HRC steel price in the US may peak at $2,000 in Q3; in China commitments to cut emissions cause the country to limit production output and limit exports; opportunities for manufacturers, including in Southeast Asia such as Hoa Phat, are expanding.

HRC price in the US has increased by 220% since the beginning of 2020, forecast to peak in the third quarter

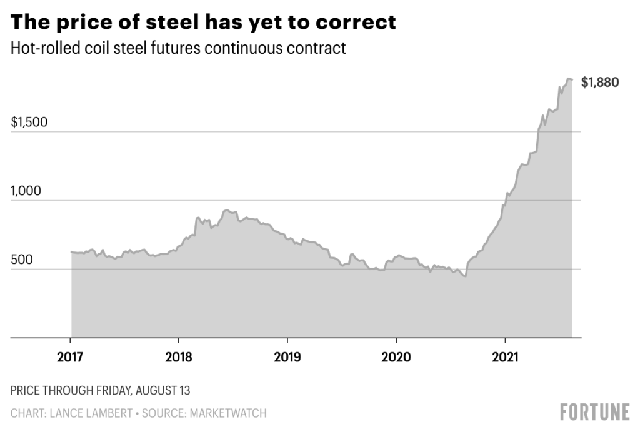

Steel prices have increased by nearly 220% since January 1, 2020. The benchmark price for hot rolled coil (HRC) touched $1,880 at the end of last week. Before the pandemic took place, the price ranged from only 500-800 USD.

HRC price has tripled since the beginning of 2020

Exorbitant steel prices drive up the selling price of everything from cars to irons to ovens. High demand for products using steel materials has led to a shortage of steel in the US.

When the pandemic first hit, states instituted strict closures, causing steel mills to reduce output. Americans stuck at home began to use the money to travel, eat and spend on household items, including machinery. In addition, the housing boom has also increased the demand for these devices. The combination of high demand and low supply causes prices to escalate.

Steel giants such as United Steel Corporation and Cleverland – Cliffs last year bought SK Steel for $1.1 billion and ArcelorMittal’s plants (USA) for $1.4 billion to increase capacity. production force. However, this plan was stalled by the tightening labor market.

Steel expert at Fastmarkets told Fortune: “The addition of US steel production capacity continues to be delayed, mills are experiencing more disruptions than originally planned. Sourcing and labor are delayed. The impact of the epidemic is far-reaching. Therefore, the construction and start of new steel production projects are not immune to challenges.”

Fastmarkets forecasts that the price of HRC steel may peak in the third quarter (about 1,900 – 2,000 USD/ton). Then there will be a slight downward adjustment in 2022 as factories catch up with demand. This organization also forecast that HRC price will average $1,250/ton next year.

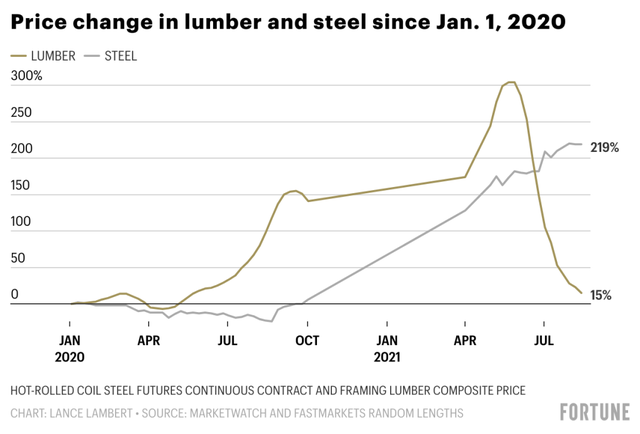

But even if HRC drops to $1,250, the correction falls around 34%. Another commodity that has risen sharply since the pandemic is lumber, which has fallen 71% from its May peak this year.

Wood prices have almost “collapsed” since the peak of May, but this will not be true for steel

According to Fortune, the price of steel will not follow in the footsteps of wood because it is less dependent on DIY (Do It Yourself) projects. Many steel-intensive industries are seeing higher demand as the economy continues to recover. Even steel demand may increase. Once the global chip shortage is alleviated, automakers will be able to ramp up production. This leads to a huge demand for steel.

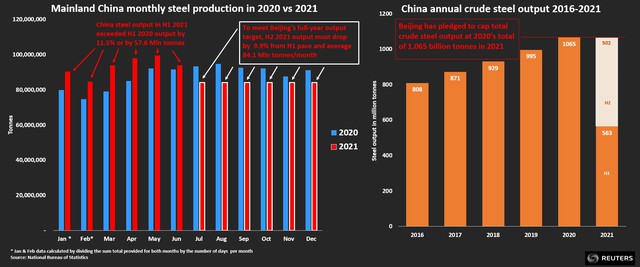

China is cutting production sharply in the fight against climate change China is fulfilling its commitments to limit industrial pollution after steel production surged in the first half of the year, causing emissions to soar.

