The iron ore market was mixed largely because investors were bewildered about the conflicting policies of the Chinese government.

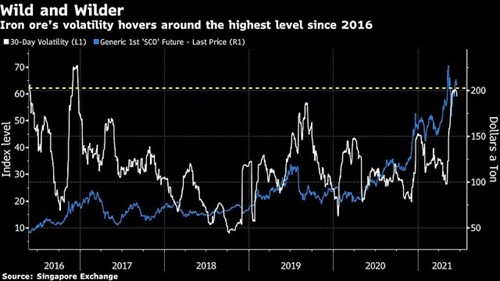

Iron ore, one of the hottest commodities in the early days of the recent rally in raw material prices, has now become the world’s most volatile commodity as both optimists and pessimists “equalize” power” in the market.

Prices for iron ore, vital to China’s massive steel industry, surged to record levels, then fell into a bear market and then back into a bull market in about a month. Iron ore’s rapid turnaround over the past 30 days makes it the most volatile of more than 20 of the world’s most traded commodities.

The iron ore market was mixed in large part as investors were bewildered about how Beijing’s conflicting policies would affect domestic steel mills’ demand for ore.

China wants to reduce steel production but control prices, wants to reduce investment but maintain jobs, said Tomas Gutierrez, an analyst at Kallanish Commodities. “Every time the policy is changed to maintain a balance between these goals, the outlook for the steel market will either improve or deteriorate accordingly.”

Volatility in iron ore prices is around the highest level since 2016. Photo: Bloomberg.

China is gradually revitalizing its economy after the Covid-19 pandemic by turning to fiscal stimulus and monetary easing. That means they have to produce a huge amount of steel to serve the boom of the real estate and infrastructure sectors. As a result, iron ore prices have more than doubled in the past year.

Meanwhile, Beijing is also under growing pressure to rein in inflation, which means it has to tighten credit and rein in construction spending.

Add to that the fact that China must map out a roadmap to achieve the carbon emissions target that President Xi Jinping pledged last year. That is, they will have to drastically reduce steel production, according to Goldman Sachs. The steel industry contributes 17% of China’s carbon emissions.

Bets on these conflicting policies upset the iron ore market, which has long followed the movement of steel prices. The price of iron ore futures in Singapore hit a record of $233.75 per tonne on May 12. But two weeks later, prices fell to $170.50 a tonne, though still more than twice the average since the contract began trading in 2013.

Iron ore prices don’t have much room to rise, said a Singapore-based commodity futures trader with five years of experience. Because, China started to tighten credit and that signaled that iron ore prices will fall.

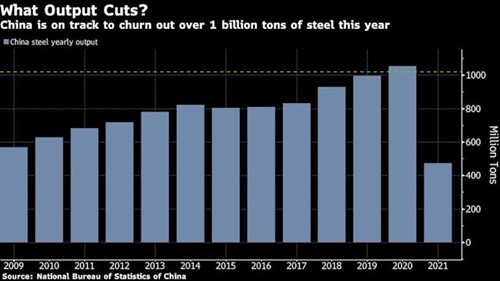

Along with that, China’s steel mills continue to break records in output. The country’s steel production hit an all-time high in May and reached 473 million tons since the beginning of 2021. At this rate, production could surpass last year’s figure of 1.05 billion tons. This will be a worrying output level when China is having to find ways to limit emissions from this industry.

As a result, the supply side will struggle to keep up with demand.

Structural problems affecting iron ore supplies in China persist, said the director of an investment firm in Shanghai. According to him, inventories are at a record low, shipments from major suppliers Australia and Brazil in recent weeks have not been enough, and domestic production may be limited after some disasters. recent accident in the mines.

China can produce more than 1 billion tons of steel this year. Photo: Bloomberg.

China can produce more than 1 billion tons of steel this year. Photo: Bloomberg.

At least in the short term, China seems to have decided that lowering the prices of raw materials, including iron and steel, would be its most pressing concern. To that end, Beijing has stepped up its campaign to curb commodity inflation in recent weeks, with particular emphasis on preventing speculative behavior that it believes is the cause of sharp price increases.

One irony of that policy is that speculators have an important role to play in reducing volatility by increasing liquidity in the commodity futures market, according to Goldman. Simply put, when the market has more buyers and sellers, price corrections also become less unexpected.

Lu Ting, senior analyst at Shanghai Metals Market, said that while the policy outlook for the iron ore and steel markets remains dim, summer is a season for construction and manufacturing to slow in China and slow down the growth. This will affect steel prices.

In the longer term, Beijing’s efforts to lower commodity prices will be supported by a change in the economic cycle as measures to support the economy shrink.

Steel demand may slow as China withdraws from large-scale stimulus measures and seeks to boost growth driven by domestic consumer spending, said Richard Lu, senior analyst at CRU Group, predict.

China is also continuing to look for alternatives to reduce dependence on foreign iron ore sources such as increasing imports of scrap steel.

However, none of these factors can guarantee a collapse in iron ore prices, as low steel output will stimulate prices to increase, helping to improve the profit margins of mills, so they can easily easier to buy iron ore that is more efficient and less polluting, according to Lu. He predicts iron ore prices will fluctuate in the range of 180-210 USD/ton within the next 3 months.

Therefore, when stabilizing, ore prices may be higher than before, especially in the context that the demand of the rest of the world is still strong.

“Going forward, we expect China’s policy to remain a supportive factor in steel demand through 2021. Economic indicators outside China will also continue to improve with steel production in other countries. Others increased about 11% year-on-year in the first four months of 2021 and returned to pre-pandemic levels,” said Elizabeth Gaines, CEO of mining group Fortescue Metals Group, the world’s fourth-largest supplier of iron ore.

Source: ndh/bloomberg

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com