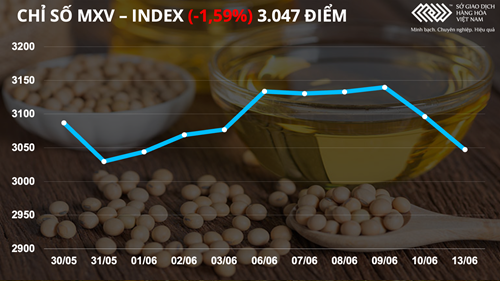

Ending yesterday on June 13, the selling force was completely overwhelming when up to 25 out of 31 commodities being traded internationally at the Vietnam Commodity Exchange (MXV) simultaneously closed in color. red.

Along with that, 6 rare commodities that kept the green color, namely Chicago Wheat, Raw Rice, Cotton, White Sugar, Brent and WTI oil also had only negligible increases, below 0.4%, which made it even more remarkable. added the plunge of world commodity prices yesterday. The steady and very deep decline in all 4 groups of Agricultural Products, Industrial Materials, Energy and Metals pulled the MXV-Index down by 1.59%, to 3,047 points.

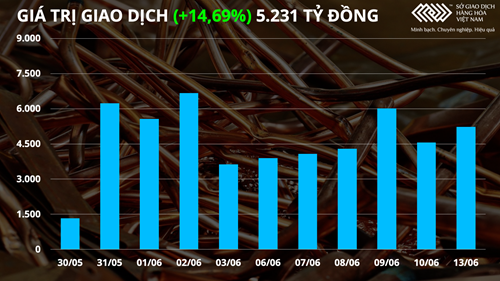

However, with the strength of the T0 market, investors can profit even when the market is up and down; Yesterday, the cash flow into the commodity market still had a strong increase. According to the MXV Transaction Management Division, the transaction value increased by nearly 15%, reaching more than 5,200 billion VND. Notably, the “taste” of domestic investors is still relatively stable as Agriculture and Energy continue to be the two groups of preferred and prioritized products for trading. The transaction value of these two groups alone reached more than 4,100 billion dong, accounting for 90% of the total amount of the market.

|

Precious metals plunge ahead of the Fed meeting

Metals simultaneously plunged before the news that the US Federal Reserve (Fed) will strongly raise interest rates from this week, in the context of record inflation in the US. Gold price fell 2.79% to 1818.77 USD/ounce. Silver prices lost 3.08% and closed at $21,255 an ounce, the lowest level in nearly a month. Meanwhile, platinum fell for the fifth consecutive session and plunged nearly 4% to $932.3 an ounce. As commodities that are most affected by the effects of monetary policy and are very sensitive to interest rate changes, yesterday’s deep drop in silver and platinum was not unexpected by analysts. and investment.

Ahead of the Fed meeting tomorrow night, many speculate that the Fed could immediately raise interest rates by 75 basis points, the largest increase since 1941. The Fed Watch interest rate tracker is showing saw a big change when more than 91% said that this strong increase will happen. The fear of investors drove money out of risk markets and boosted demand for highly liquid USD holdings. The US dollar yesterday set a two-decade high and put pressure on the cost of physical holdings. At the same time, the safe-haven role of precious metals was completely lost to the strength of the greenback.

Base metal group under double pressure

In the base metal market, COMEX copper price had a 3rd consecutive decline to $ 4.2 / pound and iron ore price also plunged 3.66% to close at 134.58 USD / ton last pressure on Fed rate hike and concerns about a re-blockade in the Chinese market.

Along with that, especially for copper and iron ore, according to experts, the short-term outlook for copper is facing challenges related to the possibility of an economic downturn and the slower-than-expected acceptance of green industries. ants. Greater availability of scrap as well as the replacement and reduction of industrial metal use have also affected copper prices. However, the long-term outlook will still be a big driver for the metal as demand in the electric vehicle and clean energy sectors remains buoyant. Metals miner CRU’s latest forecast calls for global copper demand to grow 2.1% annually to 28.5 million tonnes by 2030.

Today, the US producer price index (PPI) for May is released and it is likely that this number will be higher than expected. Next will be the focus of the Fed meeting and the officially decided interest rate. According to the assessment, it is very likely that the Fed will still increase 50 basis points at this week’s meeting as planned, but there may be comments on stronger increases at the next meetings. Therefore, in the face of macro fluctuations, copper price is likely to fall deeply this week.

In the domestic market, the price of iron and steel has been stabilized after 3 times of downward adjustment since mid-May. Specifically, the price of CB240 coils and D10 CB300 rebar products in the North still fluctuated. in the range from 16.9 to 17.5 million VND/ton.

In the opposite direction, the price of cement has increased by about 40,000 – 80,000 VND/ton in May according to each type of cement PCB30 or PCB40. In the second half of May until now, the cement market recorded about 10 units of increase in selling price.

According to the Department of Building Materials, Ministry of Construction, cement consumption of both domestic and export markets is estimated at 9.72 million tons in May, up 3% over the same period last year. In which, domestic consumption reached 5.97 million tons and export was estimated at 3.3 million tons.

Currently, the country’s inventory of cement products in the 5 months of 2022 is about 4.7 million tons, equivalent to about 20-25 days of production.