Closing the session on January 6, Brent crude oil increased by 1.19 USD or 1.5% to 81.99 USD/barrel, after reaching the highest level since the end of November 2021; WTI oil rose 1.61 USD or 2.1% to 79.46 USD/barrel, this contract touched 80.24 USD/barrel.

Kazakhstan is currently producing 1.6 million barrels of oil per day and so far there is no sign of its oil production being affected by the current unrest. Russia has sent paratroopers to Kazakhstan to quell a nationwide uprising after deadly violence spread across the former Soviet Union. There is no indication that oil production in Kazakhstan is affected.

Meanwhile, according to National Oil Corp., Libya’s oil production fell from more than 1.3 million bpd to 729,000 bpd due to pipeline maintenance and field closures.

Oil prices have increased in the past few sessions in a row since the beginning of this year, despite OPEC+’s agreement to maintain production increases and the increase in US fuel inventories. However, according to a Reuters survey, the OPEC+ output increase in December 2021 again fell short of the agreed OPEC+ increase, indicating capacity constraints.

In addition, the minutes of the meeting of the US Federal Reserve (Fed) showing that the bank’s policymakers could raise interest rates faster than forecast has put pressure on risk assets such as oil.

JP Morgan bank (USA) forecasts that the price of Brent oil will increase from an average of 70 USD/barrel from last year to 88 USD/barrel in 2022.

Government data showed US gasoline inventories rose by more than 10 million barrels last week, the biggest one-week increase since April 2020. Crude inventories fell for a sixth straight week to 419 million barrels, their lowest level since September 2021.

Meanwhile, Saudi Arabia, the world’s top oil exporter, reduced the official selling price by at least $1 per barrel for all crude oil sold to Asia in February 2022.

In the precious metals market, gold fell to a two-week low as US Treasury yields rose after the US Federal Reserve was able to raise interest rates faster than expected.

Accordingly, the price of spot gold fell 1.2 percent to $1,788.25 an ounce, after hitting its lowest level since December 22. Gold futures fell 2% to $1,789.2 an ounce. The US 10-year benchmark yield rose to its highest level since March 2020.

Gold, a non-yielding asset, tends to lose its appeal to investors as interest rates rise. If US Treasury yields continue to move higher in the short-term, that will be disconcerting. great for gold trading. Ed Moya, senior market analyst at brokerage OANDA (USA), said that investors’ interest is turning to the number of rate hikes and how positive the Fed is with the balance sheet. books, which has left gold in a vulnerable state.

Minutes of the Fed’s December 2021 meeting released on January 5 showed that the bank’s officials discussed scaling back its asset purchase program as well as raising interest rates earlier than expected to curb. inflationary.

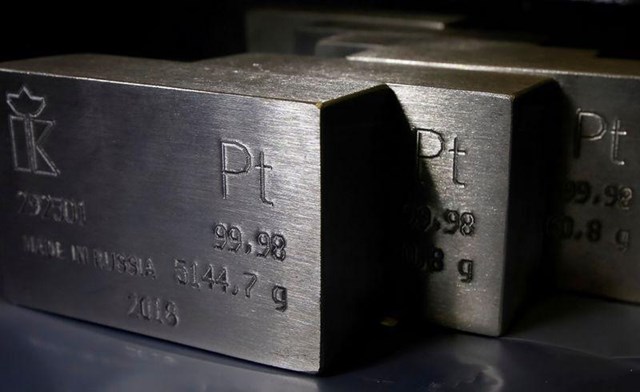

In other precious metals, spot silver fell 2.9% to $22.12 an ounce, its lowest level since December 16. Platinum fell 2.3% to $959.91 an ounce and palladium fell 0.5% to $1,874.26 an ounce.

In the industrial metal market, prices mostly fell after the release of minutes of the Fed meeting in December 2021 showed interest rates could rise faster than expected.

A stronger USD reduces the demand for assets denominated in this currency. Also, the Fed minutes pulled stocks lower while some government bond yields rose.

U.S. central bank policymakers said the tightening of monetary policy could be spurred more quickly by a strong job market and rising inflation.

Although pressured by macroeconomic effects, metals like copper are underpinned by low inventories and a bullish demand outlook from the green revolution.

Copper prices on the LME metal exchange fell 1.6 percent to $9,540 a tonne. Aluminum price this session was stable at 2,923 USD/ton. LME’s aluminum stockpiles at 550,700 tons, the lowest since December 2005, decreased by about 160,000 tons in the past two sessions.

As for other base metals, zinc fell 0.8 percent to $3,559 a tonne, lead rose 0.2 percent to $2,307 a tonne, tin was steady at $39,305 a tonne and nickel fell 1.2 percent to $20,385 USD/ton.

High electricity costs in Europe have underpinned prices for power-intensive metals such as aluminum and zinc, where some production has been cut.

Iron ore prices rose on anticipation of a recovery in demand for steelmaking raw materials and steel products after the Beijing 2022 Olympics next month, while spot prices were well supported by inventory demand. China is expected to maintain production restrictions to ensure fresh air during the Olympic Games.

Iron ore for May delivery on the Dalian Commodity Exchange closed up 4.1 percent at 717 yuan ($112.47) a tonne, near a session high of 717.5 yuan, its highest since 27. October 2021.

While iron ore arrivals to China remained strong and pushed port inventories to their highest levels since mid-2018 last month, stockpiling demand ahead of China’s Lunar New Year (starting), analysts say January 31st) continues to support spot prices. The Chinese market may have a surplus of 15 million tonnes of iron ore this year due to falling steel demand in the real estate sector and production controls to curb emissions.

Shanghai rebar price increased by 1.6 percent, while hot-rolled coil increased 2.2 percent, stainless steel dropped 2.1 percent.

In the agricultural products market, the price of raw sugar for March futures fell 0.15 US cents or 0.8% to 18.19 US cents/lb, in the session having fallen to the lowest level since the beginning of August 2021 in 18.15 US cents; March white sugar futures rose 0.1% to $488.8/ton.

Dealers note that both the Thai and Indian harvests are going well and that there have been heavy rains in recent weeks across Brazil’s sugarcane growing region. They added that the market is likely to be more balanced than short this season and that funds will continue to sell if broad markets remain under pressure.

Robusta coffee futures in March closed down $14 or 0.6% to $2,307 per ton, continuing to retreat from 10-year highs at $2,384 set at the end of December 2021; Arabica coffee for March delivery fell 0.05 US cents to 2,317 USD/lb.

Robusta coffee prices are under pressure due to the favorable harvest of Vietnam.

Japanese rubber prices fell on expectations that the US Federal Reserve would tighten monetary policy faster while the increase in the number of Covid-19 infections also added pressure.

Rubber for June term on the Osaka exchange closed down 5.8 JPY or 2.4% to 238 JPY (2.1 USD)/kg; May rubber in Shanghai fell 295 CNY to 14,545 CNY ($2,281)/ton.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com