5%

Oil prices fell 2.5% at the close of the session on Wednesday (May 18), reversing initial gains as traders eased worries about the risk of supply dwindling after government data showed US refineries increase output.

Brent crude ended the session down $2.82, or 2.5%, at $109.11 a barrel. U.S. West Texas Intermediate (WTI) crude fell $2.81, or 2.5%, to $109.59 a barrel.

Brent prices remain unusually below WTI, after falling below US oil prices for the first time since May 2020.

U.S. government data showed U.S. crude inventories unexpectedly fell by 3.4 million barrels last week as refiners ramped up output due to tight oil product inventories, coupled with high exports. Near-record levels have pushed U.S. gasoline and diesel prices to record levels.

US gasoline prices fell 5% on May 18, two days after hitting a record high.

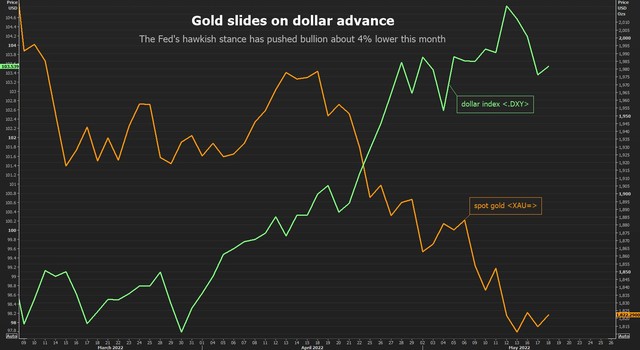

Gold moves in the opposite direction

Spot gold and gold futures prices fluctuated in opposite directions amid falling US Treasury yields, but the dollar strengthened as the US Federal Reserve (Fed) plans to raise interest rates aggressively.

Spot gold price this session increased 0.1% to 1,816.49 USD/ounce; June 2022 gold futures fell 0.2 percent to $1,815.9.

Yields on U.S. Treasuries tumbled in volatile trade, as Wall Street stocks tumbled after weak U.S. housing market data raised fears of a recession. economic.

Gold price fell due to USD increase.

The dong fell as the US announced a sharp increase in interest rates

Copper prices fell in the past session due to pressure from the strengthening of the USD after the Fed Chairman confirmed his ‘hawkish’ plan.

Jerome Powell pledged that the US central bank will adjust interest rates as high as necessary to prevent a rise in inflation that he says has threatened the foundation of the economy.

Those comments boosted the dollar, reducing demand for assets denominated in the US currency by making them more expensive for holders of other currencies.

Meanwhile, investors have yet to fully regain optimism due to China’s “zero-COVID” strategy, which has disrupted the global recovery in manufacturing of everything from mobile phones. to the tram. China’s anti-COVID restrictions are expected to be lifted on June 1.

Wheat fell

Wheat futures fell sharply after a report on UN efforts to restore Ukraine’s grain exports and on forecasts of ample Russian supplies added to sentiment that higher prices will limit demand restriction.

Corn and soybean prices also fell as the fall in wheat prices led to profit taking.

United Nations chief Antonio Guterres said he was in talks with the European Union, Russia, Turkey, Ukraine and the United States to try to restore Ukrainian grain shipments, the United Nations said. and restored fertilizer exports from Belarus and Russia.

The most actively traded wheat contract on the Chicago Mercantile Exchange (CBOT) ended the session down 46-3/4 cents to 12.30-3/4 USD/bushel.

The contract extended its downtrend overnight after the head of Russian agricultural consulting firm IKAR told a conference in Geneva that Russia’s 2022/23 wheat crop could reach 85 million tonnes and export potential. 39 million tons.

Corn prices this session fell 19-1/4 cents to 7.81-1/2 USD/bushel, while soybean fell 15-1/4 cents at 16.62-3/4 USD/bushel.

Coffee down 4%

Arabica coffee prices on the ICE exchange fell more than 4% on May 18, after touching a 3.5-week high in the previous session, as investors eased concerns about the risk of frost in commodity producers. top, Brazil.

Arabica coffee for July delivery fell 9.6 cents, or 4.2%, to $2,176/lb, after touching a 3.5-week high of $2.2935, on Tuesday. 17/5).

The latest weather forecast said frost damage to coffee and sugarcane crops in southern and central Brazil, if any, is expected to be very low.

Robusta coffee price delivered in July this session also decreased by 41 USD, or 1.9%, at 2,063 USD/ton.

Iron and steel decrease

China’s iron ore and steel futures fell on May 18 after a two-day rally, as traders cautious about the risks from the COVID-19 restrictions overshadowed the outlook for economic growth. of the world’s largest steel producer.

The September iron ore contract on China’s Dalian Commodity Exchange ended daytime trading 5.3% lower at 791 yuan ($117.15) a tonne, after touching a high the most since May 6 on Tuesday (May 17), was 849 yuan.

On the Singapore Exchange, futures for June delivery fell 3% to $124.20 a tonne.

Analysts say China’s slowing economy will struggle to generate the amazing recovery the country has achieved from the early stages of the pandemic like two years ago.

Prices of rebar, used in construction, on the Shanghai Futures Exchange last session fell 2.9%, while hot rolled coil fell 2.1%, stainless steel fell 2.9%.

Rubber rose

Rubber futures prices in Japan rose on Wednesday (May 18), supported by a rally in the Tokyo stock market and tighter supplies of raw materials from top producer Thailand.

Rubber contract for October delivery on the Osaka Exchange ended the session up 2.6 yen, or 1.1%, to 247.5 yen ($1.92)/kg.

Thai rubber prices hit the highest level since April 13, at 52.80 baht ($1.53)/kg in the same session.

The average of Japan’s Nikkei stock index rose 0.9 percent to its highest close in nearly two weeks, with technology heavyweights leading the gains, after Wall Street closed also. Boosted by strong retail data.

Rubber contracts for September delivery on the Shanghai futures exchange fell 95 yuan to 12,980 yuan ($1,924.02) a tonne, after touching the highest since April 22 at 13,175 yuan. bad before.

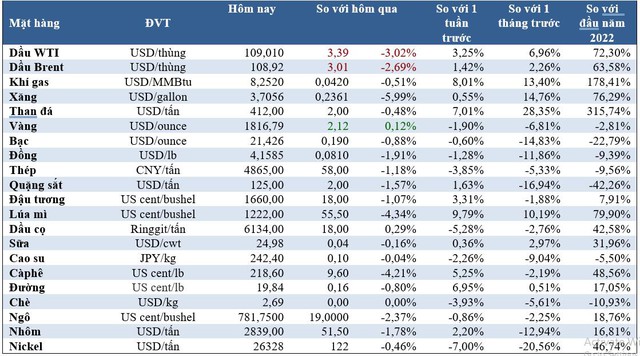

Prices of some key items in the morning of May 19:

T&G Import-Export Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 02473010868

Email: hrm@tginterjsc.com

Website: http://tgimportexport.co