China is in a dilemma as restrictions on steel production could cripple efforts to control prices. This will have a significant impact on the global steel market, because China accounts for about 60% of the world’s total crude steel production.

China is facing a tough test on its commitment to curbing industrial emissions after steel production surged in the first six months of the year, far exceeding this year’s target of limiting output to zero. or below 2020, causing emissions from this sector to continue to rise to new record highs.

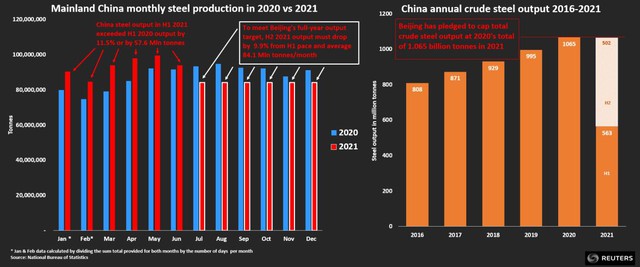

The country pledged to limit crude steel output this year to no higher than the 1.065 billion tonnes it produced in 2020. To achieve that goal, steelmakers will have to cut output by about 10 % for the rest of 2021 compared to a record in the first half of this year, according to Reuters calculations based on data from China’s National Bureau of Statistics.

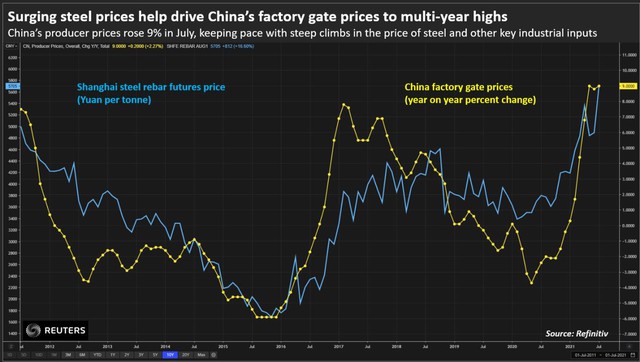

However, with steel prices already near record highs amid a boom in the manufacturing and construction sectors due to stimulus programs, any supply cut could boost raw material price inflation. rising further, making China-made steel prices poised to return to multi-year highs and forcing mills to slow down again, like a vicious circle.

Analysts say it won’t be easy for China to strike a balance between its emissions target and its economic target, but they will try to ease supply shortages and curb price increases with tariffs. exports and increased imports.

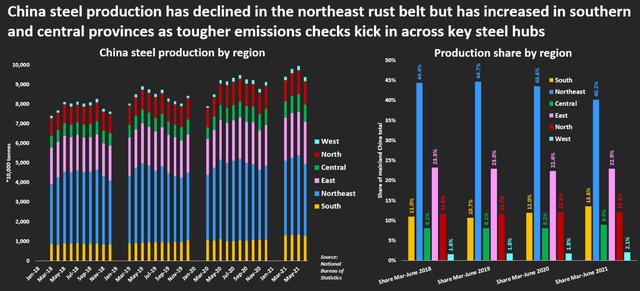

Comparison of monthly Chinese steel production in 2021 vs. 2020 and period 2016-2021

As the world’s largest polluter, contributing almost 31% to total global CO2 emissions (according to BP), China plays a key role in determining whether it can meet its deflation targets. worldwide or not.

A landmark climate report released by the United Nations last week found that climate change is worsening as the heavy use of fossil fuels has exposed China to severe scrutiny. more closely.

Meanwhile, the steel industry as a “criminal”, is an industry with a great task in decarbonizing, because the nature of the industry is to use a huge amount of electricity, accounting for about 15% of the country’s total greenhouse gas emissions. China.

