Closing the session on June 27, oil prices increased by about 2 USD/barrel due to the possibility of tighter supply, gold fell slightly, iron ore reached a one-week high while sugar reached a 4-week low.

Oil rose about 2 USD

Oil prices rose 2 USD/barrel in the first session of the week due to the possibility of even tighter supply, when the G7 organization pledged to tighten pressure on Russian President Vladimir Putin.

Closing the session on June 27, Brent crude oil gained 1.97 USD or 1.7% to 115.09 USD/barrel, WTI oil increased 1.95 USD or 1.8% to 109.57 USD/barrel.

The Organization of G7 nations has vowed to stand with Ukraine as long as possible, proposing a cap on Russian oil prices as part of new sanctions targeting Moscow’s finances.

A French presidential official said the international community should explore all options for reducing scarce energy supplies, including negotiations with producing nations such as Iran and Venezuela. The oil exports of these two OPEC members are limited by US sanctions.

Recession fears and anticipation of further rate hikes have fueled volatility and risk aversion in the futures markets, with some energy investors and traders pulling out of the market, while prices spot crude oil remains high due to strong demand and a decline in supply.

The Organization of the Petroleum Exporting Countries (OPEC) has reduced its 2022 oil surplus forecast to 1 million bpd, down from 1.4 million bpd in its previous estimate.

On June 27, Libya, an OPEC member, said that it may stop exports in the Sirte Gulf region within 72 hours because of the instability that limits production.

Ecuador also said it could stop production altogether for 48 hours amid anti-government protests that have left at least six people dead.

Copper rose slightly

Copper prices rose slightly as sentiment improved after China eased Covid-19 restrictions and the dollar fell, but recession fears, rising prices and interest rates weighed on the metal.

Three-month copper on the London Metal Exchange rose 0.3 percent to $8,404 a tonne. The price of this metal, used by investors to assess the health of the economy, was at $8,122.5/ton on June 24, the lowest since February 2021.

Rising inflation and interest rates, with expectations of further rate hikes taking a toll on growth and demand, have sent stock and commodity prices plummeting in recent weeks.

Copper prices came under pressure after LME data showed copper inventories rose 11,825 tonnes to 124,850 tonnes.

Zinc for delivery in 3 months fell 0.2% to 3,342 USD/ton. Concerns about reduced supply in the LME market, the difference between the spot price and the 3-month zinc futures price fell to $66/ton from above $200/ton last week.

Iron ore rises to one-week high

Iron ore prices in Dalian and Singapore hit one-week highs on hopes Chinese steelmakers will restart dozens of blast furnaces that have been shut down due to falling profits and weak demand to replenish inventories. warehouse.

The September iron ore contract on the Dalian Commodity Exchange closed up 4% to 775 yuan ($115.92) a tonne, after touching 782.5 yuan, its highest since June 20. .

In Singapore, July iron ore futures rose 5.7 percent to $120.6 a tonne, the highest price since June 20.

Dalian iron ore prices fell 22% in the 10 sessions to June 23, while iron ore in Singapore fell to its lowest close this year at $108.14 a tonne on June 23, as production steel production is decreasing in China.

Restricted steel production is expected to help reduce high inventories, and the reduction in supply should help stop prices from falling. However, the overall outlook for China’s iron and steel remains essentially unchanged.

China’s zero Covid policy will make the risk of blockade high, while adverse weather conditions with construction projects are also a concern.

Bar in Shanghai rose 1.1%, while hot rolled coil increased 1.2%. Stainless steel fell 3.3%.

Japanese rubber highest 2 weeks

Japanese rubber prices hit two-week high as strong Tokyo stock market supported sentiment while easing Covid-19 restrictions in China raised hopes for stronger rubber demand in this country.

The December rubber contract on the Osaka exchange closed up 3.7 JPY to 259.0 ($1.92)/kg, after hitting the highest since June 13 at 259.5 JPY in this session.

The June futures contract expired last weekend at JPY 270.

While rubber in Shanghai may recover next week, the increasing supply of raw materials from Thailand may limit price momentum.

Rubber for September futures in Shanghai rose 80 yuan to close at 12,850 yuan ($1,922.24) per ton, after hitting its highest since June 15 at 12,945 yuan.

Sugar prices fall to 4-month low

Raw sugar for July delivery closed down 0.07 US cents or 0.4% at 18.30 US cents/lb, after falling to its lowest since March 1 at 18.2 US cents.

Dealers said sugar prices rose early in the session then fell on news that the Brazilian state of Sao Paulo, where the country’s biggest fuel market is, cut taxes on gasoline but unchanged on hydrated ethanol. Lowering the gasoline tax will cause factories to produce less ethanol and more sugar.

Suedzucker, the German sugar producer, plans to raise prices significantly to offset rising costs and is preparing to switch to coal as Russian gas supplies to Western Europe slow.

White sugar for August futures fell $2, or 0.4%, to $541.6 a tonne.

Reduced coffee

September arabica coffee futures closed down 1.15 US cents or 0.5% at $2,221/lb after falling to a two-week low at $2.19/lb.

Prices fell even as ICE-certified arabica stocks continued to fall to 951,000 bags, their lowest level since early 2000.

September robusta coffee futures fell $4, or 0.2%, to $2,040 a tonne.

Soybean up, corn and wheat down

Soybean prices on the Chicago Mercantile Exchange closed higher as buying to close short positions after last week’s steep decline as well as strong spot markets amid dwindling old-crop soybean supplies. .

CBOT July soybeans closed up 19-3/4 US cents to 16.30-1/2 USD/bushel and December futures of the new crop increased 8-1/2 US cents to 14.32-3 /4 USD/bushel.

Corn prices fell on better-than-expected rain over the weekend in the Midwest, technical selling and expectations the US Department of Agriculture (USDA) will raise US corn acreage estimates in a final report. this week.

CBOT corn for July term closed down 6 US cents to 7.44-1/4 USD/Bushel while new December contract fell 21 US cents to 6.53 USD/bushel.

Wheat closed lower, with the July spot contract the lowest since February on pressure from the northern hemisphere winter wheat harvest and weak US export demand.

Winter red soft wheat closed down 19-3/4 US cents at $9.04/bushel after falling to $9.00-1/2, the contract’s lowest since Feb. 28, near the level. 200-day average at $9.01.

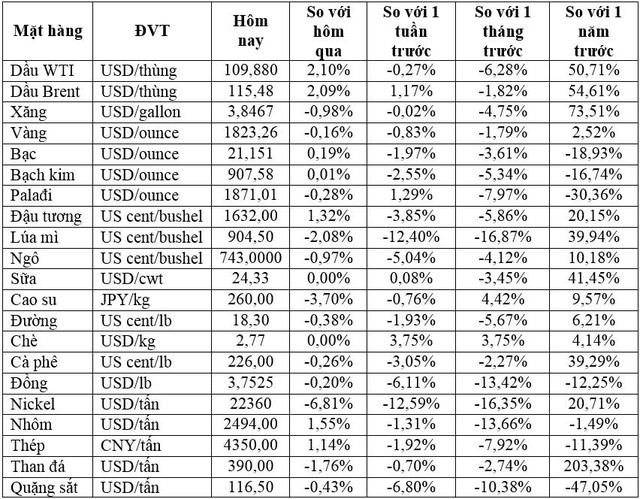

Prices of some key items in the morning of June 28