Tin and aluminum prices are likely to continue to outperform other base metals in the second half of 2021 due to strong demand and tight supply.

“Tin and aluminum prices are still much stronger than other metals, followed by nickel and lead,” said Antaike senior analyst Xia Cong.

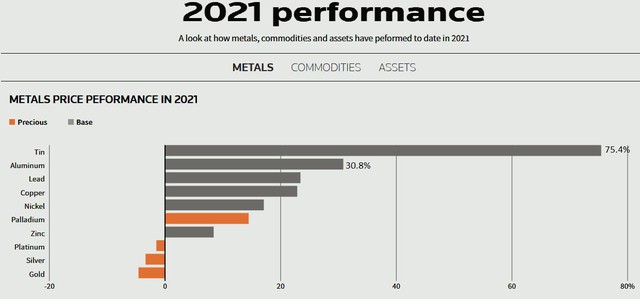

In 2021, base metal prices surged to multi-year record highs as demand recovered from the Covid-19 pandemic and supply problems, amid continued government easing and monetary easing. Speculators have ramped up hoarding, driving up the costs of manufacturers in China – the world’s top metal producer and consumer.

The price increase has slowed in recent months, after the Chinese government took many measures to reduce the price of raw materials, and demand in the country recovered slowly.

Even so, tin prices on the London Metal Exchange will likely still average $28,500 a tonne in August-December 2021, up from an average of $27,393 in the first seven months of this year, Antaike said. said.

Tin prices have been supported in recent times by limited supply and strong demand from the electronics sector during the pandemic, while aluminum consumption outstripped supply, which was affected by the Power cut and flood in China leading manufacturer.

Aluminum prices are forecast to increase to an average of $2,550/ton for the rest of 2021, from $2,295/ton in the January-July 2021 period.

Aluminum supplies are at risk of being squeezed due to anti-pollution policies in China, which accounts for about 60% of global aluminum production. China’s aluminum output increased by 7.3% in the first half of this year year-on-year, but the Chinese market is still short of the metal. The recent floods in Ha Nam province, where there are many large aluminum factories, made the balance of supply and demand even worse. Last month, China imported 294,081 tons of primary aluminum and alloys, up 30% from May, according to information from the General Administration of Customs of China.

Meanwhile, the US announced a series of sanctions against Russia for accusing Moscow of election interference, cyber security, the war situation in Ukraine, etc. Russia is a major aluminum producer and US sanctions against Russia in 2018 pushed aluminum prices on the London Stock Exchange to a seven-year high.

While the supply is difficult, the demand for aluminum is still increasing rapidly. Citi analysts predict global aluminum demand will grow 6.4% this year to nearly 68 million tonnes and further 4.6 percent in 2022 to nearly 71 million tonnes. Citi forecasts that the world aluminum market in 2021 will still have a surplus of 720,000 tons of aluminum, but will be short of 590,000 tons in 2022. The United Nations has raised its forecast for global economic growth to 5.4% in 2021 due to the strong recovery of major economies including the US, China and EU. Because aluminum is widely used in transportation, construction, electronics, etc., when the world economy recovers after the pandemic, the demand for this material increases sharply.

Nickel prices for the last five months of 2021 are expected to rise slightly to an average of $18,000/ton due to strong demand from the stainless steel sector and higher-than-expected consumption from the electric vehicle battery industry. .

Ms. Xia said that the growth rate of global nickel demand from the battery sector is expected to be 31% between 2021-2025.

The average lead price in the period August-December 2021 is likely to increase to $2,190 per tonne, from an average of $2,121 per tonne so far this year. Lead inventory on the LME is currently only 58,850 tons, the lowest since July 2019.

According to Ms. Xia, the tight lead supply will support prices, but the large inventory of lead ingots in China will prevent prices from rising sharply, unless the country exports to markets such as the US and Europe.

The average price of copper and zinc from now to the end of the year is forecasted to fall below current levels as supply gradually improves. Copper prices are now down quite a bit from their record high in May (then reaching $10,747.5 per ton), but are still 20% higher than they were in early 2021. Capital Economics forecasts copper prices in 2022. will only average 7,500 USD/ton, due to the slow growth of China’s economy.

Antaike’s forecast on metal prices on LME (3-month futures, Unit: USD/ton)

| metal | price 5/8 | Average from 1-7/2021 | Average from 8-12/2021 | 2021 |

| copper , | 9.492,50 | 9.147 | 9.050 | 9.100 |

| aluminum | 2.596 | 2.296 | 2.550 | 2. 423 |

| lead | 2.355,5 | 2.121 | 2.190 | 2.150 |

| zinc | 33.024,50 | 2.866 | 2.700 | 2.800 |

| nickel | 19.470 | 17.727 | 18.000 | 17.864 |

| tin | 34.690 | 27.393 | 28.500 | 27.854 |

Reference: Reuters

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com