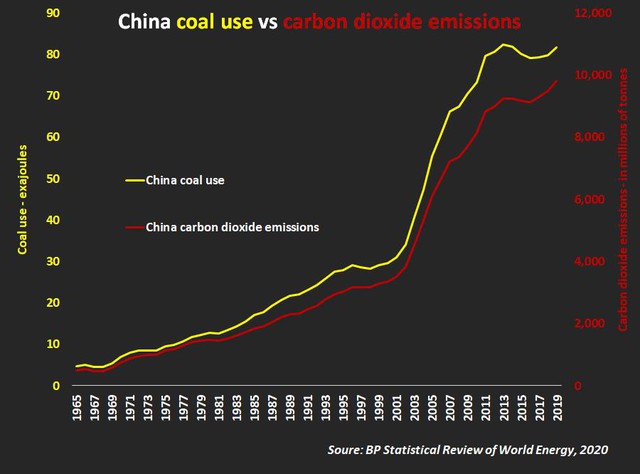

Correlation of coal consumption and carbon dioxide emissions in China

China has ambitious plans to reduce pollution. They are: Limit emissions by 2030, make the country’s emissions carbon-neutral by 2060, and shut down now obsolete smoke-producing capacities – including some steel factory.

Leading steelmaker Baowu Group – also the world’s largest group – said the steel production cuts were now “a political issue and not something to be bargained for”.

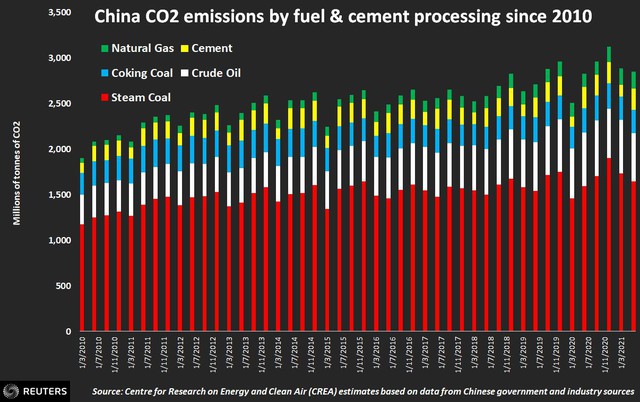

But the recovery in the manufacturing and construction sectors, fueled by massive stimulus measures with cheap financing and a global consumer goods boom, since the anti-Covid-19 measures. was lifted last year, which has resulted in soaring CO2 emissions.

CO2 emissions from the energy and cement production sectors from 2010 to present

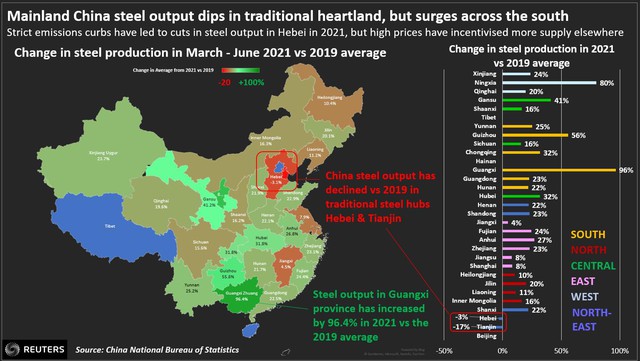

Despite the target of limiting steel output, there are very few regions in China that have reduced output. Among the country’s 31 provinces and regions, only steel hubs Hebei and Tianjin reported planned capacity cuts for the January-June period. Meanwhile, manufacturing regions The second and third largest exporters, Jiangsu and Shandong provinces, both increased their output by 13% and 17% respectively.

Less reputable steel producers all increased output in the first half of 2021. Southern Guangxi Autonomous Region increased output by 88% to nearly 20 million tons – equal to the production level of the whole country of Vietnam for the year. 2020 (according to Reuters data) – due to new factories.

Steel production decreased in steel centers but increased in the South region

Other provinces, including Yunnan and Guangdong, also increased output by double digits in the first six months of the year. As a result, southern China alone is enough to offset the reduction in output in the country’s main steelmaking hubs.

Much of the relocation of steel production out of northern China is planned as part of Beijing’s air cleanup plan. But the distributed nature of the steel industry makes it difficult to monitor the situation in remote areas, especially where local governments want to promote economic development, so there is a high demand for the metal. .

