China’s commodity market plunged on October 20, led by thermal coal prices, after China’s state policymaking agency announced it was considering intervention to cool coal prices. The coal market is repeating the same story as the iron ore market. Can China’s move help cool down the current “hot” coal price?

China’s National Development and Reform Commission (NDRC) – the country’s policy-making body – said on October 19 that it was studying solutions to intervene in the coal market. The NDRC will take all possible solutions to bring coal prices to a reasonable level, after holding a meeting to call on key coal miners, coal associations to increase production, and open sell a part of the coal reserve. They also require energy companies to ensure enough coal to provide electricity for the winter at all costs.

Coal is a leading indicator of Chinese economic activity, as the mineral is used to fuel about 60% of China’s power plants, which have struggled to keep up with demand for electricity. . Due to the lack of electricity, China has had to allocate energy consumption, part of households and some factories are only supplied with intermittent power.

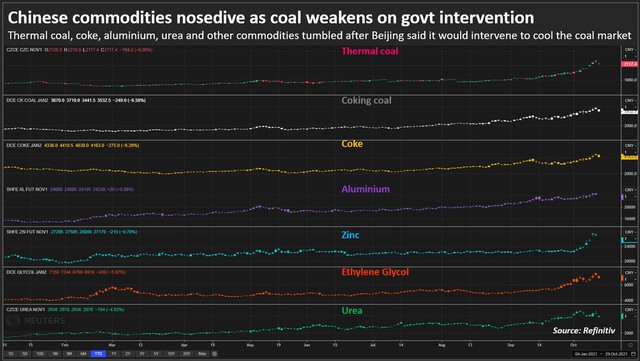

The price of thermal coal futures on the Zhengzhou Commodity Exchange and coking coal and coking coal on the Dalian Commodity Exchange stopped rising in the session of October 19, after the announcement of the Chinese Government, after that fell sharply in the session of 20/10.

At the end of the session on October 20, on the Asian market, the price of thermal coal fell 8% to 1,755.40 yuan (US$274.71)/ton, coking coal and coking coal both fell 9% – the maximum decrease. allowed, down 3,442 yuan ($538.58)/ton and 4,039 yuan/ton, respectively.

Shanghai aluminum and zinc futures (ShFE) both fell more than 6%, while petrochemicals, such as methanol, ethylene glycol and urea, which use coal as a feedstock, fell from 8 % to 9%.

The immediate drop in commodity prices in China had a strong impact on the global market, causing the prices of base metals – used in manufacturing and construction, such as copper, aluminum, zinc… on the London Metal Exchange (LME). also decrease. Prices of reference oil contracts also share this downward trend.

Commodity prices in the Chinese market all fell after the Government intervened in the coal market.

The NDRC said Chinese law allows the State Council, China’s cabinet and regional governments to limit profit rates and set price caps when prices for important goods or services rise sharply. promises to prevent any abnormal behavior and maintain market order.

The NDRC said it will ensure coal mines operate at full capacity to produce at least 12 million tonnes per day.

China produced 11.14 million tonnes per day in September, according to Reuters calculations based on official monthly figures. Official figures released last week show that production is still only 11.2 million tonnes a day.

The story of the coal market today reminds many people of the story of the iron ore market a few months ago. In May 2021, the price of iron ore rose to a historic record high after many consecutive months of increases, prompting Chinese authorities to find ways to intervene to cool down this steelmaking material.

However, although global commodity prices turned down after China announced plans to cool down coal prices, the downward trend outside China did not last, lasting only a few hours, ending the 20th session. /10 metal prices on the LME and Brent oil as well as WTI oil quickly recovered to high levels.

Many analysts believe that this is just a “pause” for the market in the context that central banks around the world are extremely concerned about the situation of inflation, when China and other major economies. “sucking” fuel and many other goods, amid a strong economic recovery after the Covid-19 pandemic.

Commerzbank analyst Daniel Briesemann said: “We do not believe the current price drop will mark the beginning of a trend reversal.” The Frankfurt-based bank raised its base metals forecast, saying that high electricity prices will lead to further output cuts.

In fact, the metal supply in the world is very scarce. Copper inventories on the London Metal Exchange (LME) last week fell to their lowest level since 1998, at 17,875 tonnes, then inched up by 2,650 tonnes, but remained the lowest in more than a decade. Copper inventory on ShFE is also at its lowest level since 2009, at 41,668 tons.

Xiao Fu, head of commodity strategy at Bank of China International (BOCI) in London, said: “Currently, the very limited amount of copper in storage is still a concern. concerned, but the price (is) slowing down mainly due to technical signals that copper is overbought.”

The “fire” is still smoldering in the commodity market

Lower coal prices and more abundant supply could dampen price inflation at Chinese mills, which hit a record high in September due to a power crunch and soaring commodity prices.

Frederic Neumann, HSBC’s co-head of Asia economic research, said: “The official intervention has finally poured cold water on flaming energy prices… So far, the locality has only had so much impact.

“At the heart of the problem is a global shortage of energy supplies as the Northern Hemisphere approaches its cold season,” he said.

China is not alone in trying to cool down a burning energy market. Singapore’s energy regulator said it would take rare drastic measures to protect the nation’s energy system. Germany’s regulator cuts income from the federal gas and electricity grid to help lower costs for consumers.

Beijing has also sought to tackle supply, instructing its two top coal regions to increase output and approving new coal mining projects.

Some of China’s major coal producers said they would increase output and cap prices this winter and next spring after the government urged grid companies to maximize purchases of electricity from sources. regenerative.

However, that is not boosting supply enough, and high coal prices are likely to persist as industrial activity picks up, leaving inflation likely to persist, analysts say.

Alex Whitworth, Wood Mackenzie’s head of renewables and energy research, Asia Pacific, said that “increased energy, labor and other costs will be carried over to the shoulder. end consumers and further increase inflation.”

“The measures have had an impact on increasing electricity supply, but it will be an uphill battle to rein in prices in the coal market before the end of the year,” he added.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com