China may lose its dominant position in the field of tungsten exports due to many objective and subjective factors.

China may lose its dominant position in the field of tungsten exports due to many objective and subjective factors.

A detailed study of the situation of tungsten mining and use in China published in the journal Resources, Conservation & Recycling has revealed a lot about the industry.

Tungsten production and consumption situation in China

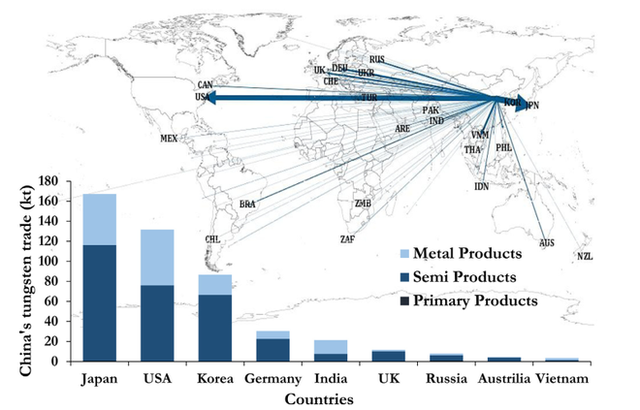

China was a net exporter of tungsten products from 1980 to 2017 and exported about 35% of tungsten to other countries. China’s tungsten exports are shipped to nearly 200 different countries, most of which are developed economies. As of 2020, Japan is the largest importer (167 thousand tons), followed by the US (131 thousand tons) and South Korea (86 thousand tons).

However, although China has always maintained its role as a net exporter of tungsten in many stages, the structure of its exports has changed significantly. During the 1980s, China was a net exporter of primary tungsten products. Since 1992, the Chinese government has begun to implement a series of restrictions on the extraction and export of tungsten minerals.

China’s tungsten export map to countries.

China’s tungsten export map to countries.

As a result, China’s role in the global tungsten supply chain has been altered: China gradually becomes a net importer of tungsten minerals from abroad to fill the mineral gap constrained by production quotas. . Specifically, China imports raw tungsten and exports a large amount of semi-finished tungsten and tungsten metal products.

The aggregated data from the study show that China was a small-scale tungsten producer prior to the 1980s. All tungsten was then used to meet domestic demand, of which about 60% was used. Used directly as an alloying additive for steel or alloys.

From 1980 on, the production of tungsten has increased significantly due to a sharp increase in exports. Tungsten export volume reached 32 thousand tons in 1996, accounting for about 80% of total production.

However, China’s domestic demand for tungsten has increased sharply since 2000. The rapid development of China’s economy has led to huge domestic demand for tungsten carbide in transportation. , industry and infrastructure construction. Domestic tungsten consumption increased to 58.7 thousand tons in 2017, about 55 times more than in 1949.

Moreover, in order to build high-tech industrial and manufacturing base, China has a growing demand for high value-added tungsten products.

China dominates the market

China is considered to dominate the global raw tungsten supply mainly because it accounts for about 85% of the world supply. However, China’s “tungsten dominance” will not last long, the study said.

First, China has a relatively small share (about 58%) of global tungsten reserves. If exploited at current production, the tungsten reserves discovered in China are estimated to be exhausted within 30 years.

Second, although tungsten reserves in China may increase as new resources are found (or economically and technically feasible), the quality of tungsten ore is declining in China.

The tungsten ore currently mined in China is wolframite which can be efficiently mined and processed, but it has been exhausted. In addition, 70% of China’s tungsten reserves are scheelite, an ore of lower grade than wolframite, where mining can cause greater energy consumption, enhanced environmental pollution and higher operating costs.

High value tungsten ore.

High value tungsten ore.

As a result, further tungsten mining operations in China will largely be constrained by limited tungsten supplies and declining ore quality. This could further undermine China’s ability to supply raw tungsten globally.

Notably, China has begun to import tungsten ore from other countries. With the continued decline in domestic ore quality as well as increasing domestic demand, China is expected to become more dependent on foreign mineral resources.

In addition, although China currently has the largest tungsten reserves and largest production of tungsten raw materials, the country is still dependent on imports of high-grade tungsten products from other countries, which are manufactured from raw tungsten. imported from China.

As domestic mineral resources are increasingly scarce with decreasing quality, Chinese manufacturers need to quickly improve the ratio of mineral output in tungsten mining and refining.