The country will limit crude steel production this year to no higher than 1.065 billion tons in 2020. To achieve that target, steel producers will have to cut output by about 10% for the rest of the time. of 2021 compared to a record in the first half of the year ( Reuters calculation).

China is expected to cut steel production by 10% in the second half of the year

However, with steel prices near record highs amid a construction and manufacturing boom fueled by stimulus measures, any forced supply cuts could boost raw material inflation. , sending China-made steel prices to their highest levels in years.

Analysts say that it will not be easy for China to balance its emissions target with its economic target; but they will try to alleviate the supply shortage, increase export tax and increase import volume.

China is the world’s largest polluter, contributing nearly 31% of global carbon emissions (according to BP). The country therefore plays an important role in determining whether global emissions reduction targets can be met. The steel industry, with its huge power needs, accounts for about 15% of China’s total greenhouse gas emissions.

However, experts say that the production cuts, if strictly enforced, could lead to a supply shortage in the Chinese market.

In response to this, China raised steel export duties twice in three months, lifting export tax breaks on nearly 170 steel products.

Even so, there is still a gap between supply and demand, which is estimated to be around 5% in the second half of the year.

Jinrui Capital’s analysis said that the conflict of supply and demand will cause steel prices to increase at a high level. But some comments are also less pessimistic about the impact of production cuts on steel prices.

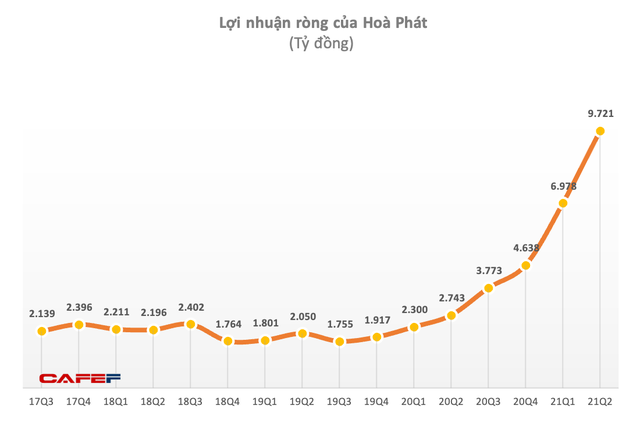

The number one steel producer in Southeast Asia seizes the opportunity

The writer of Nikkei Asia said that Beijing’s move to tighten output with steel manufacturers creates conditions for Southeast Asian companies like Hoa Phat of Vietnam to have the opportunity to expand.

Hoa Phat is the largest steel producer in Southeast Asia and is planning to start a blast furnace with a total investment of $3.7 billion in early 2022.

Hoa Phat Chairman – Mr. Tran Dinh Long said that steel demand is very large in Vietnam, so there is confidence in this investment.

The new blast furnace can help Hoa Phat add 5.6 million tons of steel (up 70%) to its annual capacity, to 14 million tons (including 4.6 million tons of HRC and 1 million tons of bar and wire steel). ).

Hoa Phat’s move partly comes from the fact that China is cutting steel exports. The nation of billions of people produces nearly 60% of the world’s crude steel. Years ago, cheap Chinese steel products flooded the Southeast Asian market, including Vietnam.

This combined with the global economic recovery after the pandemic has created a great impetus for Vietnamese steel manufacturers. In the first 6 months, Hoa Phat produced 4 million tons of crude steel, up 55% over the same period. Sales volume of steel products reached nearly 4.3 million tons, up more than 60%. Net revenue reached 66,295 billion dong, up 67%; profit after tax is 16,751 billion dong, up 231%

Vietnam is currently the largest steel producer and consumer in Southeast Asia. Last year, crude steel production reached 19.5 million tons, up 11%. This number has tripled in 5 years amid increasing competition between Hoa Phat and Formosa Ha Tinh.

According to Nikkei Asia, the Vietnamese government has been trying to be self-sufficient in hot rolled coil for many years. Vietnam’s annual demand for this material for production is about 12 million tons.

In fact, Hoa Phat started producing HRC last year, together with FHS. However, Vietnam still depends on imports, accounting for half of the supply. Most of this comes from China, making the Vietnamese market vulnerable to decisions by Beijing or its leading companies. Hoa Phat’s new blast furnace, if completed, will have enough capacity to replace most of the imported goods.

Iron and steel was the biggest increase in Vietnam’s exports in the first 7 months of the year, worth $5.6 billion, up 121% over the same period. Imported iron and steel reached more than 8 million tons, approximately the same period. In terms of value, it reached 6.79 billion USD, up 42.4%.

According to the Vietnam Steel Association, the main export markets of Vietnam include Asean, China, EU, US, UK… Of which Asean accounts for about one third, China accounted for 1/5, EU accounted for 1/10. and the US accounted for 1/20.

T&G International Joint Stock Company

Address: 352 Hue Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi

Hotline: 0345786803

Email: hrm@tginterjsc.com

Website: http://tginternationaljsc.com