Closing the session on May 26, oil prices reached a 2-month high, soybeans a 3-month high, while iron ore was a 1-week low, sugar was a 2-week low, natural gas, gold, copper and rubber… simultaneously decreased.

Oil price highest in 2 months

Oil prices rose 3% to a two-month high, on signs of tight supply ahead of the summer driving season in the US and EU sparring with Hungary over plans to ban crude imports from Russia over the Russia-Ukraine conflict. .

Closing the session on May 26, Brent crude oil increased by $3.37, or 3%, to $117.4 per barrel, and West Texas Intermediate crude rose $3.76, or 3.4%, to $114.09. /bin. Thus, after increasing for 6 consecutive sessions, Brent oil price reached the highest level since March 25, 2022 and WTI oil reached the highest level since May 16, 2022.

In addition, oil prices rose in line with a rising stock market trend and the dollar fell against a basket of major currencies, making oil cheaper to buy in other currencies.

Natural gas prices fall

U.S. natural gas prices fell 1%, as demand forecasts for this week were lower than previously expected.

The price of natural gas for June 2020 futures on the New York Stock Exchange fell 6.3 US cents, or 0.7%, to $8,908/mmBTU, the previous session hitting the highest level since August 2008. – 2nd session in a row.

Since the beginning of the year, the price of natural gas has increased by 139% due to the increase in gas prices in Europe and Asia, boosting the demand for liquefied natural gas (LNG) exports in the US to increase sharply, especially since the war. The Russian-Ukrainian conflict on February 24, 2022, raised concerns that Moscow might cut off gas supplies to Europe.

Gold price continues to fall

Gold prices fell, as the US Federal Reserve’s aggressive monetary policy tightening plan reduced the attractiveness of gold, along with pressure from the recovering stock market.

Spot gold on the LBMA fell 0.18% to $1,849.52 an ounce, while gold futures for June 2022 on the New York Stock Exchange rose 0.07% to $1,847.6 an ounce.

Gold’s decline, however, was capped by the dollar hitting a nearly 1-month low and 10-year US Treasury yields falling to their lowest levels since April 2022.

Copper prices continue to fall

Copper prices fell for a third consecutive session, on concerns about the impact of Covid-19 restrictions on economic growth in the top metal consuming country – China – and the impact of global inflation.

Three-month copper futures on the London exchange fell 0.03% to $9,370 a tonne, after falling to a one-week low ($9,277 a tonne).

So far, copper prices are down 14% since a record high ($10,845/ton) in early March 2022.

Iron ore price lowest in 1 week, rebar increased

Iron ore prices in China hit a one-week low, as downstream demand softened while investors worried about the world’s second-largest economy shrinking in the second quarter of 2022, amid economic downturns. Covid-19 restrictions.

China is facing greater economic difficulties than in 2020, with some indicators starting to plummet since March 2022, Premier Li Keqiang said.

On the Dalian bourse, the price of iron ore for September 2022 futures fell 0.8% to 834 CNY/ton, in one session fell 4.1% to 806 CNY ($119.99)/ton – the lowest since May 19, 2022. Coking coal prices fell 0.7% to CNY 2,473/ton and coking coal prices fell 0.2% to CNY 3,256/ton.

Meanwhile, on the Shanghai trading floor, the price of rebar for October term in October 2022 increased by 0.2% to 4,505 CNY/ton, the price of hot rolled coil decreased by 0.1% to CNY 4,632/ton. The price of stainless steel for June 2022 futures fell 0.4% to 18,530 CNY/ton.

Rubber prices in Japan continue to decline

Rubber prices in Japan fell, as domestic business services data raised concerns about inflation and the prospect of weakening demand.

The price of rubber for November 2022 on the Osaka floor fell 1.2 JPY to 246.4 JPY (1.94 USD)/kg, after reaching the highest level since May 12, 2022 (248.8 JPY). /kg) in the beginning of the session.

Meanwhile, the price of rubber for September 2022 on the Shanghai Exchange increased by 170 CNY to 13,255 CNY ($1,969.66)/ton, after reaching the highest level since April 22, 2022 (13,260 CNY//ton). tons) at the beginning of the session.

