Ending the session on September 22, oil prices increased as US inventories fell to a 3-year low, gold fell, copper increased by nearly 4%, iron ore also increased from a 10-month low.

Oil rises as US inventories fall

Oil prices rose after U.S. crude inventories fell to a three-year low as refining activity recovered from recent storms.

Despite recent woes from US economic data, overall fuel demand has recovered to pre-pandemic levels. Product supplies over the past four weeks have reached nearly 21 million bpd, close to the 2019 peak.

According to the US Energy Information Administration, US crude oil inventories fell 3.5 million barrels last week to 414 million barrels, their lowest level since October 2018.

The president of the Lipow Oil Association in Houston said crude prices remain supportive as demand recovers around the world and inventories continue to decline.

Closing the session on September 22, WTI crude rose $1.74, or 2.5%, to $72.23 a barrel, while Brent crude rose $1.83, or 2.5%, to $76.19 a barrel.

Oil facilities in the Gulf of Mexico continue to return to production, with weekly output rising by 500,000 bpd in the latest week to 10.6 million bpd. BP said on September 22 that all four of its offshore facilities in the area had resumed operations following Hurricane Ida.

Also support prices when OPEC members are struggling to raise output. Rising prices in other markets such as natural gas also support oil, and a shortage in energy markets causes supply shortages in Europe and Asia.

Iraq’s Oil Minister said OPEC and its allies are working to keep oil prices near $70 per barrel as the world economy recovers.

Gold fell

Spot gold prices fell in a volatile session after the US Federal Reserve signaled an earlier-than-expected interest rate hike and easing of bond buying by the middle of next year.

Spot gold fell 0.4 percent to $1,767.38 an ounce, while U.S. gold for December delivery closed up 0.03 percent at $1,778.80 an ounce.

Federal Reserve Chairman Jerome Powell said a reduction in bond purchases could happen by mid-2022. That’s partly positive for gold prices as the Fed didn’t start reducing stimulus immediately and they are still very moderate in their statement.

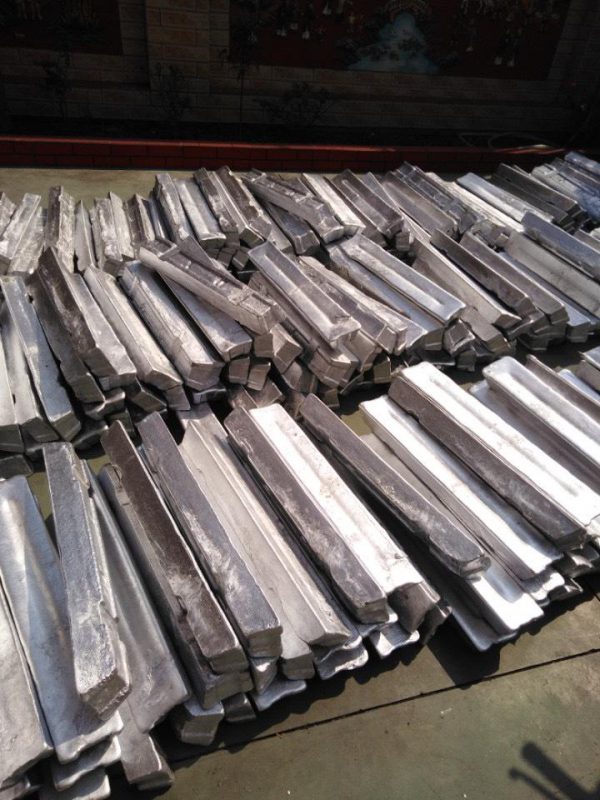

Dong up 4%

Copper prices rose nearly 4% as debt-ridden conglomerate Evergrande made interest payments on a domestic bond, easing fears the real estate giant’s troubles could affect the global economy.

Three-month copper on the London Metal Exchange LME rose 3.9% to $9,322 a tonne, reversing the decline in the previous session.

Evergrande agreed to pay interest on a domestic bond on September 23, while China’s central bank injected cash into the banking system.

Lead was the only metal that fell on the LME, falling 0.5% to $2,124 a tonne after touching $2,108.5, the lowest level since April. Inventories in Shanghai more than tripled in the past six months. to 205,898 tons.

Peru wants to revise the framework for the country’s mining industry, rewrite the law that regulates the sector as well as the law that sets out royalties payments.

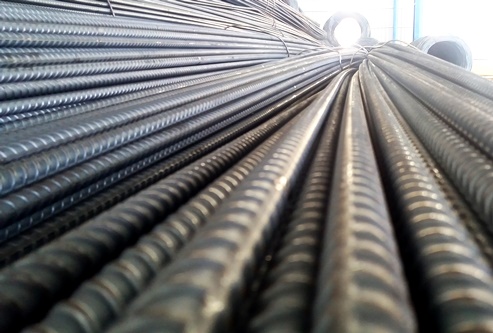

Iron ore rises from 10-month low

Iron ore prices in Asia recover, with Dalian iron ore contract bouncing from 10-month lows, but doubts can be sustained as China’s demand falters and supply outlook improve.

Iron ore for January 2022 on the Dalian Commodity Exchange closed up 3.7% to 668.5 CNY ($103.41) a tonne, reversing the previous decline that sent the contract down. lowest level since 11/26/2020.

In Singapore, the October iron ore contract rose 12.9% to $105.75 a tonne.

Spot iron ore prices in China fell to $103 a tonne last week, a 14-month low, according to data from consulting firm SteelHome.

Restrictions on steel output in China aimed at reducing carbon emissions intensified last month, with top producers in Hebei and Shandong posting annual declines of more than 20%.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com