Steel production decreased in the North but increased in the South

Tighten production

Faced with the fact that emissions have increased to an alarming level, Beijing has announced that it will strengthen monitoring of compliance with regulations on production cuts and said it will deal with localities or production facilities that reduce emissions. carbon in a “campaign” fashion.

Major steel-producing regions including Hebei, Jiangsu, Shandong and Fujian have received orders to cut output for the rest of this year.

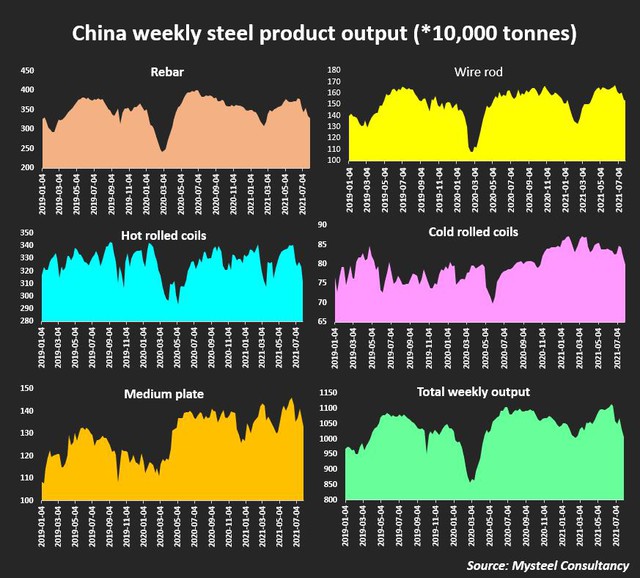

China’s weekly steel output (Unit: thousand tons)

However, for the steel consuming sectors, falling output has raised concerns about the risk of supply shrinking at the end of 2021.

“If the production cuts are strictly enforced, the market will be short of supply,” said Steve Xi, a senior adviser to Wood Mackenzie, adding that export volumes will inevitably decline in Last half year.

To ensure sufficient supply, China has increased steel export tax twice in just 3 months and removed export tax refund policies for nearly 170 steel products.

Even so, analysts still expect the domestic market to be tight in supply.

“There is still a gap of more than 5% in steel supply (versus demand) in the second half of this year,” said Tang Chuanlin, an analyst at CITIC Securities.

The increase in steel prices is one of the main reasons that pushed producer prices at Chinese factories to their highest levels in many years

Price increase pressure

With the profits of many businesses dented by high prices, Beijing last month unexpectedly cut banks’ reserve requirements with the goal of encouraging them to increase lending to businesses to boost production. export.

However, global demand is also strong as travel restrictions due to Covid-19 are gradually lifted. As a result, China’s strict output controls could increase pressure on downstream steel consuming sectors.

“It is very likely that there will be a decrease in steel supply in the second half of this year,” said Zhuo Guiqiu, an analyst at Jinrui Capital. Reduced supply and recovery in demand will drive steel prices higher.”

However, there are also more optimistic opinions on this issue. Richard Lu, senior analyst at commodities consultancy CRU, is among those less pessimistic about the impact of steel production cuts in China. “We see no contradiction between the policy and the government’s intentions,” Lu said, adding that the shortfall would not be too large and the industry could see high profit margins. Steel profit increased and inventory decreased.

But the price pressure due to the shortage of supply – demand balance is really a risk that cannot be ignored.

The National Bureau of Statistics of China (NBS) on August 17 said that global commodity prices will continue to stay high in the short term due to three basic factors: (1) the world economy is recovering. recovery causes increased demand for goods; (2) the supply of main materials from the main producing countries is being tightened due to the negative impact of the Covid-19 pandemic along with other factors, including increased freight rates; and (3) quantitative easing and fiscal stimulus measures in the world’s major economies, which will keep commodity prices high, and even rise further.

According to NBS spokesman, Fu Linghui, China will continue to take measures to ensure the supply of goods and keep prices stable, in order to support small and micro-importing enterprises in the context of high costs. production costs increase.

References: Reuters, Metalbulletin

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com