Coffee prices simultaneously increased in Vietnam, Indonesia, New York and London

Coffee prices in Vietnam market were unchanged in a quiet session due to low inventories, while trading activity in the Indonesian market became active due to increased supply and demand.

In Indonesia, the price of Robusta coffee grade 4 (80 defective beans) offered for sale at a discount of $220/ton compared to the July 2022 futures contract and up from a deduction of $200/ton a week ago.

The price of Vietnam’s export robusta coffee (2.5% black & broken) is offered at a discount of 250-270 USD/ton compared to the July 2022 futures contract on the London Stock Exchange and compared with the deduction level. 230-270 USD/ton 1 week ago. In the domestic market, green coffee beans were sold for 40,600-41,700 VND (1.75-1.8 USD)/kg, unchanged from a week earlier.

In New York, the price of arabica coffee for July 2022 futures increased by 9.55 US cents, or 4.4%, to $2,266/lb.

In London, the price of Robusta coffee for the term of July 2022 increased by 19 USD, or 0.9%, to 2,107 USD/ton.

Lowest sugar price in nearly 2 weeks

The price of raw sugar on the ICE floor touched a nearly two-week low, due to concerns that the top producing country – Brazil – will try to reduce energy prices.

The price of raw sugar for July delivery on the ICE floor fell 0.14 US cents, or 0.7%, to 19.54 US cents/lb, after touching the lowest level since May 13, 2022 (19, 2022). 27 US cents/lb).

Meanwhile, the price of white sugar for August 2022 on the London floor increased by 1.5 USD, or 0.3%, to 565.4 USD/ton.

Soybean prices hit 3-month high, wheat and corn fall

U.S. soybean prices rose 2.7 percent to a three-month high, as wetter forecast in the key northern growing region turned wet, threatening to further delay planting progress.

On the Chicago Mercantile Exchange, the price of soybeans for July 2022 futures rose 45-1/2 US cents to 17.26-1/2 USD/bushel – the highest since February 24, 2022. The price of soft red, winter wheat for July delivery fell 5 US cents to 11.43-1/4 USD/bushel, while the price of spring wheat for delivery for the same term increased 11-3/4 US cents up. 12.92-1/4 USD/bushel. Corn futures for July 2022 fell 7-1/4 US cents to $7.65/bushel.

Rice prices are at their lowest in more than 5 years in India, up in Thailand, unchanged in Vietnam

India’s export rice prices fell to a more than five-year low, weighed down by a weakening local currency and ample supplies in top exporting countries.

In India – the leading rice exporter, the price of 5% broken rice dropped to $350-354/ton, compared with $351-356/ton a week ago.

In Thailand, the price of 5% broken rice was at $450/ton, up from $430-445/ton a week ago, due to the strong baht and rising production costs.

For the 5% broken type, the price of Vietnamese rice is at $415-420/ton, unchanged from a week ago.

Palm oil price highest in 3 weeks

Palm oil prices in Malaysia reversed to increase to a 3-week high, as buying activities profited in the context of tight supply, when Indonesian oil was still absent from the global market.

The price of palm oil for August 2022 on the Bursa Malaysia exchange increased by 156 ringgit, or 2.44%, to 6,539 ringgit per tonne – the highest since May 5, 2022.

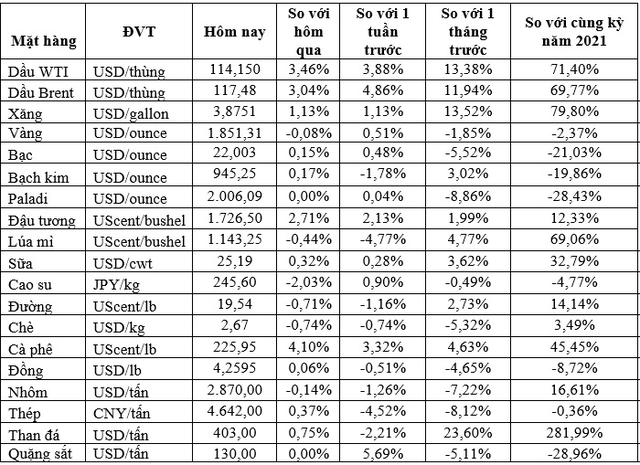

Prices of some key items in the morning of May 27