Many organizations and experts agree that oil prices will continue to increase. The almost only factor that can hinder this upward momentum is the possibility of a resurgence of the Covid-19 pandemic.

With the success of Saudi Arabia in the policy agreement meetings of the Organization of the Petroleum Exporting Countries and its allies (OPEC+), the group has agreed to increase production by 400,000 bpd from August 2021. According to many large organizations, this is an important factor to create momentum for oil prices to rise to 80 USD/barrel in the third quarter or the fourth quarter of this year at the latest.

Closing on July 28, 2021, the price of WTI September crude oil on the NYMEX rose 1.03% to $72.39 a barrel and the price of Brent oil on the ICE rose 0.35% to 74.74 USD/barrel. World oil prices are at the highest level in 2 weeks. Since the beginning of this year, oil prices have increased by more than 50%.

The economies of developed countries are still recovering

The economic prospects of major countries such as the US and China are being evaluated very positively this year, with expectations on the progress of COVID-19 vaccine vaccination and adaptive policies from the Central Banks. nurse.

Despite concerns that vaccination progress in the United States has slowed in recent times, recent figures show that the number of people getting vaccinated has increased as they face the risk of a resurgence of the disease. According to statistics from Our World in Data, the number of vaccinations recovered from the lowest level of 200,000 doses/day to stable at 600,000 doses/day in the last week.

Most analysts expect the U.S. economy to post impressive growth this year, with a Bloomberg survey forecasting U.S. GDP in 2021 to grow 6.6%. Meanwhile, the European Central Bank (ECB) continued to commit to keeping interest rates low until inflation reaches 2% in the last meeting, to minimize the impact of the COVID-19 pandemic on the general economy. of the whole bloc as member countries are gradually reopening.

OPEC+ production growth lags behind recovering demand

In the second quarter of this year, worldwide oil supply fell nearly 2 million bpd short of demand as travel activity approached pre-COVID-19 levels.

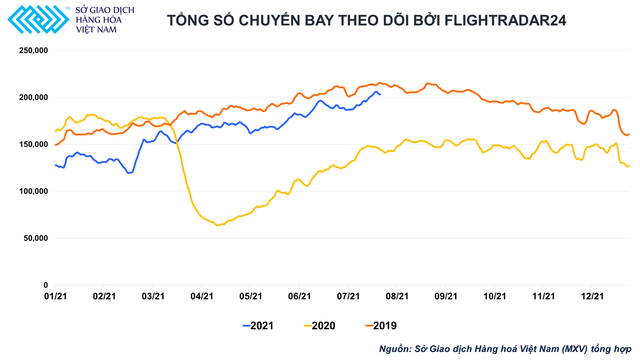

The number of commercial flights recorded by service provider Flightradar24 at the moment is only about 6% lower than the number in the same period in 2019 – the time before the COVID-19 epidemic. Meanwhile, according to data from the UK Department of Transport, the amount of road traffic in the country surpassed pre-COVID-19 levels in early June 2021, when the distancing orders had not been completely lifted. .

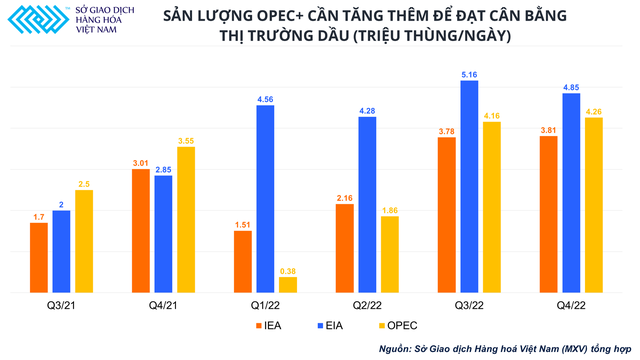

According to the latest estimates from the three major Oil organizations, namely the World Energy Organization (IEA), the US Energy Information Administration (EIA), the Organization of the Petroleum Exporting Countries (OPEC), the amount of oil that OPEC+ needs to supply to balance the market is much larger than the 2 million bpd the group set for the second half of this year.

Meanwhile, shale oil companies in the US are limiting production increases to ensure good margins and avoid legal trouble as the government tightens environmental protection regulations. Therefore, if world crude oil demand recovers strongly as predicted, the oil market will fall into a state of serious shortage, pushing up oil prices.

According to the Commodity Exchange of Vietnam (MXV), the agreement to cut production is extended from April to the end of next year, allowing OPEC + more flexibility in adjusting output levels within the group.

In addition, the outcome of this agreement also strengthens Saudi Arabia’s leadership role in the group, making it easier for Saudi Arabia to implement price support measures if necessary. With a budget heavily dependent on oil revenues, Saudi Arabia has many incentives to support oil prices.

The Delta variable and the uncertain future of oil prices

The biggest factor that can currently hinder the rise of oil prices is the possibility of a resurgence of the COVID-19 pandemic. All optimistic forecasts of the IEA, EIA or OPEC are based on the scenario that the COVID-19 pandemic will be under control this year. Meanwhile, the Delta variant is spreading again in the US as well as in Southeast Asia, showing the difficulty in controlling the epidemic, especially in the context that the vaccination rate is still not high enough.

In fact, the impact of the COVID-19 epidemic on energy consumption in 2020 is much larger than previous predictions, with crude oil consumption falling by 9.3%, a large decrease. most in history.

According to MXV’s assessment, if there are not enough effective measures to limit the epidemic, countries will be forced to return to a large-scale blockade, and then, oil prices may be pushed down to the price area of 60 USD/ bin. However, even in this case, with the major oil producing countries continuing to tightly control output, the market will not have a major crisis that causes prices to fall into the negative price zone like in April last year.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com