The recovery of the economy

The International Monetary Fund (IMF) predicts that global economic growth in 2020 will decrease by 4.4% compared to 2019 but will recover 5.2% this year. China’s economic growth is forecast at 1.9% in 2020 and accelerates to 8.2% this year.

The global economy is likely to recover from the 2020 recession if the Covid-19 pandemic is brought under control following the worldwide rollout of a vaccine. This could support the tungsten market as consumption of the metal is tied to the growth of the global economy, which includes products such as tungsten carbides, alloys and chemicals widely used in various industries. construction, electronics, mining, automotive and petrochemicals.

China will continue to consume tungsten in large volumes.

China will continue to consume tungsten in large volumes.

New infrastructure construction, security projects and 5G plans in China are expected to support the manufacturing industry, the main downstream sector of tungsten, which is likely to continue to grow into 2021. .

According to research site Argus, the cost of producing tungsten concentrate remains high as China’s high-grade tungsten and easy-to-mine concentrate have been exhausted after years of mining operations. Furthermore, anti-pollution policies require equipment to be upgraded, increasing costs.

The average production cost of refined tungsten is about 80,000 yuan/ton. Low profit margins have forced producers to downsize and keep prices stable throughout 2020. Data from China’s non-ferrous metals industry association shows the country has produced 111,831 tonnes of tungsten concentrate containing 65 % tungsten trioxide in January-October, down 2.25% from 114,407 tons in the same period of 2019.

Breaking China’s monopoly

According to data from the International Tungsten Industry Association, China consumes about 60% of basic tungsten reserves. In the past 10 years, tungsten consumption in China has increased by an average of 10% due to the high rate of industrialization and urbanization.

VnEconomy cited sources as saying that China is imposing strict regulations and even stiff penalties on mining and processing projects of contaminated tungsten. When facilities temporarily suspend or stop mining and producing tungsten products, the supply will continue to shrink. In fact, many tungsten project owners in China have had to leave the market. Therefore, China’s export of tungsten to the world is likely not to increase dramatically in the coming years.

Also according to VnEconomy, a non-ferrous metallurgy expert said that Vietnam is in a respectable position ready to compete directly with China for the world tungsten market area. Although tungsten mining is on a huge scale, but China also consumes most of the products for domestic demand. Meanwhile, there is still a lot of room for exploitation and production of tungsten finished materials in Vietnam.

According to data from the United States Geological Survey (USGS), Vietnam has the third highest tungsten reserves in the world with 95,000 tons, after Russia (400,000 tons) and China (1.9 million tons).

Masan Group’s products at Nui Phao mine are gradually being recognized globally and are a favorite supplier of major partners in the world. Nui Phao mine has huge reserves of tungsten, fluorspar, copper and bismuth.

According to information from Masan Group, with its open-pit mining method and low soil removal rate, the mining project at Nui Phao will help the company become one of the lowest-cost tungsten producers in the world. world. This is also one of the largest identified tungsten mines in the world (outside China), with 52.5 million tons of WO3 ore of 0.21% average grade.

In 2018, Masan increased the processing of raw tungsten materials purchased from outside to 350%, reaching 937 tons of WO3. The ability to expand raw material supplies outside of Nui Phao is key to growth ambitions.

Masan’s representative is confident that the Nui Phao project has been successfully transformed from a mining project into a “Vietnam strategic resource supplier” for global partners using high-grade materials, including: semiconductor materials. , 3D printing, robotics, electric cars, renewable energy, medicine and aerospace.

Masan High-Tech Materials’ modern factory line in Vietnam.

Masan High-Tech Materials’ modern factory line in Vietnam.

In 2020, Masan High-Tech Materials Joint Stock Company (MHT) and Mitsubishi Materials Corporation (MMC) signed a commitment to establish a strategic alliance towards the goal of developing a leading high-tech tungsten material platform.

According to VOV, MHT is a supplier of new tungsten products from a stable supply of primary (refined) and secondary (recycled) raw materials, and then processed into tungsten oxides, tungsten powder, tungsten carbide and chemicals of the best quality.

“The tungsten business including the cemented carbide tools business is one of the key pillars of MMC’s growth strategy,” said Mr. Makoto Shibata, Director and Chief Financial Officer of MMC. The decision to cooperate and invest in MHT has a significant impact on our future growth potential. I am very excited and confident about the bright prospects from the cooperation between the two sides.”

After 2020, Masan company also sets a roadmap to expand its market share from 36% to 50% (outside China) through increasing the refining plant capacity to 12 thousand tons by 2021 to gradually become a leading producer. global industrial materials.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com