In the first 2 months of the year, sales of finished steel stood at 5 million tons, up 18.5% over the same period in 2021.

According to a report by the Vietnam Steel Association (VSA), finished steel production in February was 2.6 million tons, up 1.2% over the previous month and up 16.1% over the same period last year. . Sales of all kinds of steel stood at 2.6 million tons, up 5.8% over the previous month and up 30.1% over the same period last year.

Generally in the first 2 months of the year, finished steel sales stood at 5 million tons, up 18.5% over the same period in 2021. In which, exports reached 126,017 tons, up 11.6% over the same period last year. last.

According to a recent report by VNDirect Securities Joint Stock Company, Vietnam’s steel industry has entered an expansion phase from the third quarter of 2020 when the gross profit margin of listed steel companies has been continuously expanded to the third quarter of 2021. . During this period, a number of companies have announced plans to expand capacity (Hoa Phat Dung Quat 2 – HPG; Ba Ria Vung Tau – Ton Dong A; Nghi Son 2 – VAS Nghi Son Group) or join the industry. (Long Son Binh Dinh – Long Son Group). These new factories may raise concerns about oversupply of Vietnamese steel in the coming years, especially when the steel industry enters a recession.

However, VNDirect believes that the demand for steel in Vietnam will remain high due to 4 factors.

Firstly, the need for investment in infrastructure is huge in Vietnam. According to the Ministry of Transport, the Government is aiming to own 3,000 km of highways by the end of 2025 (from 1,163 km of current highways). In the medium-term public investment disbursement plan for the 2021-2025 period, the estimated capital also increased by 43.5% compared to the previous 5-year period.

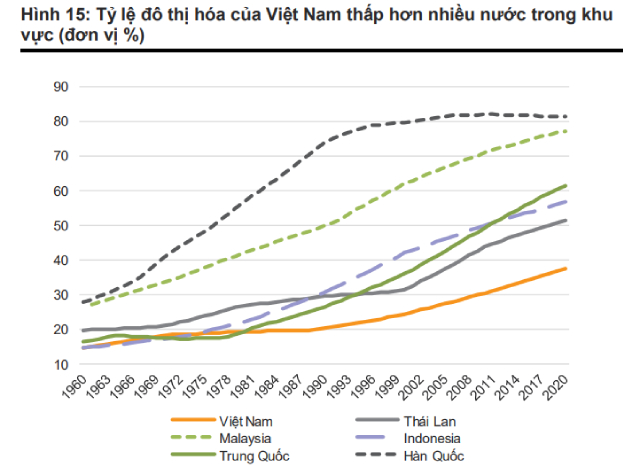

Second, the urbanization rate in Vietnam is still low. The urbanization rate in Vietnam has increased rapidly since 1990 and will reach 37% by 2020, but still lower than many countries in the region. According to the United Nations, the urban population of Vietnam will surpass the rural population by 2050. The population shift to urban areas will lead to an increase in housing construction demand, stimulating demand. use of steel in civil construction.

Vietnam’s urbanization rate is lower than many other countries in the region. Source: VNDirect

Third, Vietnam’s per capita steel consumption is still lower than the Asian average. According to data from the World Steel Association (WSA), Vietnam’s per capita steel consumption is 283 kg, higher than the world average (245 kg), but lower than the Asian average (316 kg). ). On the other hand, the compound growth of Vietnam’s steel consumption per capita also set an impressive rate of 7.3% in the period 2009-2019, which is 4 times/2 times higher than the average growth rate of Vietnam, respectively. world and Asia.

Fourth, Vietnam faces the opportunity to become the new steel factory of the world. China – the country producing 45% of global crude steel output in 2021, is implementing a series of policies that negatively affect the country’s steel industry such as eliminating 13% VAT refund for 146 steel products from May 2021, reduce import tax on crude steel, cast iron and scrap steel to 0% from May 2021. China bans coal imports from Australia, making it difficult for steel mills to access cheap raw materials. The world’s most populous country is also pursuing a target of 65% reductions in CO2 emissions per unit of GDP compared to 2005 levels, the focus will be on reducing output in heavy industry, including steel.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com